Duke Realty (NYSE:DRE) Corp. DRE recently secured a lease deal with Allios for space at Pinebrooke Business Center 10350 in Tampa, FL. The lease deal for 53,709 square feet of the 107,418-square-foot distribution facility with the U.S.-based digital supply-chain solutions and advanced logistics company reflects solid demand for the company’s well-located properties.

Duke Realty’s Pinebooke Business Center at 10350 Windhorst Road in Tampa, FL boasts 32’ clear height, 12 dock doors and a 180’ truck court, garnering solid interest from tenants in search of high-quality industrial space in convenient locations. It is only two miles south of I-4 and the Martin Luther King Jr. interchange, with frontage on I-75 and also minutes away from several airports.

Demand for logistics infrastructure and efficient distribution networks have been shooting up amid the e-commerce boom, with growth in industries and companies making efforts to improve supply-chain efficiencies. This, in turn, is helping the industrial real estate market to prosper.

Given Duke Realty’s solid capacity to offer modern, high-quality logistics facilities, it is poised to bank on this trend. It is witnessing healthy demand in its markets. DRE leased 9.5 million square feet of space during the September-end quarter. Tenant retention was 71.5% for the reported quarter and 86.2% after considering the immediate backfills.

Apart from the fast adoption of e-commerce, logistics real estate is anticipated to benefit from a likely increase in inventory levels post the global health crisis, offering scope to industrial landlords, including Duke Realty, Prologis (NYSE:PLD) PLD, Terreno Realty (NYSE:TRNO) Corporation TRNO and Rexford Industrial Realty, Inc. REXR to enjoy a favorable market environment. However, with the asset category being attractive in these challenging times, there is a development boom in several markets, which is likely to fuel competition and curb pricing power.

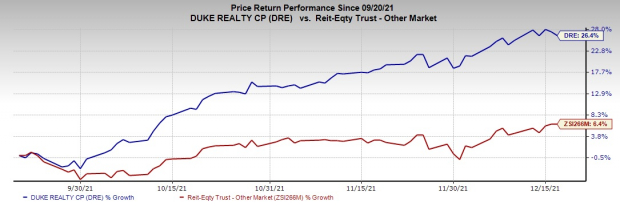

Duke Realty currently carries a Zacks Rank #3 (Hold). DRE’s shares have rallied 26.4%, outperforming its industry’s increase of 6.4% over the past three months. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Prologis carries a Zacks Rank of 2 (Buy) at present. Prologis’ 2021 FFO per share is expected to increase 8.4% year over year.

The Zacks Consensus Estimate for PLD’s 2021 FFO per share has been revised marginally upward in a month.

Terreno Realty holds a Zacks Rank of 2 at present. 2021 FFO per share for Terreno Realty is expected to increase 19.4% year over year.

The Zacks Consensus Estimate for TRNO’s 2021 FFO per share has been revised marginally upward in two months.

The Zacks Consensus Estimate for Rexford Industrial’s ongoing-year FFO per share has moved 4.5% north to $1.63 over the last two months.

The Zacks Consensus Estimate for Rexford Industrial’s 2021 FFO per share suggests an increase of 23.5% year over year. Currently, REXR carries a Zacks Rank of 2.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD): Free Stock Analysis Report

Duke Realty Corporation (DRE): Free Stock Analysis Report

Terreno Realty Corporation (TRNO): Free Stock Analysis Report

Rexford Industrial Realty, Inc. (REXR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research