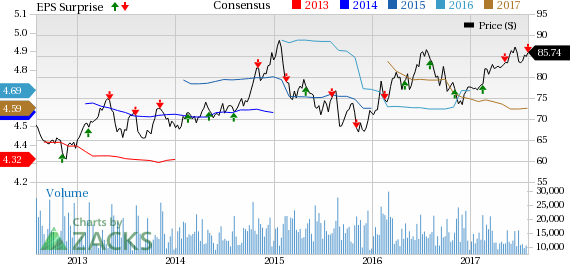

Duke Energy Corporation (NYSE:DUK) reported second-quarter 2017 adjusted earnings of $1.01 per share, missing the Zacks Consensus Estimate of $1.02 by a penny.

Quarterly earnings also declined 5.6% year over year due to the absence of International Energy that was sold in Dec 2016, less favorable weather, and higher income tax expense. These were, however, partially offset by higher retail revenues from increased pricing and riders and stronger retail volumes at Electric Utilities and Infrastructure.

Total Revenue

In the reported quarter, the company’s total operating revenue was $5,555 million, up 6.6% from $5,213 million a year ago. The reported figure also surpassed the Zacks Consensus Estimate of $5,541 million by 0.3%.

The regulated electric unit’s revenues were $5,158 million (up 3.1%), representing approximately 92.9% of the company’s quarterly total revenue. Revenues from the regulated natural gas business were $301 million (up 204%). However, its commercial renewable revenues were $110, down 1.8% year over year.

Other segment generated revenues were $35 million, up 16.7% year over year.

Operational Update

The company’s total operating expenses were $4,175 million in the quarter, up from $3,962 million a year ago. Costs increased on account of higher fuel used in electric generation and purchased power, cost of natural gas, operation, maintenance and other expenses, depreciation and amortization expenses and property, impairment charges as well as other taxes.

Operating income in the quarter increased to $1,387 million from $1,259 million a year ago.

Interest expenses rose to $486 million from $478 million a year ago.

Quarterly Segmental Highlights

Electric Utilities & Infrastructure: Adjusted income in the quarter was $729 million, up from $704 million a year ago. The upside can be attributed to increased pricing and riders, and higher retail volumes.

Gas Utilities & Infrastructure: Adjusted income of $27 million at this segment demonstrated an improvement from $16 million in the year-ago quarter. The upside was driven by higher earnings from midstream pipeline investments.

Commercial Renewables: This segment reported adjusted income of $26 million in the quarter compared with $11 million a year ago.

Other: The segment includes corporate interest expenses not allocated to other business units, results from Duke Energy’s captive insurance company, and other investments.

Adjusted net expenses were $94 million, down from $107 million in the year-ago quarter.

Financial Condition

As of Jun 30, the company had cash & cash equivalents of $298 million, down from $392 million as of Dec 31, 2016. Long-term debt was $46.1 billion at the end of second quarter compared with $45.6 billion as of Dec 31, 2016.

In the first six months of the year, net cash from operating activities was $2,756 million compared with $3,225 million in the year-ago period.

Guidance

The company still expects to report its 2017 adjusted EPS in the range of $4.50−$4.70.

Zacks Rank

Duke Energy presently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

DTE Energy Company (NYSE:DTE) reported second-quarter 2017 operating earnings per share (EPS) of $1.07, which surpassed the Zacks Consensus Estimate of 97 cents by 10.3%. Operating earnings also grew 9.2% from the year-ago figure of 98 cents.

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 adjusted earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.7%. Reported earnings were also up by 11.4% year over year.

WEC Energy Group (NYSE:WEC) reported second-quarter 2017 adjusted earnings of 63 cents per share, surpassing the Zacks Consensus Estimate of 59 cents by 6.8%, and the year-ago figure of 57 cents by 10.5%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Original post

Zacks Investment Research