During the past decade or so nearly every sector of the transporation industry has run into serious Secular cycle problems. First it was the Airlines, then Trucking, then the Autos and now Shipping. While the first three sectors appear to be in early stages of recovery, the Shipping sector has yet to find its bottom. During the 2000's demand-driven commodity boom, shipping rates skyrocketed and new ships were coming online every month. After the 2008 collapse in demand and commodity prices, the shipping industry found itself dealing with much lower rates and huge excess shipping capacity. During the past four years some shipping companies have been forced into bankruptcy, some are facing bankruptcy and others a struggling with high, long-term debt. To reverse this downward cycle, demand has to rise along with shipping rates while industry consolidation continues.

Since the middle of the last decade we have been tracking the Baltic Dry Index (BDI). This is a weighted index of international shipping rates. Its three components are the Capesize, Panamax, and Super Panamax (Handy) dry bulk cargo ships. For the past few months we have been examining this index, looking for signs of a potential upcoming bottom in this industry. We have concluded that is likely to occur this year.

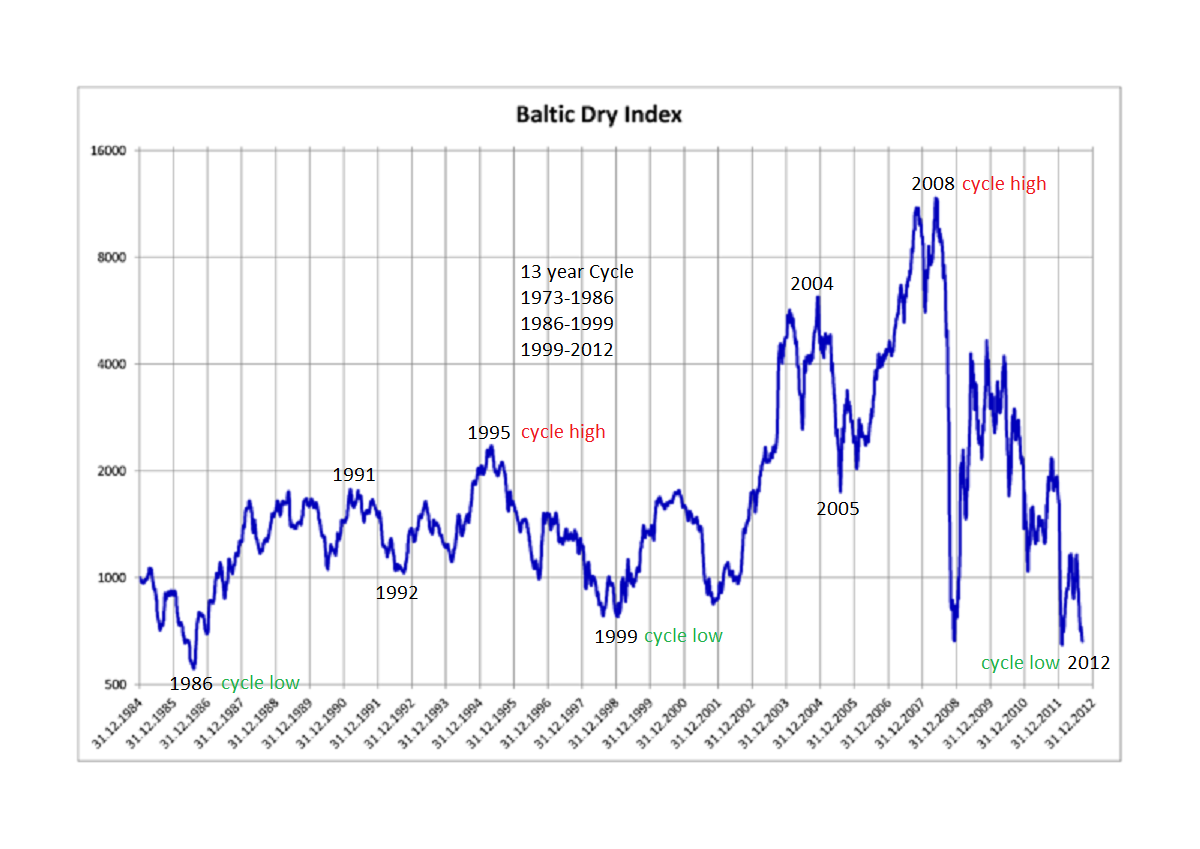

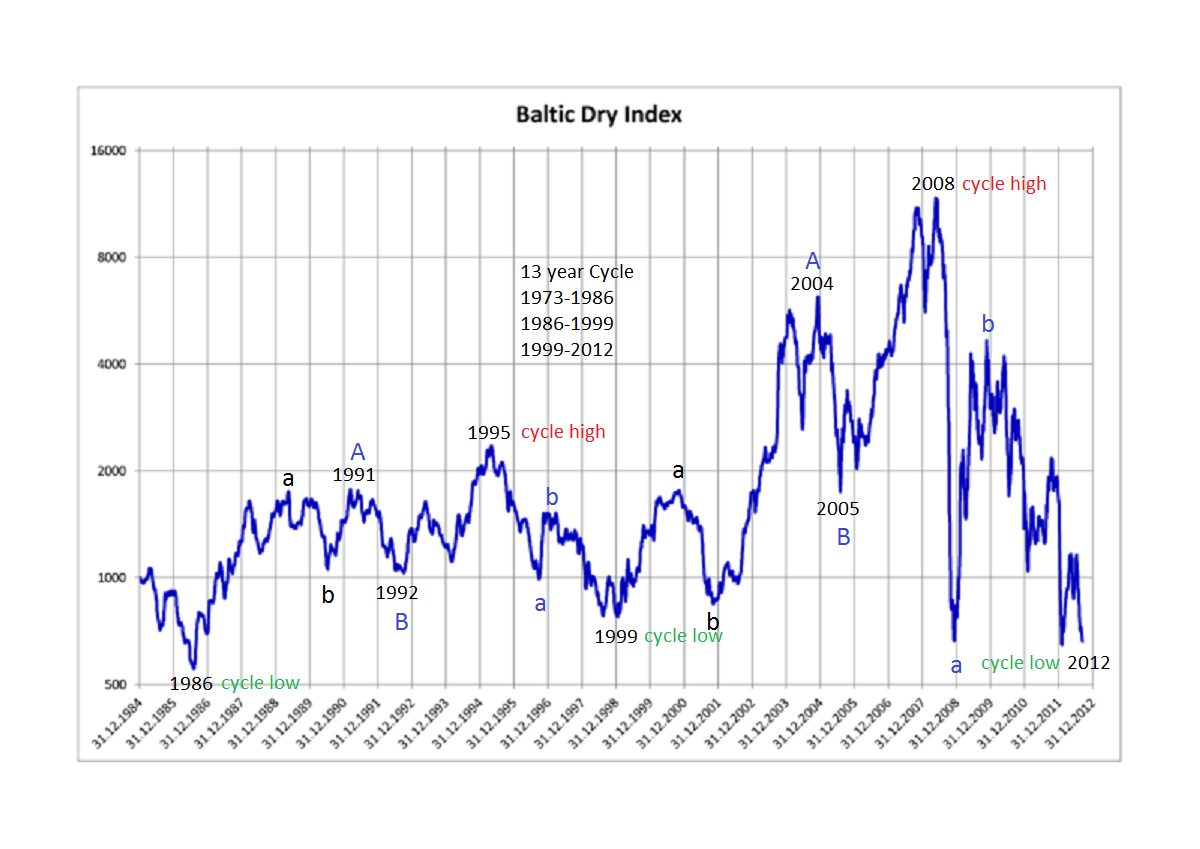

When reviewing the BDI from 1985, and using written reports on the shipping industry as far back as the early 1970′s, we believe we have uncovered a regular 13-year cycle. It appears every 13 years shipping rates make a cyclical low: 1973-1986-1999-2012. After the low is in place rates generally rise for the next nine years, then decline four years into the next cyclical low. During the nine-year bull market, rates rise for five years, decline for one year, and then rise for another three years into the cyclical peak. In addition, in the early stages after the cyclical low, rates typically triple during the first two-to-three years. This is the recovery stage for the shipping industry.

From an OEW perspective. We count the nine-year rising Cycle as an Primary ABC wave advance. With each of the rising Primary waves dividing into three Major waves. The four year declining Cycle is a simple Primary ABC wave decline.

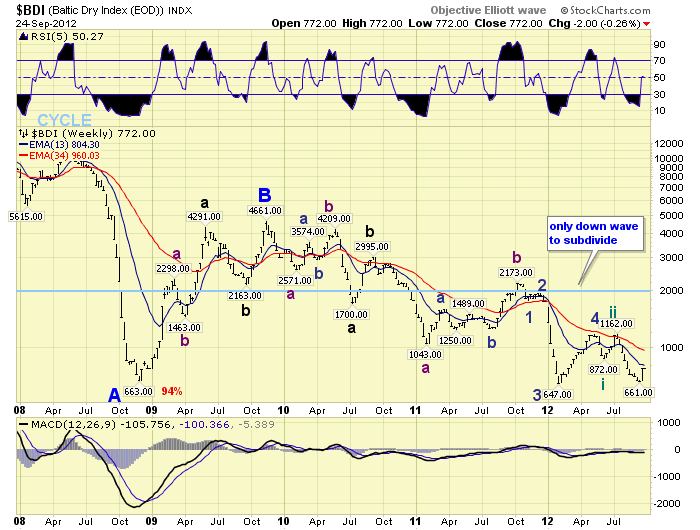

When we examine Primary wave C of this declining Cycle we observe a nearly completed pattern. Primary B topped in late 2009 at BDI 4661. Over the next several months there was an abc Major wave A decline into mid-2010 at BDI 1700. Then after a quick Major B wave advance to BDI 2995, a complex Major wave C was underway. Intermediate wave A, of Major C, bottomed in early 2011 at BDI 1043. Then Intermediate wave B topped in late 2011 at BDI 2173. After that, the only subdividing Intermediate wave decline of this down Cycle began. At the Feb12 BDI 647 low Minor waves 1, 2 and 3 had completed. Then after a Minor wave-4 rally into May 12 at BDI 1165, a subdividing Minor wave 5 began. Currently, we can count three Minute waves into the recent BDI 661 low, with possibly Minute wave iv underway now. We will know for sure once we get an OEW uptrend confirmation.

Should this occur, all that will be required is one more downtrend to complete the entire four-year down Cycle from 2008. That downtrend should end the bear market is dry bulk shipping rates. With three months left in the year, it appears the four-year down Cycle should bottom before year end. When it does we would expect shipping rates to triple over the next two to three years. To track the BDI, on a daily basis, just scroll down page nine using the following link: http://stockcharts.com/public/1269446/tenpp/9.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dry Bulk Shipping: Looking For A Bottom

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.