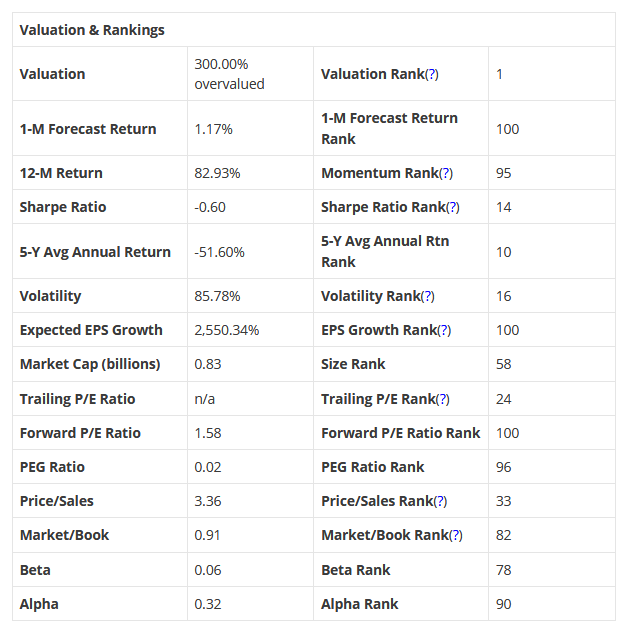

VALUATION WATCH: Overvalued stocks now make up 56.07% of our stocks assigned a valuation and 23.05% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued.

Genco Shipping & Trading Ltd. (NYSE:GNK) is a ship owning company. It transport iron ore, coal, grain, steel products and other drybulk cargoes along shipping routes. The company owned fleet of dry cargo vessels which consists of Capesize, Panamax, Ultramax, Supramax, Handymax and Handysize vessels. Genco Shipping & Trading Ltd. is based in New York, United States.

An old maxim for investors is that transportation stocks are a leading indicator for the overall market. When they do well/are doing well, one expects the market to do also do well–and vice versa. A corollary to that theory is that when transports like dry bulk shippers do well, the world economy will do well. One generally expects that with a good world economic outlook, the US economy–and stock market–will benefit. Of course, as with all similar indicators, past performance is no guarantee of future behaviour.

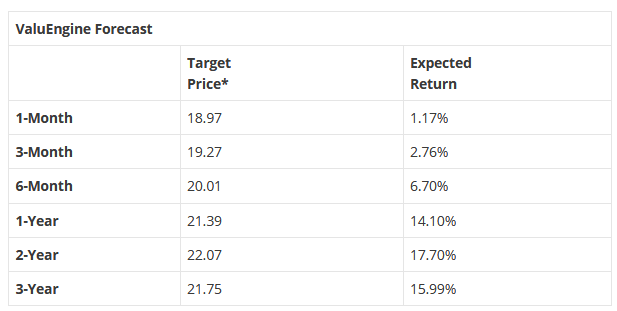

Today, we take a look at a dry bulk shipper that has been doing well over the past few months, Genco Shipping. Our models have noticed, and we now have a STRONG BUY on the stock whereas we were negative on it at the beginning of the year. Genco has generally outperformed its competitors within the Batlic Dry Indices.

They reported earnings a few weeks ago, and at that time the company’s revenues more than doubled to $76.9 million as compared with revenues for the first quarter of 2017 of $38.2 million. The increased revenues were primarily due to higher spot market rates achieved by the majority of the vessels in their fleet and the employment of vessels on spot market voyage charters. These increases were partially offset by the operation of fewer vessels during the first quarter of 2018 as compared to the prior year period.

For the first quarter of 2018, the company recorded a net loss of $55.8 million or a basic and diluted loss per share of $1.61. And this compares to a net loss of $15.6 million or $0.47 basic and diluted loss per share for the first quarter of 2017. Adjusted net income for the first quarter of 2018 was $600,000 or adjusted basic and diluted earnings per share of $0.02 per share, excluding $56.4 million of noncash impairment charges.

ValuEngine continues its STRONG BUY recommendation on Genco Shipping & Trading Ltd for 2018-05-22. Based on the information we have gathered and our resulting research, we feel that Genco Shipping & Trading Ltd has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Earnings Growth Rate and Momentum.

You can download a free copy of detailed report on Genco Shipping & Trading Ltd. (GNK) from the link below.