Drums of war sound louder

- Russia announced yesterday, that it will hit any missile trying to hit Syrian ground and target its source as well. President Trump tweeted in response that "Russia should get ready because the missiles will be coming and they are new and smart." Theresa May seems also to be about to get Cabinet approval today for the UK to participate in a possible conflict. As no timetable seems to be laid out, clouds of war seem to be drawing near. Gold and oil gain as they seem to be feeding on the news. Any further escalation could push prices higher.

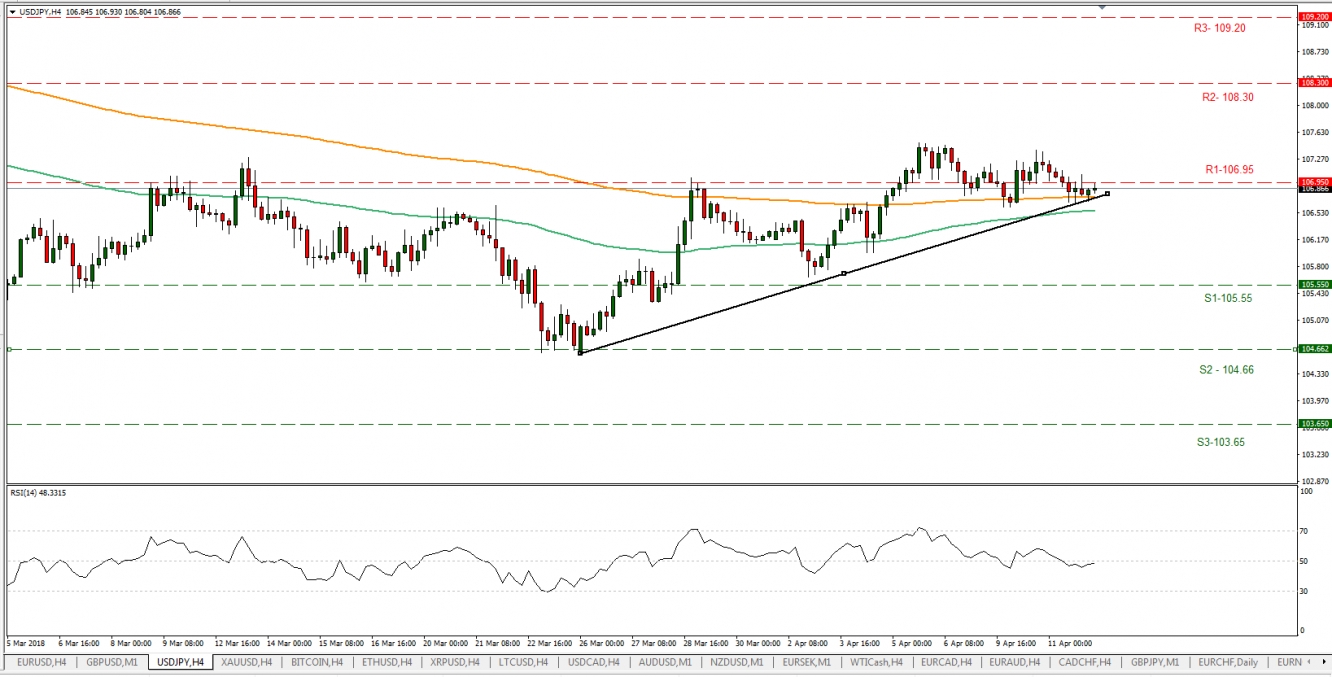

- USD/JPY moved in a sideways manner yesterday, just below the 106.95 (R1) resistance line. Currently, we share the view that the pair could be moving in a sideways manner today without much volatility. Technically, the pair has been trading above the upward trend line incepted since the 26th of March and the parallel courses of the 100 and 200 moving averages since Friday are indicative of its sideways movement. On the fundamentals, we could see the pair dropping as the JPY side could strengthen due to its dual nature as a safe haven. Should the pair come under selling interest, we could see it breaking the upward trend line and aiming if not breaking the 105.55 (S1) support line. Should it find fresh buying orders along its path, we could see it breaking the 106.95 (R1) resistance line and aim for the 108.30 (R2) resistance barrier.

All of Fed’s policymakers saw a strengthening economy

- All participants in the latest FOMC meeting seem to agree that the US economy outlook is stronger than previously anticipated and that inflation (yoy) will most probably reach the 2% target. Furthermore, all agreed on gradual rate hikes and a strong majority consider trade retaliation acts as a downside risk. The minutes definitely had hawkish elements, however, they did not clearly provide signals for a 4 rate hike path. Overall, we could see the US dollar strengthening in the long run, as the arguments for a more hawkish stance prevail. Especially considering the possibility that the likelihood of trade war could diminish in the future and fears slowly fade away.

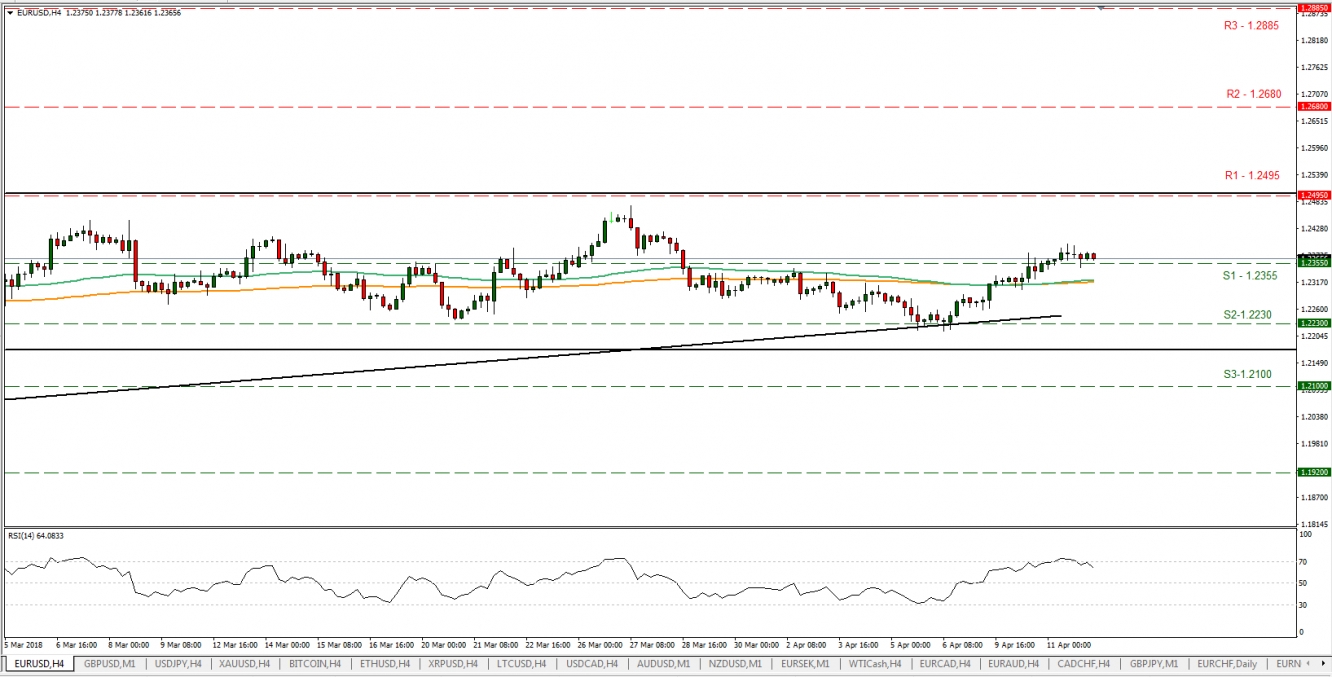

- EUR/USD traded in a sideways manner yesterday testing the 1.2355 (S1) support line. Actually the pair broke the prementioned support line as it dropped some 25 pips upon the release of the FOMC meeting minutes, however, quickly regained any losses made. We see the case for the pair to continue to trade in that manner, however, the pair could prove to be sensitive to any news regarding the tensions in Syria as well as the financial data due out today and the ECB member’s speeches. Technically, the pair trades steadily above the upward trend line incepted since March last year and within the ranges of a sideways movement incepted since the 17th of January. Should the bulls have the upper hand, we could see the pair aiming or even reaching the 1.2495 (R1) resistance hurdle. On the other hand, should the bears take the driver’s seat we could see it trading south, breaking the 1.2355 (S1) support line and aiming for the 1.2230 (S2) support barrier.

In today’s other economic highlights:

- During today’s European morning we get France’s final CPI (EU Norm.) rate for March, Sweden’s CPI rate for March which could support the SEK, Eurozone’s Industrial Production for February, and the ECB’s meeting minutes will be published. In the North American session, we get the Initial Jobless Claims as well as the OPEC monthly report. As for speakers, ECB member Benoit Coeure, BuBa President Jens Weidman and BoE governor Mark Carney speak.

USD/JPY

·Support: 105.55(S1), 104.66(S2), 103.65(S3)

·Resistance: 106.95(R1), 108.30(R2), 109.20(R3)

EUR/USD

·Support: 1.2355(S1), 1.2230(S2), 1.2100(S3)

·Resistance: 1.2495(R1), 1.2680(R2), 1.2885(R3)