After a relatively quiet and less than stellar 2017 for initial public offerings (IPOs), 2018 looks to be both more promising and potentially more exciting, with a pack of 'Unicorns'—Zscaler, Dropbox and Spotify— leading the charge. Unicorns are the designation given to start-ups with $1-billion or greater valuations.

Zscaler (NASDAQ:ZS), a provider of cybersecurity solutions and the first Unicorn out of the gate, went public this past Friday. It priced at $16 but finished its first day of trading up 106% at $33, though shares moved lower yesterday. Its market cap as trading began was $2.5 billion; currently that's grown to $3.27B

Dropbox (NASDAQ:DBX), a cloud storage company, is up next, with final pricing expected this coming Thursday and trading to begin the following day, Friday. According to Reuters, the IPO is already oversubscribed, though it's not clear if this would be enough to lift shares above the expected initial range of $16 to $18.

Spotify's (NYSE:SPOT) more unusual IPO, a direct listing, is expected to occur on April 3rd, with a valuation estimated at $20 billion. We'll cover Spotify in greater detail in our next post.

Biggest US Tech Offering Since Snap

Dropbox is a file hosting service that offers cloud storage, file synchronization, personal cloud, and client software. The company's IPO is expected to be the biggest US technology offering since Snap Inc (NYSE:SNAP) went public a bit over a year ago, on March 2, 2017. Though Snap continues struggling to find its footing, expectations are high for Dropbox, though there are some concerns.

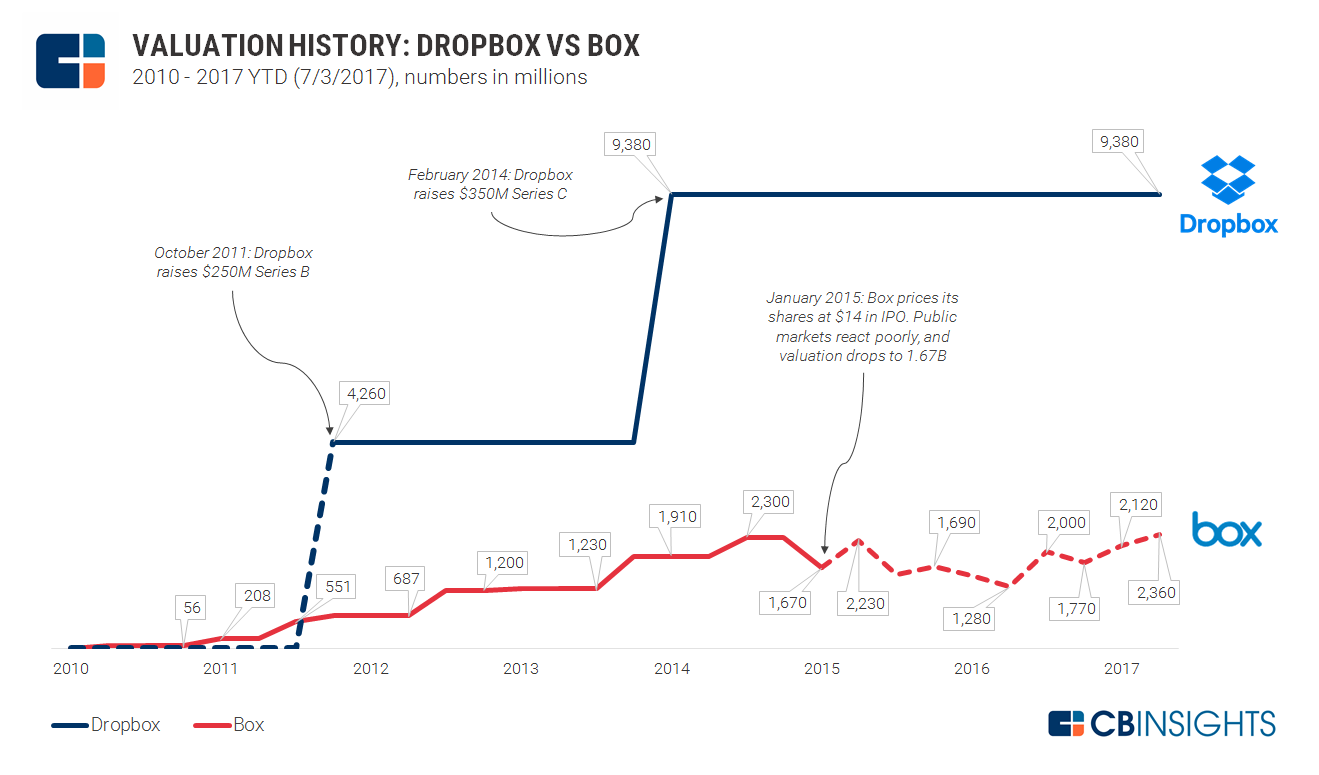

With its market cap expected to come in between $7 and $8 billion, Dropbox is now valued significantly lower than it had been during its last round of private fund raising in 2014. At that point it was valued at over $10 billion. If the company's expectation that shares will price at $16-$18 continues to hold, it would be worth $7.4 billion at $17 a share.

As well, competitor Box Inc (NYSE:BOX) went public in 2015. It's valuation hasn't really changed all that much since then (see chart, below).

Might Box's public markets experience herald what could be ahead for Dropbox?

Though Dropbox has about half a billion registered users, unquestionably an impressive number, unfortunately, only 11 million are actually paying customers, having either upgraded their accounts or due to the fact they're corporate users. The company generated $1.1 billion in sales in 2017, up from $845 million in 2016, and $604 in 2015. Quick calculation indicates that Dropbox's revenue grew by about 30% in 2017, down from 40% growth in 2016.

Its bottom line, while not yet profitable, improves each year. Dropbox lost $112 million in 2017, compared to losses of $210 million in 2016, which was better than 2015 when it lost $326 million. There was an additional positive in 2017—it also generated $305 million in cash flow, a favorable sign.

However, there is one big red flag worth watching as Dropbox IPOs: five years ago, in 2013, Dropbox was already valued at $8 billion dollars. This means that every private investor who got in after 2013 is, best case scenario, about to break even.

As I see it then, as trading begins there are three critical caveats to keep in mind:

- Thus far, Dropbox hasn't justified its valuation, even in the world of inflated, private valuations.

- I'd expect some pre-IPO investors to cut their losses as soon as the company goes public, since they've already endured five years of value stagnation.

- I'm not seeing any indicators that would point to Dropbox appreciating in value as a public company, when it couldn't do so as a privately-held entity.

Dropbox is a 10-year-old business. It would be reasonable to assume that after a decade its startup phase has passed. With 500 million users still harnessing Dropbox's service for free, there's considerable growth potential.

However, as with so many things customers first encounter as freebies, there's no reason that if they haven't already paid for the service they'll suddenly be glad to cough up funds for the same or similar account. And with more and more competitors entering the fray, including Google Drive (NASDAQ:GOOGL), Apple's iCloud (NASDAQ:AAPL), Microsoft's OneDrive (NASDAQ:MSFT), I'm concerned any sort of conversion to paid utilization is unlikely.

Dropbox does have a few things going for it. It appears to be able to attract some very interesting business partners, including Google and Salesforce.com (NYSE:CRM). At the beginning of March, Google and Dropbox announced they'd inked a cross-platform compatibility deal which will allow some of each of their services to integrate with the other. This is particularly interesting since Google already has a Dropbox clone in Google Drive.

Last week news broke that Salesforce will reportedly embed Dropbox folders in its commerce and marketing clouds, as well as purchase $100 million in common stock at IPO price. Might this signal a potential acquisition somewhere down the line? My guess is it depends on the success of this first partnership.

Another thing working in Dropbox's favor: 90% of its paying customers came on their own, with no sales personnel involved. That speaks volumes about the quality of the product, crucial in a crowded space such as cloud storage.

Conclusion: Dropbox's IPO doesn't strike me as outrageously expensive. Still, my rule of thumb for initial public offerings is that unless there's a real bargain to be had, waiting on the sidelines till things settle is generally a good idea.

Dropbox seems to have a path to profitability, but growth concerns remain. Just becoming profitable doesn't warrant a $7 billion valuation.

For the time being Dropbox provides an adequate balance between potential future growth and price. But I'd like to see a bit more. I believe this is one to keep an eye on as it progresses. Dropbox is worthy of a place on one's watchlist, but it's not ready for one's actual portfolio.