The questions nervously being asked during this market turmoil and onslaught of worrisome news is:

1. Are we experiencing an Intermediate-Term pullback or the beginning of a major Long Term move down?

2. How do you determine when and where a pullback might stop?

3. What should I be looking at to give me the correct perspective and what tools will help give me an investment edge?

It is too soon to answer #1 until we see the "whites of the eyes" of the global central bankers and how (NOT 'IF') they will react.

Whether to QE III or not to QE III?

Smart investors will leave that to the central bankers and speculators and focus on questions #2 and #3. These questions we can answer!

MARKETS MOVING MARKETS

Several methods can be used to help determine at what level the market will stop.

1. MULTIPLE METHODS: One technique is to combine multiple tools and methodologies. When several different techniques all seem to point to a specific area, it is wise to take notice.

2. MULTIPLE MARKETS: Another method would be use #1 on multiple markets, as well as the market you are trading. When you see several markets all appearing to be due for a technical event at the same time, again it is wise to take notice.

3. KEY DRIVER$: Additionally, you can add another level of confidence by fully understanding what markets are actually directly affecting the one you are trading. This is a little more tricky and requires much more diligence. This is where the pros spend their time.

Let's work through these, starting with what we know.

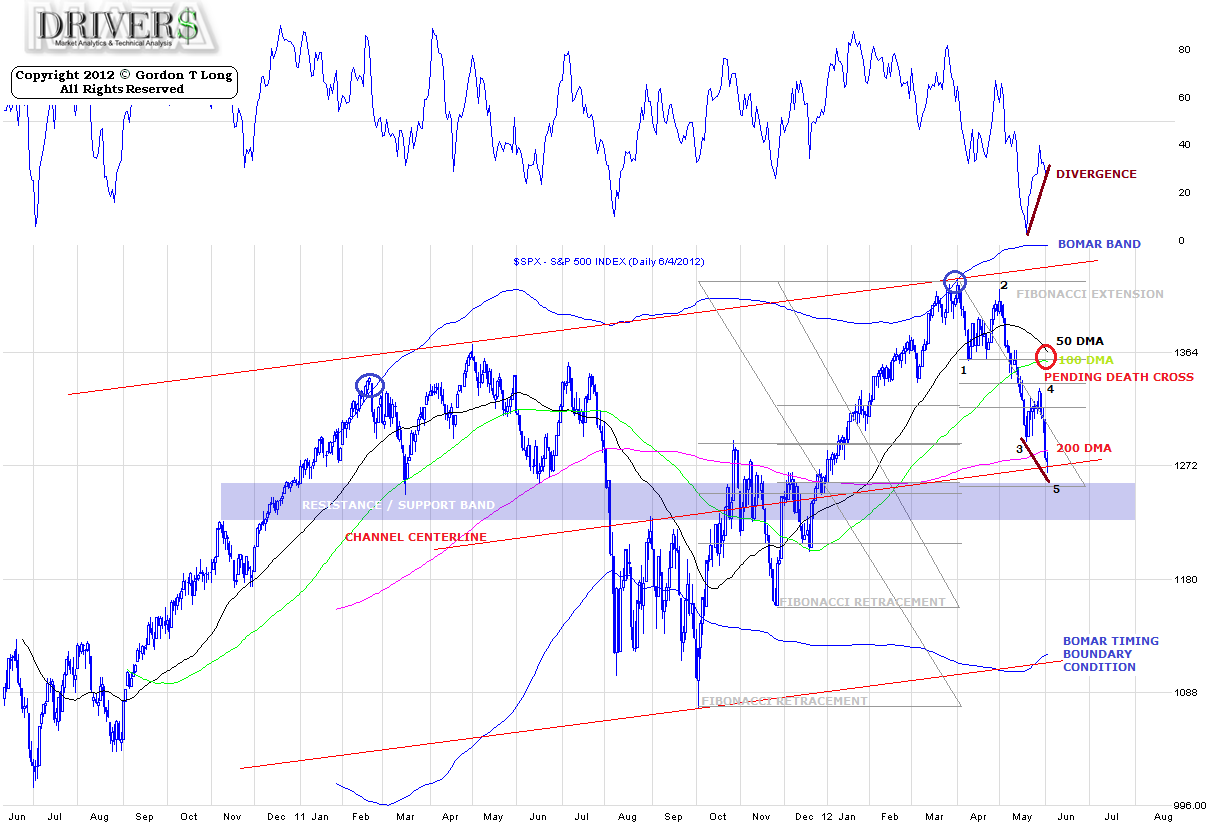

MULTIPLE METHODS:

There are a few technical tools like Fibonacci that we know can be uncanny in doing retracement predictions, as the market respects this natural growth and decay cycle. The issue however, as with many tools, is that you get several choices to choose from.

The tools you use seldom give you one answer, but, like Fibonacci retracements, Gann levels, Bomar Bands, Moving Averages or Elliott Wave Principle, you get a series of levels of interest. The Divergence, 200 DMA, support zones suggest the following Elliot Wave targets a strong S&P 500 possibility: 1) 1254 where wave 5 is 0.618 of wave 1 to wave 3, 2) 1249 with a 50% October 2011 retracement and 3) 1230 where wave 5 is 1.618 of wave 1.

MULTIPLE MARKETS:

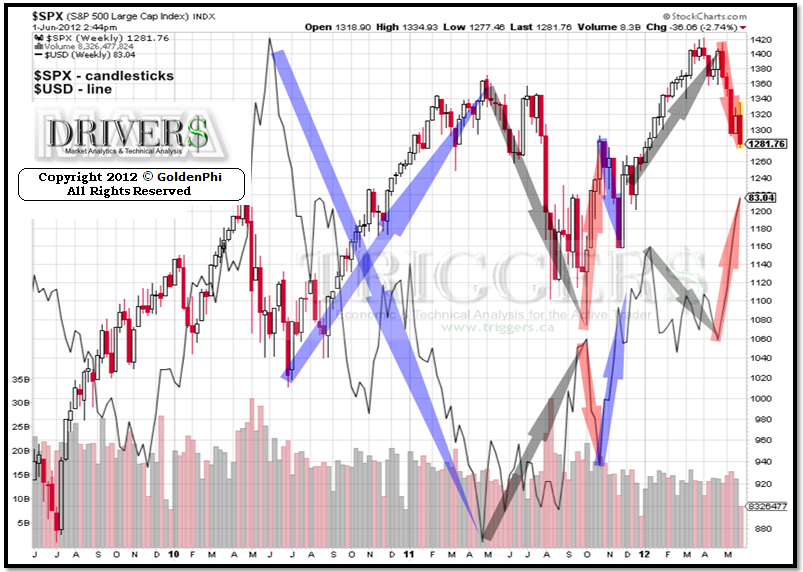

In the case of the S&P we know the value of the USD has an impact. In a general sense, as the dollar rises or falls, it takes more or less of them to equate the same value. The chart below of the SPX and USD show us this:

The line graph is the USD and the candlesticks are the SPX. Highlight arrows have been added to illustrate the point. We know when the dollar falls, more are required to equal the same value and it is reflected in the rise of the market.

We also know when the value of the dollar rises, it requires less of them to equal the same value and the markets fall. This tells us we should be looking to the USD and what it is doing. When it reaches technical areas and turns (or not) at them, you can expect the SPX to do the same.

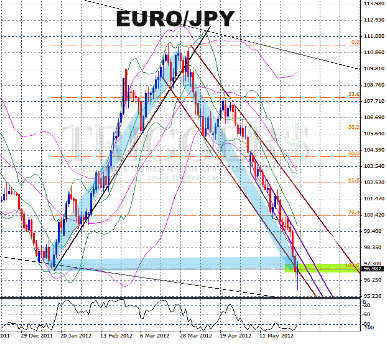

We also know that the USD is also influenced by other markets. With a little investigation we will discover that presently it looks like it is the EUR/JPY that is the Driver for the USD. There are a number of reasons for this, the Japanese Yen Carry Trade being but one example. Economic events in Europe right now are having an impact on the $EURO and these too influence the EURO/JPY. Through the EURO/JPY we are able to gauge the Economic effects of numerous events taking place at the same time. In turn, as shown in the chart below, the EURO/JPY influences or Drive$ the $USD.

This chart is the USD superimposed on to the EUR/JPY. Each are their own scale, but the dates line up and we can see the highlighted arrows again illustrating the point. Movement in the EUR/JPY causes an inverse reaction in the USD.

Note the technical analysis that has been marked up. This analysis was done on the EUR/JPY. You can see the green highlighted box, marking a technically significant area.

There are numerous reasons why it is significant, not the least of which is that it is back to the previous level low from Dec 2011. If you note the shape of the EUR/JPY from the Dec 2011 low, it is a near perfect triangle and gives us another reason - Gann, squaring of price and time - to consider this level technically significant. Indeed you can see that the market appears, at this time, to have reacted to this level. It did “spike” through it, however it also looks to have found support, as the pullback/shape of the candlestick indicates.

As mentioned, numerous factors influence the EUR/JPY at this time. Events in Europe, the unwinding carry-trade, and also Commodities, are all reflected in to the pricing of the EUR/JPY. We showed that this in turn impacts the $USD, which influences the SPX.

Let’s consider then, a chart of the EUR/JPY and the SPX.

Again, the scales are not the same, however the dates are in line, and we can see the direct relationship between the EUR/JPY and the SPX. Keeping an eye then, on the technical indications from the EUR/JPY would be important. While we could draw on numerous significant technical studies on the SPX (channels, retracements etc.) unless we see the EUR/JPY having technical levels of its own, that line up with the SPX levels, the technical analysis you have done on the SPX alone will not hold or give a reaction as expected. At this point in time, the SPX is really reacting to technical indications from the EUR/JPY.

We will have to see in the coming week how the EUR/JPY reacts to our current technical level. There is reason to expect a pullback or bounce at this point (technically) and if it does occur, we should also see a reversal in the SPX market as well.

Also on the chart is a bottom channel that runs just under our current EUR/JPY level. This would be the next likely place to expect a bounce or pullback, should our current levels break.

Should the current levels on the EUR/JPY break, then we could also expect to see more down in the SPX market.

KEY DRIVERS

The bond market is the 800 pound gorilla compared to the equity markets and when it breaks 120 year yield levels it must additionally be carefully considered. Overlaying the technical developments in this market rounds out our three point approach.

The cornerstone of our debt crisis is the yields and spreads on the debt. This gets very complex when you start considering global currency adjustments however sometimes the right perspective is all that is required.

Market fear is in the market and any 'good news' from the central bankers and the market will react. The upside to downside risk has become unbalanced and will soon be adjusted.

As was stated at the start, knowing the technical Trigger$ from various markets can help determine when the market you are trading will react. If you study several markets, and not just your own, you quickly notice that many will come to technical “ heads” at the same time, giving you some indication to pay attention.

When you understand what market(s) directly affect the one you are trading, you can again increase your knowledge and overall confidence as a trader and smart investor. Uninformed and nervous investors make bad decisions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Drivers: Markets Moving Markets

Published 06/06/2012, 02:54 AM

Updated 07/09/2023, 06:31 AM

Drivers: Markets Moving Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.