A successful portfolio manager is aware of the fact that adding well-performing stocks at the right time is of vital importance. Indicators of a stock’s bullish run include a rise in share price and strong fundamentals.

One such stock that investors need to pick up right now is Intuit Inc. (NASDAQ:INTU) . Though there are a few concerns, these are short lived and the stock has the potential to perform well over the long run.

Let’s delve deeper into the factors that make this stock an attractive investment option.

What Makes Intuit an Attractive Pick?

Solid Rank & VGM Score: Intuit currently has a Zacks Rank #2 (Buy) and a Value Growth Momentum Score (VGM Score) of ‘B’. Our research shows that stocks with a VGM Score of ‘A’ or ‘B’ combined with a Zacks Rank #1 (Strong Buy) or #2, offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

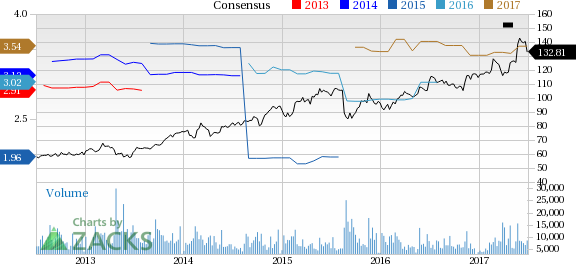

Upward Estimate Revision: Estimates for the current fiscal as well as fiscal 2018 moved north over the past 60 days, reflecting analysts’ confidence on Intuit. Over this period, the Zacks Consensus Estimate for fiscal 2017 increased around 2.9% to $3.54. The Zacks Consensus Estimate for fiscal 2018 also moved up 2.3% over the same timeframe to $3.99.

Positive Earnings Surprise History: Intuit has an impressive earnings surprise history. The company has outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 24.3%.

Healthy Growth Prospects: The Zacks Consensus Estimate for earnings for Intuit for fiscal 2017 is currently pegged at $3.54, reflecting an anticipated year-over-year growth of 13.1%. Moreover, earnings are expected to register 12.6% growth in fiscal 2018. The stock has long-term expected earnings per share growth rate of 13.9%, which is way higher than the industry average of 10.5%.

Growth Drivers: The business and financial software space in which Intuit operates has huge growth opportunities. There are over 29 million small and medium businesses in the U.S. The company had over 2.22 million QuickBooks online subscribers in the country at the end of third-quarter fiscal 2017. We believe that Intuit’s increasing SMB exposure will boost the segment and drive long-term growth. Notably, Intuit has raised expectations to end fiscal 2017 with 2.3 million QuickBooks Online subscribers.

Furthermore, the company is refreshing its product line, in a move to shift its business model from selling desktop software to cloud-based subscription providers. With emerging technology and market trends, cloud-based solutions, as against software-based ones, have gained momentum in recent years. Hence, we are positive about Intuit’s increased adoption of its cloud-based services and products.

An Outperformer: Intuit has outperformed the Zacks categorized Computer-Software industry in the last 3 months. The stock returned approximately 14.4% over this period compared with roughly 6.4% growth recorded by the industry.

Other Stocks to Consider

Other similarly-ranked stocks in the Computer-Software space include Red Hat (NYSE:RHT) , DST Systems Inc. (NYSE:DST) and Oracle Corporation (NYSE:ORCL) . You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

DST Systems, Inc. (DST): Free Stock Analysis Report

Red Hat, Inc. (RHT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Original post

Zacks Investment Research