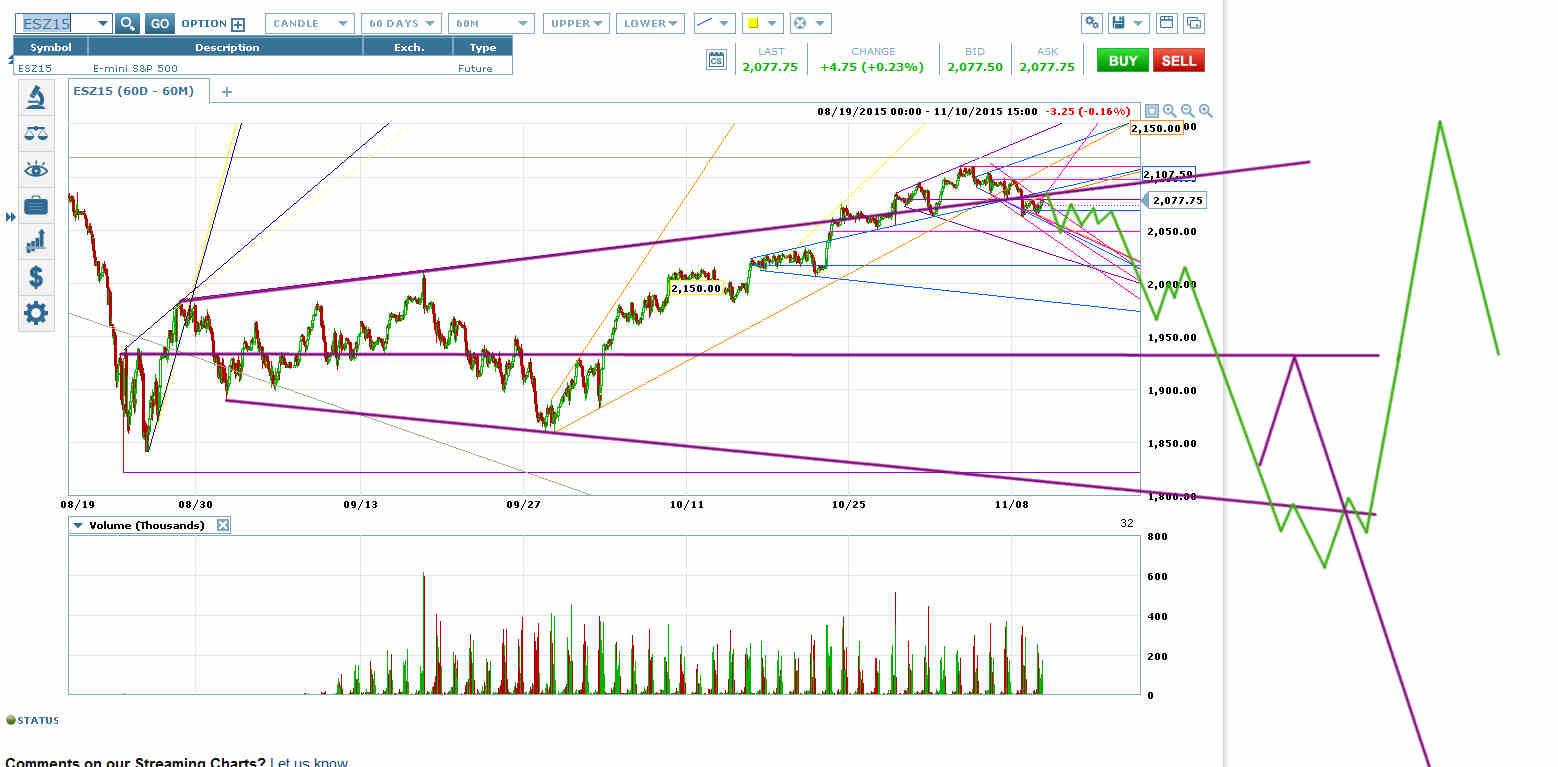

A Slight Move Up and then a Move Down to Gap N:SPY Down would be a Potential Dream Set-Up

There’s a strong potential set-up to short on the ES chart.

Here’s the way it would work. ES needs to retest the top of a big megaphone overnight. That would mean getting past the palace guard at 2080 to roughly the 5 ema on the daily.

Then ES would need to reverse at roughly the 5 ema and most definitely NOT continue up to 2098.

Next ES would have to move down to roughly 2050 to gap SPY down to the bottom of its October 22 gap. That would put an island top on the SPY chart. Often an island top would stop there to fill the gap with a triangle, which would put a triangle right shoulder on the big head and shoulders top (pink neckline on chart) for the move out of the September 29 low.

Triangle right shoulders usually break out downwards. In this case, a downwards breakout would target at least the bottom of the big megaphone (purple) off the August 24 low.

A Downwards Breakout from an H&S Across a Big Megaphone Top Targets at Least the Megaphone Bottom and Would Often Break the Price Out Downwards from the Megaphone

Ways The Dream Could Go Wrong

1. ES could retrace to 2098 tonight instead of turning at the megaphone top. That would add complications to the set-up.

2. ES could reverse off 2050 into a melt-up right shoulder similar to the move off the September 29 low. This melt-up could retest 2098 or even break out upwards through 2098 to 2110 or even a new all-time high to morph the big H&S top into a megaphone top. Then it could morph the megaphone top into a Sornette set-up for a blow-off top with a target 300 points higher.

3. Instead of a triangle right shoulder, ES could put in a normal looking right shoulder and then morph it into a megaphone right shoulder. If you see the H&S break out through the neckline, then reenter the neckline to take out the existing right shoulder high, a megaphone is likely forming. If the price puts in another breakout through the neckline, and then recrosses the neckline upwards, a megaphone right shoulder is definitely forming.

If you see a megaphone right shoulder forming, exit your short position. If the megaphone stays small, you can short again on a breakout downwards from it. But if it gets big, ES is likely headed for a squeaker new high.

However, the green scenario, or something similar, is more likely.

How to Play This

The strongest way to play this is to wait for ES to reach 2050, put in a right shoulder on the H&S (a triangle right shoulder would be the strongest possible set-up), and short on the breakout through the neckline or triangle bottom. I will definitely bet the farm if we get a downwards breakout from a triangle right shoulder.

Do not have a stop right at the triangle bottom, because the bots will usually reenter the triangle after breakout to hunt for stops there. This is a strong set-up for a big move down, so you can afford to be a little loose with your stop.