Investing.com’s stocks of the week

Central bank Thursday was always going to be dominated by the movements from the Bank of Japan and while the Bank of England may have been the snooze-fest that everyone had expected, the European Central Bank managed to bring some volatility to the afternoon’s markets.

Mario Draghi’s post-decision press conference opened the door to a rate cut in the Eurozone sooner rather than later, although we will need to see a continuation of the recent decline in economic data to ram the issue home. Monetary policy easing is a lot more difficult in the Eurozone due to the rules governing the single currency area and a UK/US/Japan-esque splurge of quantitative easing is never going to be on the cards despite the risks the region still has to deal with. The rate cut is now a lot more warranted than before in light of the 12% unemployment, below target inflation, and growth on a country-by-country basis somewhere between recession and depression.

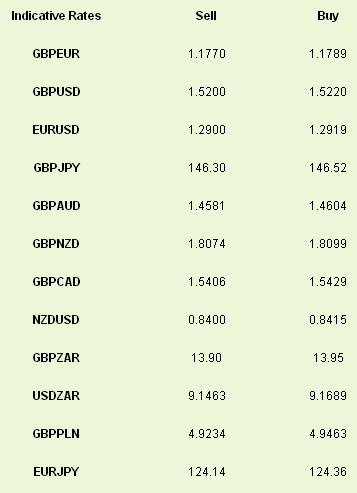

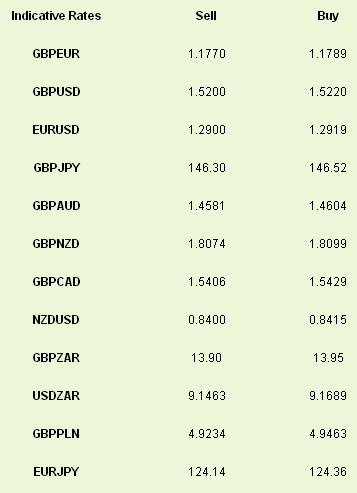

Even so, following some initial euro weakness during the press conference, the single currency has come back fighting overnight with GBPEUR off a cent from the highs it had made. This was more to do with the assertion from the ECB Chair that the recent events in Cyprus were not a “template” for further action against depositors in the Eurozone. The admission that the first plan of taxing all, regardless of deposit levels, was a mistake and, credit where credit is due, Draghi admitted the mistake.

The Bank of England held rates at 0.5% and asset purchases at £375bn as expected yesterday. There was no accompanying statement. Those of you who tuned into our Bank of England webinar yesterday will know that we now think that this is likely to stay, data depending, as is until Mark Carney takes over the stewardship of the Bank in July.

24 hours after the Bank of Japan unleashed its own bazooka and has the worm already started to turn? Yesterday the yields on Japanese longer-term debt hit record lows as investors piled into Japanese Government Bonds on the basis that the Bank of Japan will be buying them like hot cakes. This morning however, that move has been reversed in quick order. The reasons behind this are unclear at the moment but rates traders tell me there was a poor auction overnight but that should not be reason for the biggest daily price range in JGBs for over 15 years and yields back to pre-Kuroda levels.

The past 36 hours have also been a poor one for the US jobs market with a disappointing jobless claims announcement coming a day after a very weak ADP number. Obviously this only increases the pressure on the Non-Farm Payrolls release due at 13.30 BST which has seen the consensus figure go from 199k to 195k and finally to 190k. A weaker figure than 170k and USD could easily have an afternoon to forget.

Mario Draghi’s post-decision press conference opened the door to a rate cut in the Eurozone sooner rather than later, although we will need to see a continuation of the recent decline in economic data to ram the issue home. Monetary policy easing is a lot more difficult in the Eurozone due to the rules governing the single currency area and a UK/US/Japan-esque splurge of quantitative easing is never going to be on the cards despite the risks the region still has to deal with. The rate cut is now a lot more warranted than before in light of the 12% unemployment, below target inflation, and growth on a country-by-country basis somewhere between recession and depression.

Even so, following some initial euro weakness during the press conference, the single currency has come back fighting overnight with GBPEUR off a cent from the highs it had made. This was more to do with the assertion from the ECB Chair that the recent events in Cyprus were not a “template” for further action against depositors in the Eurozone. The admission that the first plan of taxing all, regardless of deposit levels, was a mistake and, credit where credit is due, Draghi admitted the mistake.

The Bank of England held rates at 0.5% and asset purchases at £375bn as expected yesterday. There was no accompanying statement. Those of you who tuned into our Bank of England webinar yesterday will know that we now think that this is likely to stay, data depending, as is until Mark Carney takes over the stewardship of the Bank in July.

24 hours after the Bank of Japan unleashed its own bazooka and has the worm already started to turn? Yesterday the yields on Japanese longer-term debt hit record lows as investors piled into Japanese Government Bonds on the basis that the Bank of Japan will be buying them like hot cakes. This morning however, that move has been reversed in quick order. The reasons behind this are unclear at the moment but rates traders tell me there was a poor auction overnight but that should not be reason for the biggest daily price range in JGBs for over 15 years and yields back to pre-Kuroda levels.

The past 36 hours have also been a poor one for the US jobs market with a disappointing jobless claims announcement coming a day after a very weak ADP number. Obviously this only increases the pressure on the Non-Farm Payrolls release due at 13.30 BST which has seen the consensus figure go from 199k to 195k and finally to 190k. A weaker figure than 170k and USD could easily have an afternoon to forget.