The euro just hit a one-month high against the U.S. dollar. But, says Elliott Wave International's Jim Martens, the bulls may need to curb their enthusiasm soon.

Since August 2, EUR/USD, the forex pair that makes up the bulk of the $4-trillion-a-day global currency trading turnover, has gained almost 300 pips.

Analysts say that last Friday's dubious U.S. jobs numbers and the European Central Bank's euro-supportive talk have helped the rally.

Sounds logical, but if you actually trade forex, neither of these explanations tells you what EUR/USD may do tomorrow.

You know what can help you get the answer? Elliott Wave analysis. And right now, the Elliott Wave message for EUR/USD is: caution!

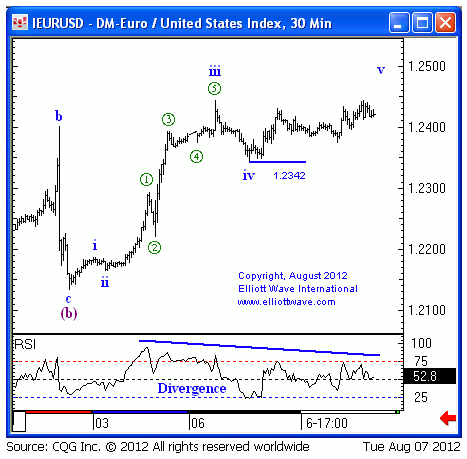

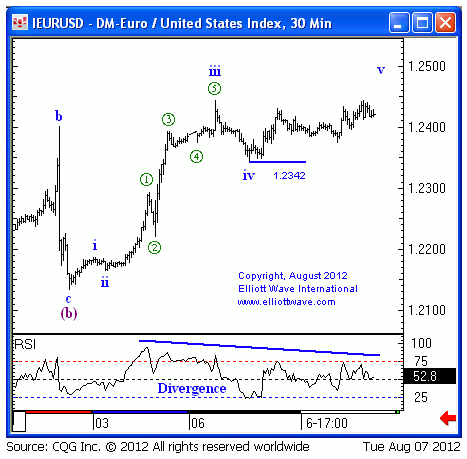

Elliott Wave International's Senior Currency Strategist Jim Martens says that right now, EUR/USD is showing an almost completed 5-wave rally pattern:

EUR/USD DM -Euro" title="EUR/USD DM -Euro" width="467" height="459" />

EUR/USD DM -Euro" title="EUR/USD DM -Euro" width="467" height="459" />

After any 5-wave move comes a 3-wave correction, according to Elliott Wave analysis. The correction is most likely to end near the end of the previous wave 4. In this case, it's the level 1.2342 you see marked on the chart with a blue line.

But that's just the half of it. The larger-degree Elliott Wave pattern in EUR/USD remains bearish.

So, Mario Draghi may think he has the market cornered, but we'll see -- very soon -- who has the last word.

Since August 2, EUR/USD, the forex pair that makes up the bulk of the $4-trillion-a-day global currency trading turnover, has gained almost 300 pips.

Analysts say that last Friday's dubious U.S. jobs numbers and the European Central Bank's euro-supportive talk have helped the rally.

Sounds logical, but if you actually trade forex, neither of these explanations tells you what EUR/USD may do tomorrow.

You know what can help you get the answer? Elliott Wave analysis. And right now, the Elliott Wave message for EUR/USD is: caution!

Elliott Wave International's Senior Currency Strategist Jim Martens says that right now, EUR/USD is showing an almost completed 5-wave rally pattern:

EUR/USD DM -Euro" title="EUR/USD DM -Euro" width="467" height="459" />

EUR/USD DM -Euro" title="EUR/USD DM -Euro" width="467" height="459" />After any 5-wave move comes a 3-wave correction, according to Elliott Wave analysis. The correction is most likely to end near the end of the previous wave 4. In this case, it's the level 1.2342 you see marked on the chart with a blue line.

But that's just the half of it. The larger-degree Elliott Wave pattern in EUR/USD remains bearish.

So, Mario Draghi may think he has the market cornered, but we'll see -- very soon -- who has the last word.