One of the common themes in 2014 that we pointed to as important for rates was the divergence of monetary policy paths between the various G10 central banks. We got a slight hint of it yesterday with the Bank of England and European Central Bank meetings although we believe the gaps will be much more evident by the end of Q1. That is not to say that they aren’t there at the moment.

Yesterday the European Central Bank decided to strengthen its forward guidance plan, further emphasising that the bank stands ready to loosen monetary policy if they believe it is necessary. Conditions for action would be tightening of money markets – further pressure on bank funding markets – or additional falls in inflation throughout the Eurozone; the trajectory of prices has been lower for a while. Movements in that direction in recent months may have prompted the move yesterday but we will need to see more before policy itself is actually amended.

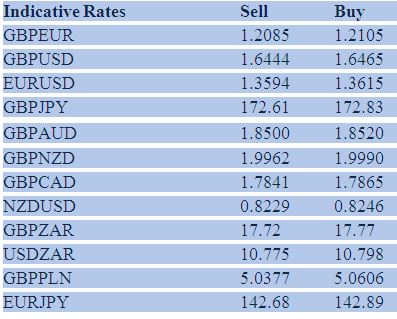

Draghi would not be drawn on what could happen next – it could be further rate cuts, liquidity operations such as LTROs, or finally some form of asset purchasing quantitative easing – but emphasised that plans in the background do exist. This was enough to push EURUSD to fresh 1 month lows while GBPEUR rose to the highest level since this time last year.

In comparison, the Bank of England meeting was an exercise in matching expectations. The Bank of England has entered 2014 in a rather remarkable quandary; a central bank eager to continue to preach the gospel of lower rates, but unwilling to talk down an accelerating economic revival. Jobs growth will continue through Q1 with anecdotal data from recruitment agencies published yesterday showing that more people were placed into permanent roles in December at the 2nd fastest rate since 1997.

We can therefore safely assume that the jobs numbers due in two weeks’ time should take another step towards the 7.0% threshold that the Bank of England first assumed would only be hit in 2016. November’s shift of that threshold being hit to Q3 2015 has brought the Bank’s forecasts slightly less ridicule and we believe that the 7% level will be hit, and remain below that level, by the end of this year.

There’s been lot of chatter in recent weeks around a possible retargeting of the unemployment threshold from 7% down to 6.5%. The average unemployment rate over the past 20 years has been 6.6% and we expressed some surprise that the Bank had plumped for a figure above that when setting its guidance out in August. We could easily see the Bank doing this, especially if declines in unemployment remain at current rates.

For my money the Bank will likely use similar language to that of the Federal Reserve last night that it “likely will be appropriate” to hold the main interest rate near zero “well past the time that the unemployment rate declines below the unemployment threshold”. Forward guidance has always been a subjective policy and will remain so until the Bank of England no longer says it is.

Any discussion about moving the unemployment threshold from 7.0% to 6.5% should take place at a meeting directly before a Quarterly Inflation Report. The next one would be February;. That being said, we do expect some discussion at today’s meeting, which will be reflected in the minutes due in a fortnight.

Today is dominated by the latest jobs report from US due at 13.30 GMT. Data from the US through November and December has been very strong and we would expect to see that continue today. Our expectations are for a 225-230k increase in payrolls and the unemployment rate to remain at 7.0% through the month of December. The risks to this are weather-related; for all the news we have heard about the recent ‘polar vortex’ there was poor weather in December which may have hurt the number. For what it’s worth there was little effect on ADP as a result.

Before that we have industrial and manufacturing numbers from the UK at 09.30 which should continue the recent growth run. The figures are from November – possibly the crucible of near-term UK growth – and should be strong.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Draghi Remains Dovish, Payrolls Should Surprise Higher

Published 01/10/2014, 05:28 AM

Draghi Remains Dovish, Payrolls Should Surprise Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.