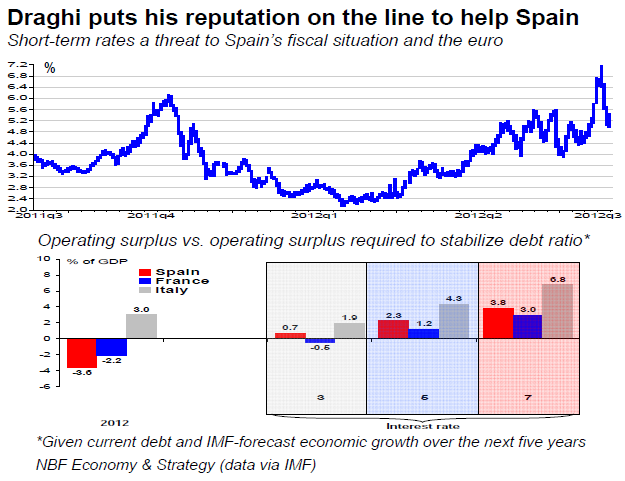

Yields to maturity of Spanish government bonds spiked last week when the province of Valencia asked the central government for financial support, confirming that not only Spain’s banks but also its provincial governments are in difficulty. Meanwhile, the national economy is struggling, having contracted 0.4% (non-annualized) in Q2. Against this backdrop, the market sent the Spanish 2-year yield to 7.15% and the 10- year yield to 7.75% on July 25. By our calculation, the IMF’s five-year growth forecast and the country’s current debt suggest that even if its weighted average cost of funds were to remain close to 3%, Spain would have to run an operating surplus of 0.7% of GDP to stabilize its debt-to-GDP ratio. A cost of 7% over the long run would raise the requirement to 3.8%. With Spain currently running an operating deficit of 3.6%, that would mean an adjustment to the primary balance amounting to 7.4% of GDP, requiring an increase in government revenue of 21%! Even in the short run, Spain’s borrowing requirements made last week’s yields a threat to its fiscal position and, by the same token, to the euro. ECB president Mario Draghi responded by pledging to safeguard the European currency, putting his reputation on the line. The market listened: the Spanish 10-year yield has fallen 115 basis points since then. Having fuelled expectations that the ECB will resume its bond-buying program, Mr. Draghi now must deliver. The Governing Council of the ECB meets Thursday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Draghi Puts His Reputation On The Line To Help Spain

Published 08/01/2012, 02:22 AM

Updated 05/14/2017, 06:45 AM

Draghi Puts His Reputation On The Line To Help Spain

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.