Mario Draghi:

The second question is on the euro exchange rate. Since the last large package of measures, it’s risen against the dollar and other currencies. How much of a concern is that? I know you don’t target the exchange rate specifically, but it’s an important economic factor. Does it say anything about the ECB’s ability to influence the exchange rate?

Draghi: I’ll answer the second question: as I’ve said many times, the exchange rate is not a policy target. It’s important for price, stability and for growth, and we’ve taken the measures in March, and these measures have been effective and will be effective in avoiding second-round effects in the price and wage setting behaviour. – European Central Bank (ECB) press conference on monetary policy statement, April 21, 2016

That was what ECB President Mario Draghi had to say about the euro. The question is a fair one because after Draghi stepped up to the plate to high expectations in December and March, the euro surged. Overall, the single currency has ever so slowly churned higher since December’s “Draghi Drubbing.” The reaction to the latest monetary statement looks almost like a blow-off top of all this unwanted buying interest.

As if the December flub touched off lasting momentum, the euro has trended higher just as the ECB needs a weaker euro to combat disinflationary pressure.

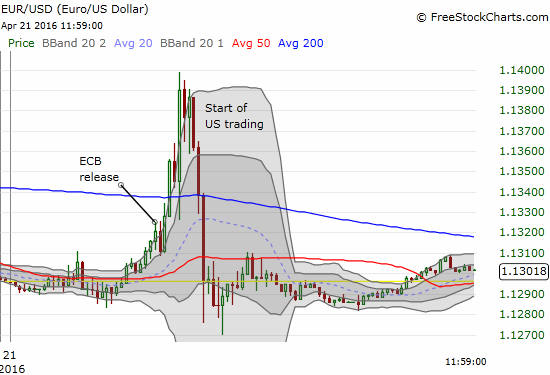

The initial reaction to the ECB press release looked like the typical “buy-the-ECB” trade. However, by the time the press conference ended and the U.S trading hours launched, the euro fell off a cliff just as rapidly as it climbed.

The euro puts on quite a display as an intraday parabolic move collapses even faster than it grew.

The above 15-minute chart is a great reminder of the dangers of chasing parabolic moves. Such moves reveal a panic of too many market participants trying to trade in the same direction all at once. The end result is a sudden and abrupt depletion of fresh forces in that direction, in this case buying pressure. Forces in the opposite direction rush to fill the vacuum. Traders took less than 45 minutes to completely reverse the buying pressure presumably triggered by the ECB meeting.

Normally, I might attribute such a move to short covering. Yet, speculators have steadily reduced net shorts for many weeks now. In fact, net shorts have not been this low since early June, 2014. That was right before the euro took a huge dive against the U.S. dollar as policy divergence first became a force to reckon with. EUR/USD traded around 1.36 at that time. I think Draghi still expects policy divergence to work its magic (emphasis mine):

…the consequence for our monetary policy stance is that of course we keep the monetary policy stance as decided in March, and we now focus on its implementation. Second, our monetary policy course will continue to diverge from the monetary policy courses that prevail in other jurisdictions better placed in the recovery cycle. Third, if there were an unwanted tightening in broad financing conditions that would alter our medium-term outlook, the Governing Council stands ready to act using all the available instruments within its mandate.

Time will tell. In the meantime, I remain short the euro in anticipation of at least one of three potential catalysts for weakening:

- Policy divergence coming into effect again.

- The euro getting used as a funding currency for carry trades.

- Collateral damage from Brexit angst and/or actual Brexit.

Draghi Isn't Worried

…first of all, let me state unequivocally that we view the participation of the UK in the European Union as mutually beneficial, and we will continue to say so in the coming weeks. Certainly the discussion about this possibility has already produced some significant consequences on the markets, for example a depreciation of sterling, quite significant. We do expect a continuation of market volatility, certainly until the referendum; I don’t want to speculate about the outcome of the referendum, but probably even after the referendum. Is it enough to endanger the economic recovery in the euro area? The assessment of our staff is that the risk of this happening is limited.

Be careful out there!

Full disclosure: short the euro