American Express Co. (NYSE:AXP) just released its third quarter fiscal 2016 financial results, posting adjusted diluted earnings of $1.24 and revenue of $7.8 billion. AXP is a Zacks Rank #3 (Hold), and is up over 4% to $63.71 per share in after-hours trading shortly after its earnings report was released.

Beat earnings estimates. The company posted earnings of $1.24 per share, soaring past the Zacks Consensus Estimate of 96 cents per share. This number excludes a restructuring charge related to cost reduction efforts.

Beat revenue estimates. The company saw revenue figures of $7.8 billion, also beating our consensus estimate of $7.665 billion but falling 5% year-over-year.

Q3 net income was $41.1 billion, down 10% from the year ago period.

It should be noted that credit quality remained strong, and AmEx returned a substantial amount of capital to shareholders through share repurchases and dividends. Year-ago results included business related to the company’s relationship with Costco (NASDAQ:COST) that ended earlier this year.

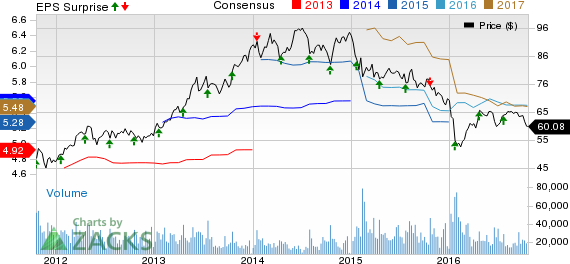

As a result, American Express has raised its 2016 earnings guidance, and remain on track to report at least $5.60 per share in 2017. The company now expects GAAP EPS for 2016 to be between $5.65 and $5.75 per share, while adjusted EPS should fall in the range of $5.90-$6.00 per share, well above previous estimates of $5.40-$5.70 per share.

Here’s a graph that looks at American Express’ price, consensus, and EPS surprise:

American Express Company is primarily engaged in providing travel related services, financial advisory services, and international banking services throughout the world. American Express Travel Related Services Company, Inc. provides a variety of products and services, including global networking services, the American Express Card, the Optima Card, and other consumer and corporate lending products and stored value products.

Stocks that Aren't in the News…Yet

You are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. Many of these companies are almost unheard of by the general public and just starting to get noticed by Wall Street. They have been pinpointed by the Zacks system that nearly tripled the market from 1988 through 2015, with a stellar average gain of +26% per year. See these high-potential stocks now >>

AMER EXPRESS CO (AXP): Free Stock Analysis Report

Original post

Zacks Investment Research