Investing.com’s stocks of the week

Reaction was mixed after the ECB outlined its highly anticipated bond buying programme. Perhaps the leaked report the previous day had taken the wind out of its sails as it would appear the markets expected an extra dollop of cream on top of what we had already heard. GBP/EUR was up and down throughout the afternoon before settling in the low – mid-1.26 range.

Straight off the bat growth forecasts for the year were revised downwards from -0.1% to -0.4%, with the inflation target raised from 1.6% to 1.9%. Draghi made it clear that central bank intervention is pointless without policy adherence to align structural reform with monetary measures. This shifted the onus onto the sovereigns themselves.

He did outline a compact two pronged structure. In order for the ECB to intervene in the secondary markets, the government in question must actively seek help by committing to lowering yields and agreeing to full macroeconomic conditionality. This would require signing a “Memorandum of Understanding” which would essentially hand the reigns to the ECB. This means further austerity and reform for countries who are already struggling with current deficit reduction targets.

In keeping with the rising inflation fears, Draghi ensured that all purchasing would be sterilised, indicated that new monies would not be printed and instead existing cash flows such as current bank deposits would be used instead. A concern that had been voiced earlier in the week.

It would appear that there was some expectation that there would be an immediate step to lower yields somewhat, just to get the ball rolling. A question was put to Draghi, asking whether yields were high due to the self fulfilling market fear that has been overinflating peripheral yields. The ECB president was quite clear and succinct in pointing out that yields were high because of poor policy decisions made in the past. In other words, it’s a deep seated structural problem which will take a deep seated structural answer: the ECB doesn’t do “quick fixes.”

As it stands, the offer has been put on the table by Draghi and the ECB, the ball is now in the opposition court. If countries want help, they know what they have to do. Mariano Rajoy, Mario Monti and their respective cabinets have a lot to think about. Already we have seen some pressure taken off the bond market as 10-year yields have already fallen.

Earlier in the day the BoE and the ECB decided to keep interest rates unchanged. For the BoE, with asset purchasing still underway from the current bout of QE, another roll of the dice to introduce further monetary easing would have been premature. Similarly, the ECB had enough eggs in the bond basket to introduce a further 25bp cut at this point.

Looking forward to today we have Industrial and Manufacturing data out for the UK and nonfarm payrolls for the US out after lunch. Much of the day and indeed next week will be spent dissecting and interpreting yesterday’s meeting and what it means for the euro.

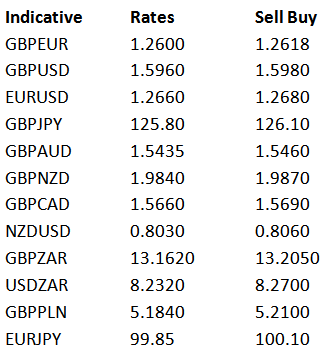

Latest exchange rates at time of writing:

Straight off the bat growth forecasts for the year were revised downwards from -0.1% to -0.4%, with the inflation target raised from 1.6% to 1.9%. Draghi made it clear that central bank intervention is pointless without policy adherence to align structural reform with monetary measures. This shifted the onus onto the sovereigns themselves.

He did outline a compact two pronged structure. In order for the ECB to intervene in the secondary markets, the government in question must actively seek help by committing to lowering yields and agreeing to full macroeconomic conditionality. This would require signing a “Memorandum of Understanding” which would essentially hand the reigns to the ECB. This means further austerity and reform for countries who are already struggling with current deficit reduction targets.

In keeping with the rising inflation fears, Draghi ensured that all purchasing would be sterilised, indicated that new monies would not be printed and instead existing cash flows such as current bank deposits would be used instead. A concern that had been voiced earlier in the week.

It would appear that there was some expectation that there would be an immediate step to lower yields somewhat, just to get the ball rolling. A question was put to Draghi, asking whether yields were high due to the self fulfilling market fear that has been overinflating peripheral yields. The ECB president was quite clear and succinct in pointing out that yields were high because of poor policy decisions made in the past. In other words, it’s a deep seated structural problem which will take a deep seated structural answer: the ECB doesn’t do “quick fixes.”

As it stands, the offer has been put on the table by Draghi and the ECB, the ball is now in the opposition court. If countries want help, they know what they have to do. Mariano Rajoy, Mario Monti and their respective cabinets have a lot to think about. Already we have seen some pressure taken off the bond market as 10-year yields have already fallen.

Earlier in the day the BoE and the ECB decided to keep interest rates unchanged. For the BoE, with asset purchasing still underway from the current bout of QE, another roll of the dice to introduce further monetary easing would have been premature. Similarly, the ECB had enough eggs in the bond basket to introduce a further 25bp cut at this point.

Looking forward to today we have Industrial and Manufacturing data out for the UK and nonfarm payrolls for the US out after lunch. Much of the day and indeed next week will be spent dissecting and interpreting yesterday’s meeting and what it means for the euro.

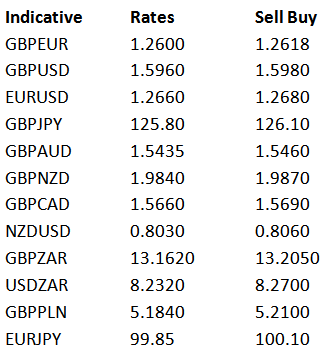

Latest exchange rates at time of writing: