Summary

- Dr Pepper Snapple Group Inc (NYSE:DPS) is a high-quality steady-growth beverage company currently going through a correction due to “disappointing” earnings in recent quarters.

- The disappointing earnings were driven by higher expenses associated with the acquisition of Bai Brands, which is “one-time”, and could prove beneficial to its future growth prospects. Non-alcoholic beverages market expansion also provide impetus for future sales growth.

- Compared to peers such as PepsiCo (NYSE:PEP) and Coca-Cola, Dr Pepper Snapple is attractively priced at 19.9x FY2016 P/E, presenting investors with an opportunity to make entry into the highly resilient beverages industry.

Quality beverages company going through a correction

Dr Pepper Snapple is a Texas-based non-alcoholic beverages manufacturer with main revenue exposures to the United States (90% by revenue). The company owns several market leading household beverage brands in the United States & Canada. Canada Dry is the #1 ginger ale in the US and Canada, 7up is the #2 lemon-lime carbonated soft drink in the US, A&W is the #1 root beer in the US, and Sunkist is the #1 orange carbonated soft drink in the US. These household names put Dr Pepper Snapple is a commanding market position, giving the company a strong competitive advantage against potential new entrants as the overall market expands.

In terms of financial health, Dr Pepper Snapple is in very good shape as well. It generates a very respectable +12.8% return on invested capital, as of FY2016. Its business model allows for a very short working capital cycle of about 20 days, therefore making the company highly free cash flow generative ($759 million FY2016 FCF or +4.9% FCF yield). The company does take on a fair bit of debt onto its balance sheet, carrying about $2.7 billion in net debt on its books as of FY2016. However, the company’s income generating abilities can easily support this, as its net debt is only 1.7x that of its EDITDA generated in FY2016.

Dr Pepper Snapple shares recently took a dive, after reporting 2 consecutive sets of earnings reports that disappointed Wall Street. The beverage company reported Q2 earnings per share (EPS) of $1.25 in July, missing expectations by $0.03, and Q3 EPS of $1.10 in October, missing expectations by $0.06. As a result, shares of the company have fallen about 7% since July. The correction has dropped Dr Pepper Snapple’s valuation to levels not seen since November 2016, presenting investors with an opportunity to consider its shares.

Higher expenses due to Bai Brands acquisition, growth prospects intact

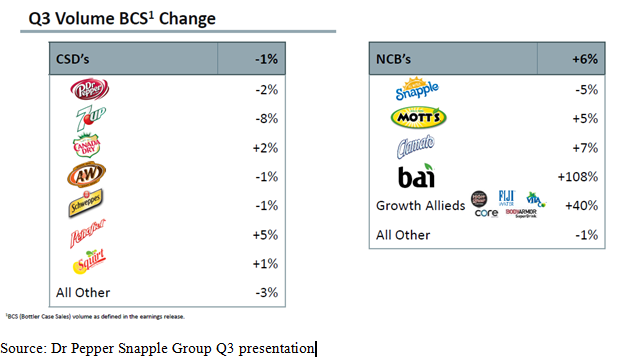

It may seem like the disappointing earnings do not bode well for Dr Pepper Snapple’s prospects. But on further inspection, earnings were lower mostly due to the company’s acquisition of Bai Brands. The acquisition added $38 million to Q3 selling, general & administrative expenses (SG&A), including $20 million in marketing investments. Sales volumes increased regardless, rising 1% inclusive of the Bai Brands acquisition, with top-line net revenue increasing 4% year-on-year. This is despite the recent hurricanes and earthquakes in the US & Mexico, which has negatively impacted volumes by approximately 0.5%.

According to Dr Pepper Snapple’s Q3 presentation, Bai Brands is currently the fastest growing non-carbonated beverage (NCB) under the company’s brand portfolio, with volumes increasing 108% YoY in the third quarter. This explosive growth rate beats out all other brands under the company’s portfolio, even the legacy carbonated soft drink (CSD) brands. This indicates that the company’s marketing investment in its new acquisition is bearing fruit, and could well be the major driver for volume growth in the future.

Attractive valuations compared to peers

Consensus estimates put Dr Pepper Snapple’s FY2017 EPS at $4.54, according to Zacks Investment Research. This means that compared with the current adjusted EPS of $4.33, forecasted earnings growth would be at +4.9%. At current market prices,shares are currently trading at only 19.9x FY2016 P/E – a decent price to pay for a company in a recession-resistant industry with healthy growth prospects.

Moreover, when compared with larger competitors such as PepsiCo and Coca-Cola Company (NYSE:KO), who are trading at valuation multiples of 23x and 24x historical P/E respectively, Dr Pepper Snapple is actually trading at an approximate15% discount. And beverage giants like Coca-Cola don’t even have positive sales and earnings growth, but by virtue of being in the supposedly resilient beverages industry, it is accorded with higher valuations despite having poorer growth prospects. Given this, we believe Dr Pepper Snapple should be re-valued upwards, and this would be a good opportunity for investors to snap up some of its shares amidst the correction.

Disclosure: We have no positions in any stock mentioned above.