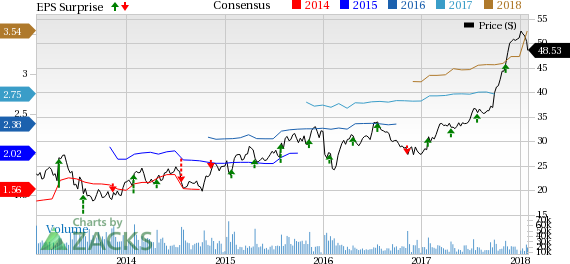

D.R. Horton, Inc. (NYSE:DHI) came up with yet another stellar performance in the first quarter of fiscal 2018. Earnings and revenues surpassed the Zacks Consensus Estimate, courtesy of a solid housing market scenario. Shares of the homebuilder increased 1.5% in the pre-market trading session after the earnings release at the time of writing.

Earnings & Revenues Discussion

The company reported adjusted earnings of 77 cents per share, surpassing the Zacks Consensus Estimate of 64 cents by 20.3%. The adjustment was primarily due to one-time charge owing to the changes in the tax law. Adjusted earnings increased from the year-ago profit level of 55 cents.

Total revenues (Homebuilding, Forestar and Financial Services) were $3.33 billion. The figure beat the Zacks Consensus Estimate of $3.28 billion and increased 14.8% year over year.

Home Closings and Orders

Homebuilding revenues of $3.2 billion increased 14% year over year. Home sales increased 13.8% year over year to $3.18 billion, aided by higher home deliveries. Land/lot sales and other revenues were $36.4 million, up from $28.4 million a year ago.

Home closings increased 15% to 10,788 homes, while it increased 14% to $3.2 billion in value. The company registered growth across all regions comprising East, Midwest, Southeast, South Central, Southwest and West.

Net sales orders increased 16% to 10,753 homes on continued improvement. Orders increased across all operating regions. The value of net orders grew 17% to $3.2 billion. The cancellation rate was 22%, same as the prior-year quarter.

Quarter-end sales order backlog (under contract) increased 8.7% to 12,294 homes. Backlog value increased 10.6% to $3.8 billion.

Revenues at the Financial Services segment increased 3.7% to $81 million. Forestar contributed $30.8 million to the quarterly revenues.

Margins

Home sales gross margin expanded 100 basis points (bps) year over year to 20.8%. The upside was driven by lower warranty, litigation and interest costs as a percentage of homebuilding revenues.

Selling, general and administrative (SG&A) expenses, as a percentage of homebuilding revenues, were 9.5%, same with the year ago level.

Balance Sheet

D.R. Horton’s cash, cash equivalents and restricted cash totaled $974 million as of Dec 31, 2017 compared with $1,024.3 million as of Sep 30, 2017.

Fiscal 2018 Guidance

The company has maintained its consolidated revenue guidance in the range of $15.5 billion to $16.3 billion. Homes closing is expected to fall between 50,500 and 52,500 units. Homebuilding SG&A expense, as a percentage of homebuilding revenues, are expected to be around 8.7%.

D.R. Horton has updated its home sales gross margin forecast to 20-21% (versus 20% expected earlier).

Consolidated pre-tax profit margin is now expected to be approximately 11.8-12% (against 11.5% to 11.7% expected earlier).

Cash flow from operations is expected to be at least $700 million, excluding Forestar (versus previous expectation of $500).

D.R. Horton expects income tax rate of approximately 26% and diluted share count increase of less than 1%.

Zacks Rank

D.R. Horton carries a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases

PulteGroup Inc.’s (NYSE:PHM) fourth-quarter 2017 adjusted earnings of 85 cents per share beat the Zacks Consensus Estimate of 84 cents by 1.2%. Also, quarterly earnings reflect a solid 27% jump from the year-ago quarter’s 67 cents.

NVR, Inc. (NYSE:NVR) reported fourth-quarter 2017 adjusted earnings of $43.41 per share, missing the Zacks Consensus Estimate of $48.95 by 11.3%. Without the adjustment, NVR reported earnings of $28.88 per share, decreasing 24% year over year.

Lennar Corporation’s (NYSE:LEN) fourth-quarter fiscal 2017 adjusted earnings of $1.29 per share fell shy of the Zacks Consensus Estimate of $1.50 by 14% and decreased 1.5% from the year-ago level of $1.31.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

PulteGroup, Inc. (PHM): Free Stock Analysis Report

Lennar Corporation (LEN): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

Original post

Zacks Investment Research