The U.S. Dollar is trading higher overnight against all major currencies. With details coming out that Greece’s bond swap may have reached the 85% level, making it eligible to receive its second major bailout from European institutional leaders, traders are shifting their focus back to the U.S. Non-Farm Payrolls report due out later this morning.

Financial market traders are pricing in an increase of about 213,000 jobs in February paired with an unchanged unemployment rate at 8.3%. Some pre-report surveys are calling for an increase of 210,000 to 216,000 with the median projection of economists surveyed by Bloomberg News estimating an advance of 215,000.

Hitting the 213,000 mark will put the number of jobs added in February well below the January report of 243,000, but above the December’s 203,000 job increase.

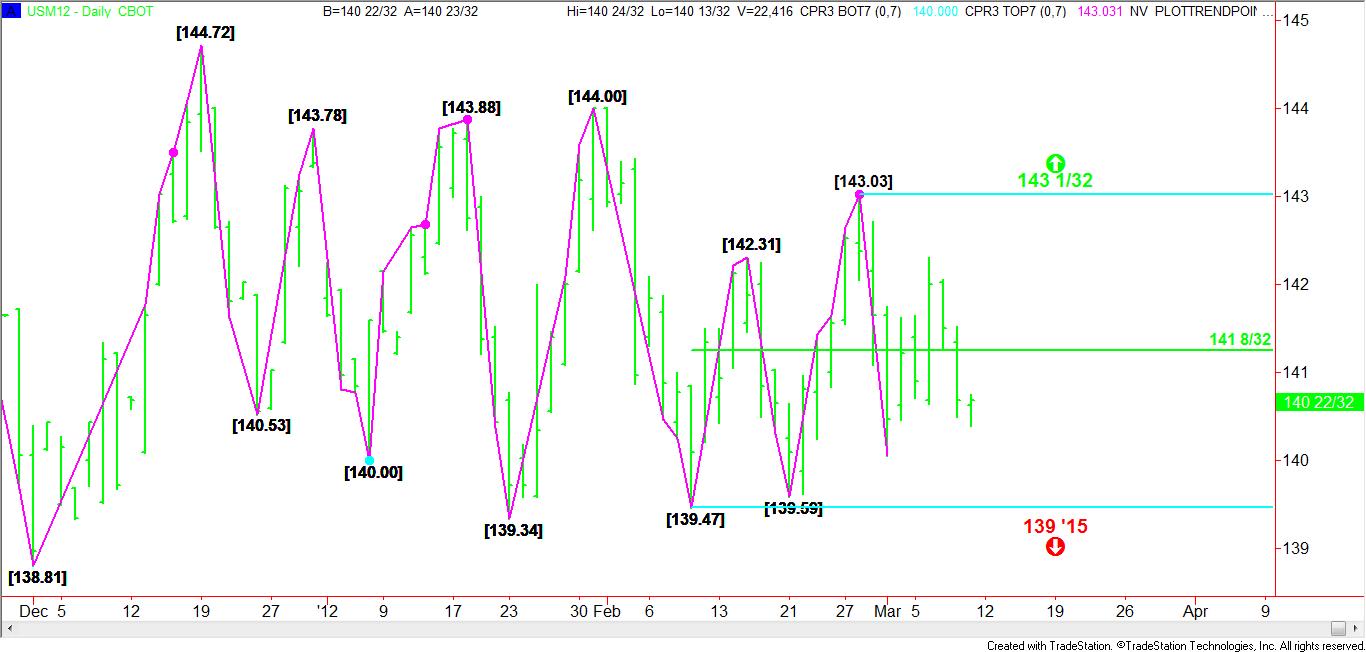

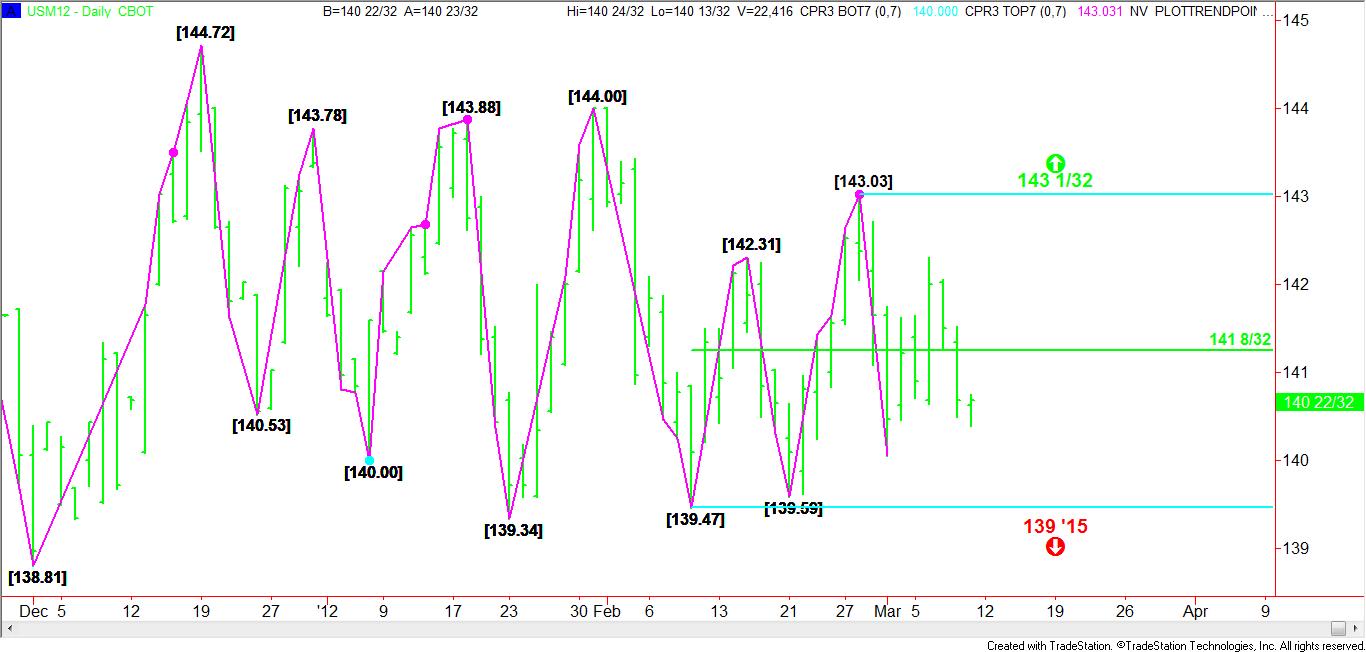

Treasury traders will be watching the report closely in anticipation of expanded volatility. Based on the short-term daily June 30-Yr Treasury Bonds range of 139 15/32 to 143 1/32, a pivot price has been created at 141 8/32. With the market currently trading below the 50 percent level of this range, one can conclude that there is a bias developing to the short side. This can be interpreted to mean that a larger than expected increase in payrolls would put more pressure on the longer-term 30-year Treasury Bonds.

Daily June Treasury Notes are straddling exactly 50% of its short range pegged at130’10 to 131’16.5. This contract will also plunge if the Non-Farm Payrolls number comes out well above the guesses. If the number is precise then a slight bias will develop to the downside. A break through the swing bottom at 130’10 is likely to trigger an acceleration to the downside. A rally through 131’16.5 will do the same on the upside.

Financial market traders are pricing in an increase of about 213,000 jobs in February paired with an unchanged unemployment rate at 8.3%. Some pre-report surveys are calling for an increase of 210,000 to 216,000 with the median projection of economists surveyed by Bloomberg News estimating an advance of 215,000.

Hitting the 213,000 mark will put the number of jobs added in February well below the January report of 243,000, but above the December’s 203,000 job increase.

Treasury traders will be watching the report closely in anticipation of expanded volatility. Based on the short-term daily June 30-Yr Treasury Bonds range of 139 15/32 to 143 1/32, a pivot price has been created at 141 8/32. With the market currently trading below the 50 percent level of this range, one can conclude that there is a bias developing to the short side. This can be interpreted to mean that a larger than expected increase in payrolls would put more pressure on the longer-term 30-year Treasury Bonds.

Daily June Treasury Notes are straddling exactly 50% of its short range pegged at130’10 to 131’16.5. This contract will also plunge if the Non-Farm Payrolls number comes out well above the guesses. If the number is precise then a slight bias will develop to the downside. A break through the swing bottom at 130’10 is likely to trigger an acceleration to the downside. A rally through 131’16.5 will do the same on the upside.