Stocks never showed a spike low this week as I’d hoped but instead are now setting up for a further move lower.

I am always optimistic in my views and look for the best outcome but I am not blinded by it.

I readily change my view as action dictates and it is telling me markets have a little more correcting to do.

That said, there are some stocks who still look great and are holding up in the face of this weakness and it is those who are my shopping list as soon as we see a low and subscribers know exactly which ones they are and exactly where to buy them as soon as we get the go ahead.

I really didn’t do much this past week as I was waiting for a low which didn’t come and now I continue to wait but we may get a few short trades in the week ahead as well.

This game is not about trading all the time, it’s about making money and in order to do that consistently and successfully I have to wait for the best setups which are most likely to work.

I like to try to save my capital when things are murky and use to to the fullest when high probability setups form.

As for the metals, they are setup to continue the dominant trend lower anytime now and support is far away.

Gold was pretty flat losing only 0.84% this past week and really just digested the previous Friday's large move lower.

We’re setup for a break here anytime now below this bear flag and this may finally be the big break that takes us to the serious capitulation/blood in the streets moment when the perma-bulls who’ve been wrong for so long but can’t admit it finally begin to give up.

That moment will be the low and then gold will finally begin to turn up again, albeit slowly.

It’s not rocket surgery.

History and market moves repeat and rhyme over and over again.

So much has changed in terms of markets but us humans and our emotions will always dictate how stocks and markets behave and that will always remain the same.

Anyhow, gold has support at the $1,160 level dating back to 2009 but major support remains at $1,000.

Silver lost 1.79% this past week and is also setup to move lower in the week and months ahead.

$10 remains as support but the dominant support level is closer to $8.

That will surely be the low area in time.

I’m not saying the metals will hit major support and then rip higher, rather they will take time to put in a low and we may not see another bull market in the metals for another 10 or 15 years.

Yes, let the hate mail come but my trading account is fine and I’ve been right about the metals for a long, long time.

Platinum lost 3.54% as it follows the leading gold and silver markets lower.

There is some support at the $1,100 area but below that is $930 or so and that’s that.

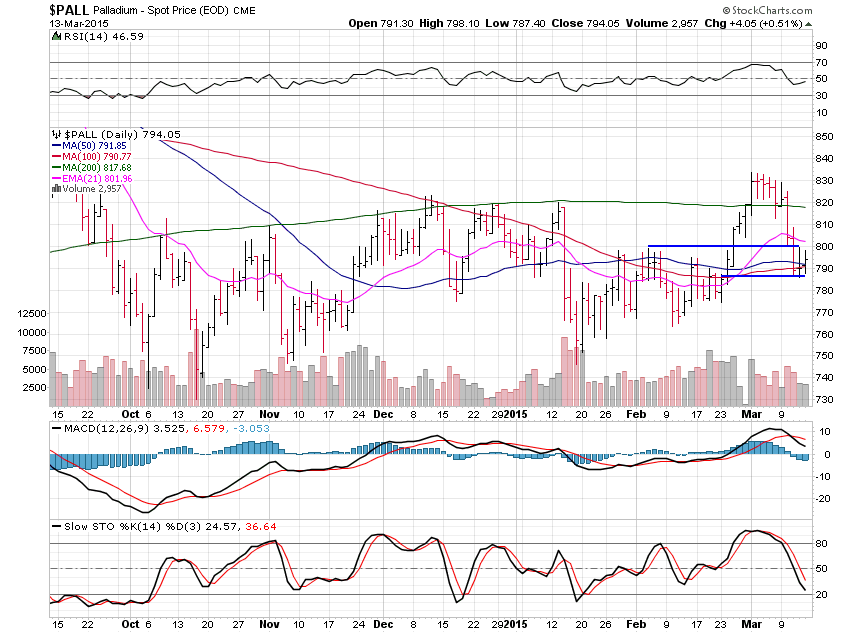

Palladium lost 3.12% and is so far holding support and moving averages at the $790 area.

It won’t hold here for long I imagine though and then we look to $645, $550 and then $500 for the next support level using the monthly charts.

None of what I’m saying here will happen overnight, rather, it will continue to be a death by a thousand cuts situation with some violent moves followed by consolidation periods.

We’re getting slammed with yet another major winter storm this ides of March here in the Maritime provinces so what better to do than lots of homework/charts.