DowDuPont Inc.’s (NYSE:DWDP) unit, DuPont Nutrition & Health has relocated its production facility in Botany to Erskine Park, New South Wales. The move is in sync with the company’s commitment to address rising demand from the food industry.

The site at Erskine Park is known for its specialty food ingredient blending plant that houses production and warehousing facilities. The premise has the potential to scale up and produce twice as much capacity vis-à-vis the previous facility in Botany.

Additionally, this latest 1000 square meters facility offers novel, state-of-the-art equipment with increased capabilities in food safety and quality and process safety control and management systems that reduce manual handling activities during the manufacturing process.

DowDuPont has underperformed the industry it belongs to in the past six months. While shares of the company moved up around 14.1%, the industry gained roughly 17.4%.

During the third-quarter 2017 earnings call, DowDuPont stated that demand outlook remains positive for most key end-markets. It remains focused on executing near-term priorities that include delivering earnings and cash flow growth, executing its $3-billion cost synergy initiatives and advancing activities to create three growth companies in Agriculture, Materials Science and Specialty Products.

Furthermore, the company announced plans to enable cost savings of $3 billion. These include workforce reductions, buildings and facilities consolidations and select asset shutdowns. In third-quarter 2017, DowDuPont recorded pre-tax charges of $180 million in connection with the actions that have been approved so far. It expects to record total pre-tax charges of around $2 billion, with around $1 billion expected in fourth-quarter 2017.

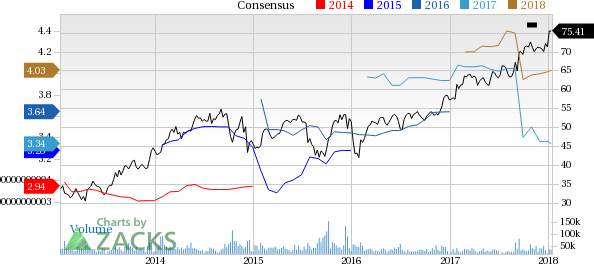

Dow Chemical Company (NYSE:DOW) (The) Price and Consensus

Zacks Rank & Stocks to Consider

DowDuPont carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:KRO) , Koppers Holding Inc. (NYSE:KOP) and Huntsman Corp. (NYSE:HUN) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has expected long-term earnings growth of 5%. Its shares skyrocketed 105.9% over a year.

Koppers has expected long-term earnings growth of 18%. Shares of the company rallied 25.3% over a year.

Huntsman has expected long-term earnings growth of 8%. Its shares soared 74.6% over a year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Dow Chemical Company (The) (DWDP): Free Stock Analysis Report

Original post

Zacks Investment Research