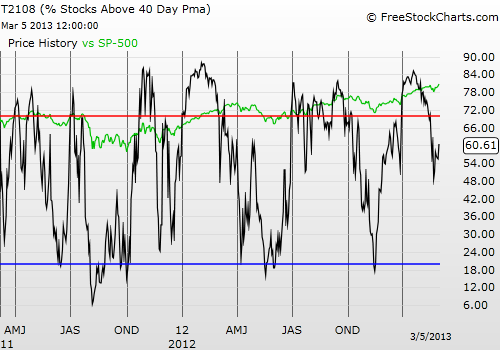

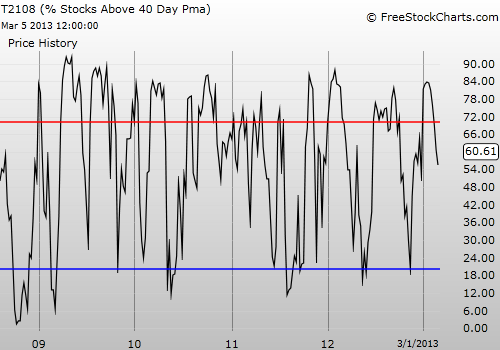

: 60.6%

VIX Status: 13.5 (driving back toward 7-year lows)

General (Short-term) Trading Call: Hold – if bullish, you can play the breakout with a stop below yesterday’s low.

Commentary

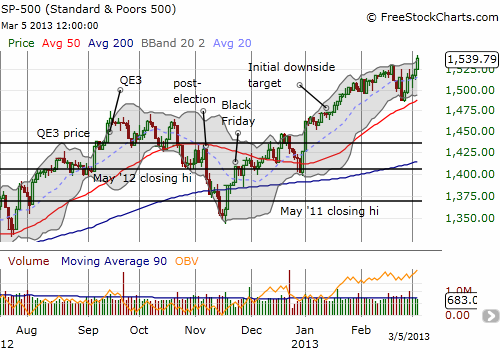

The genie is out of the bottle again. In what looks like a fresh uncorking, the S&P 500 (SPY) raced to new 5 1/2 year highs yesterday. The Dow Jones Industrial Average (DIA) made a new all-time high, but I do not follow this index as it is not representative and antiquated (mainly used as a psychological barometer since it is reported in the media as THE stock market).

This whole episode since the March, 2009 lows will likely go down as one of the strongest examples ever of “don’t fight the Fed.” To me, the market has a surreal look and feel that is lulling fresh buyers in an “effort” to gain higher ground before the next correction (which will assuredly come sooner than later). In the meantime, I must respect the price action. It is decidedly bullish, and those wishing to jump in at these levels can use yesterday’s low as a tight stop. (My last round of SSO puts will surely expire worthless next week).

The bearish signals I duly noted for last Friday’s trading are essentially and effectively rendered null and void with yesterday’s move. The Australian dollar continues its sharp rebound, the VIX is getting pushed back toward 7-year lows again, the yen is weakening again, and, most importantly, T2108 looks like it is now going to play catch up with the S&P 500. I now revert to a very neutral stance and will wait for T2108 before making another definitive move. I am now projecting new overbought conditions within a week, perhaps by this Friday. And if historical patterns hold up, the correction after the next overbought period should be relatively large.

Note carefully that I am NOT recommending being stubbornly bearish. That is the wrong reaction to a stubborn rally. The market is telling us that it does not care about the things that may concern us right now. Moreover, note that at some point, a major stock market index MUST make new highs; it MUST make new all-time highs; and it must continue doing so for some duration. Otherwise, progress cannot be made.

This is why new highs must be respected. It could signal that the market is ready to leave the past behind and establish a new regime, or level, of trading. I doubt the stock market is embarking on such an adventure here, but I must respect the non-zero probability that a powerful genie has been uncorked and unleashed!

Fortunately, T2108 will be just as useful in a new regime of higher trading levels as in the previous regime. T2108 is just relative to moving averages and does not depend on where the stock market sits relative to arbitrary historical points.

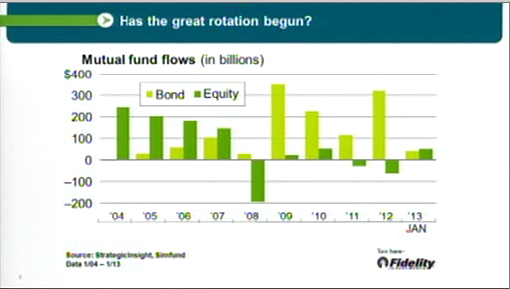

I end with this chart that I captured from yesterday’s Fidelity Investor conference called Inside Out. I believe this is an annual conference. It shows that if current patterns hold, this year will deliver the largest flow of funds into equity mutual funds since the last bull market. We are not yet at a point where funds are running from bonds into stocks. IF such a thing ever happens, look out!

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Disclosure: long VXX shares and puts, long SSO puts, short AUD/USD, EUR/AUD, and GBP/AUD

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow: The Genie Has Been Uncorked

T2108 Status

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.