Global markets are taking a pause after their three day long rout and are enjoying some gains. Investors in the US liked quarterly corporate profits just before today’s FOMC policy decision and in Asia, Turkey’s rate is boosting sentiment.

Ford Motor (NYSE: F) beat estimates and came in with higher than expected profit for Q4 2013. However, Apple (NASDAQ: AAPL) tumbled over 8 percent as they missed sales estimates. Of the 153 corporations that make up the S&P 500, those that have reported to date, 68 percent have reported better than expected results.

This morning in Asia and the Pacific Rim, financial markets are rebounding from step losses as a rate hike from Turkey, a very aggressive one from 7.75 to 12 percent, has calmed worries in the emerging markets. This move was done to curb the Turkish lira’s sharp losses of late. The Reserve Bank of India, unexpectedly, also raised its prime rate

STOCKS

Overnight, US markets rebounded. The DJIA recovered a bit from its worst five day loss since April 2012. The Dow added 90.68 points to finish at 15,928.56. Pfizer (NYSE: PFE) led winner rising near 2.57 percent after posting higher than expected Q4 results.

The S&P 500 gained nearly 11 points to close at 1,792.50. Healthcare and financial led the way and technology stocks lagged behind the others. The Nasdaq Composite rose 14.35 points to close the day at 4,097.96. Apple’s quarterly profits and resulting 8 percent plunge held the NASDAQ down.

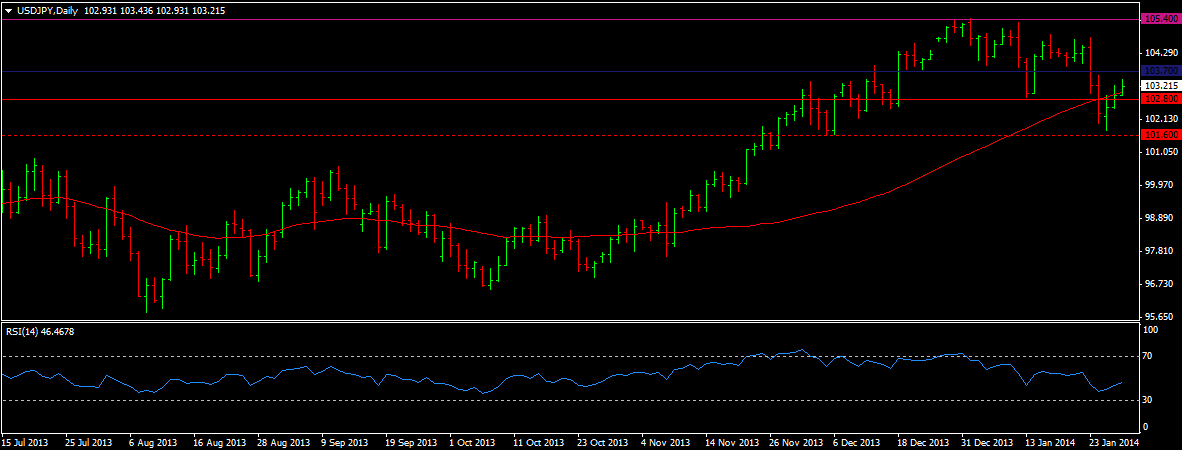

For the first time in a week, the Nikkei is up. Japan’s benchmark is up over 2 percent as we are recovering from Monday’s two week low. The USD/JPY is helping sentiment as the yen is weakening, it is near 103 at the time of this report. We are waiting on retail sales data as well.

The Shanghai Composite is up 0.30 percent as it is extending its gains. Volume is light just ahead of the Chinese Lunar Holiday. Markets shut January 30 and open February 5. The Australian ASX 200 is up 0.84 percent as it is recovering from yesterday one and a half month low. The AUD/USD is moving north of 0.88 to a one week high and will have to be watched. The South Korean Kospi is up nearly 1.2 percent as it is moving up from Monday’s five month low. Sentiment was boosted as industrial production numbers beat expectations rising three percent. This is its best gain since 2009.

CURRENCIES

USD/JPY (103.223) has recovered from the key congestion area around 101.90/50 and is above 103. We must break above 103.70 for a nice rally back to 105.

EUR/USD (1.3653) did nothing after testing 1.3750. This would have been a trend changer. We are now testing support at its current level. We must break 1.3750 for a big rally. Till that happens we can test supports at 1.35 and lower. It is likely we will trade from 1.35 to 1.37 for some time. GBP/USD (1.6571) is underperforming as we are stuck in a range trade pattern. We are trading from support near 1.6350 up to the key resistance at 1.67. We need to break 1.67 for a nice rally.

COMMODITIES

WTI Crude (97.22) is testing resistance at its current level. A break higher can target 98.70/76 then 99/99.25. A fail here can see a dip back to 95, however the bulls are in control for now. This is not for sure until we break 97.50, till then a dip is possible. WTI Brent (107.40) failed to go above 108 and has dipped a bit. We could be trapped in a broad range from 106.25 to 108.50 for a period of time until we break 108.50. Once that happens we can target 110. Gold (1253.60) has fallen from 1270 as investors are expecting another round of tapering from the Federal Reserve. If this happens we can target 1235. A break above 1270 can target 1280.

TODAY’S OUTLOOK

The world is waiting on whether or not the Federal Reserve will announce later today to shave off another $10 billion from its QE program. We will also be listening to any hints regarding the future of the record low rate that is currently at 0 to 0.25. The announcement is due at 2:00 pm EST. We will bring the breaking news as it happens.