RESEARCH HIGHLIGHTS:

- Dow Theory suggests indices must confirm each other and volume must confirm the trend.

- The new downward trend in the Dow Utilities Index suggests indices are starting to break apart in terms of trending in unison.

- Volume recently has been trailing lower, which suggests the momentum behind these new all-time highs is weakening.

- If the Utilities Index continues to move lower and we see increased volume in the selling trend, we will consider the Dow Theory Trend component “broken” and expect a major peak/top soon after.

We know some of you are Dow Theory enthusiasts and followers. We follow the Transportation Index as a leading indicator for potential major market trends almost exclusively because of what we have learned from Dow Theory. If you are unfamiliar with Dow Theory, we suggest visiting Investopedia’s summary of this technical theory for a quick refresher. You can also learn more about the primary indicator in Dow Theory here. The two most important aspects of Dow Theory that we are researching today are two components:

- Indices Must Confirm Each Other

- Volume Must Confirm The Trend

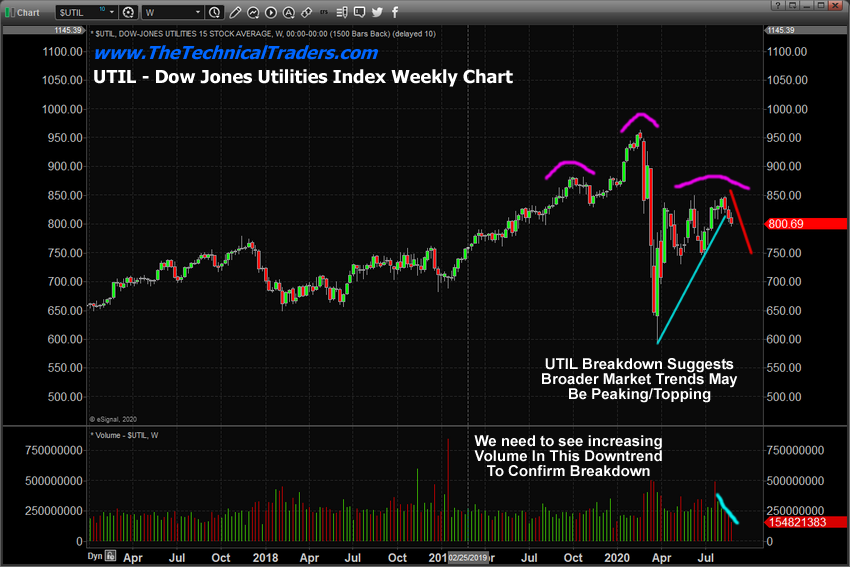

My researchers and I have identified that the Dow Jones Utility Index has started to break downward in trend, breaking the recent upside price trend. This breakdown in the Utilities Index suggests the Indices are starting to break apart in terms of trending in unison. We have not seen increased volume in the downward trending of the Utility Index yet and we are waiting for this technical trigger to confirm the Breakdown in Dow Theory Trending by watching for the Utility Index to potentially begin a broader downside price move with increased volume.

Dow Theory Signaling A Breakdown In Trend?

Our research team is focusing on the Dow Jones Industrial Average, the Dow Jones Transportation Index, and the Dow Jones Utility Index for this article. These three charts are key to understand the broader components of Dow Theory and how the technical and trending aspects of Dow Theory work. We’re focusing on the Utilities Index because it is diverging from the Industrials and Transports in a big way. We just need to see some Volume support this new downtrend in the Utilities Index to begin to raise some big RED FLAGS about a major market top setting up.

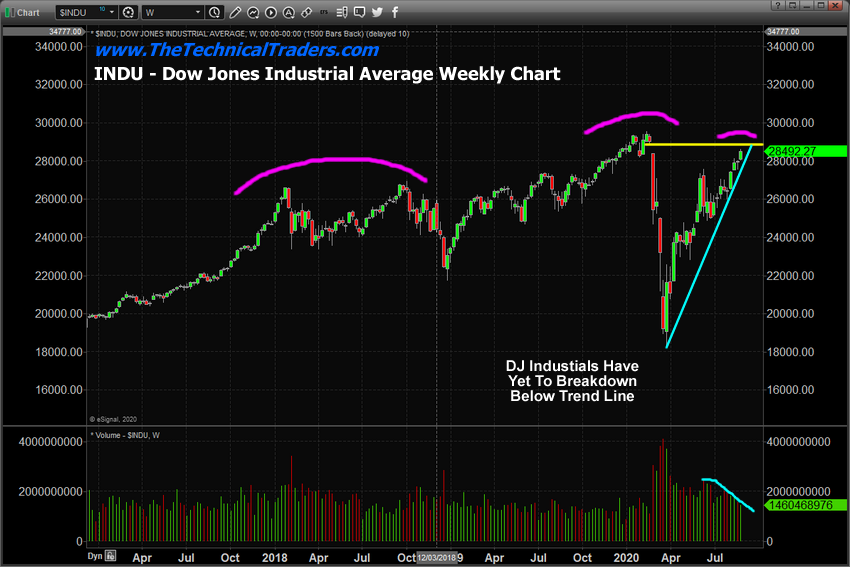

Let’s start by investigating the Dow Jones Industrial Weekly Chart, below. We’ve highlighted the broader Head-and-Shoulders pattern in MAGENTA as well as drawn a YELLOW LINE across the UPPER GAP range from the February COVID-19 market collapse. We believe these levels will be critical in understanding how the markets are poised to test and potentially break above these broader market resistance levels. Additionally, we’ve drawn an upward sloping CYAN trend line that shows you how diligently price has continued to move higher since the bottom setup in March 2020. There has been very little recent weakness in the advance of price as new highs continue to be reached.

Volume recently has been trailing lower, which suggests the momentum behind these new all-time highs is weakening. It appears many traders are sitting on the sidelines and not participating in this upside price rally out of fear or concern that it may not be sustainable.

Primary Trends Have Three Phases

A primary trend will pass through three phases, according to the Dow theory. In a bull market, these are the accumulation phase, the public participation (or big move) phase, and the excess phase. In a bear market, they are called the distribution phase, the public participation phase, and the panic (or despair) phase. It is quite possible that we have moved past the accumulation and public participation phases and are now firmly within the “excess phase” .. Or what we call the “speculative phase”.

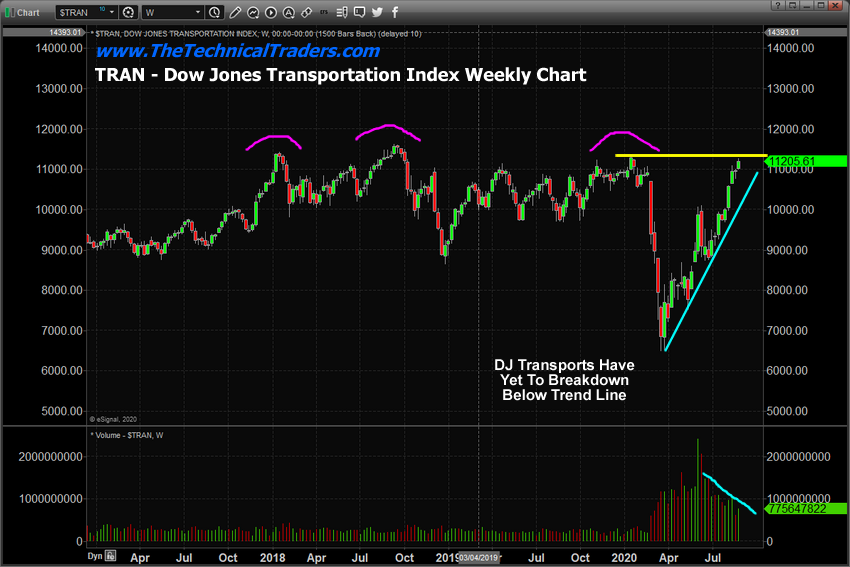

Now we will look at the Dow Jones Transportation Index, below, which is set up somewhat similar to the Industrials. We see an extended Head-and-Shoulders pattern setup with a high price level from the Right-Shoulder acting as current resistance. We also see a very solid upward price trend which has accelerated higher over the past 5+ weeks on diminishing volume. At this point, we should consider the Industrials and the Transports “in alignment” with one another. The only real concern related to a weakening trend is the diminishing volume on both of these charts.

Now, we add the Dow Jones Utilities Index, below again, which sets up the entire Peaking/Topping Dow Theory technical pattern. The first thing we see in this Dow Jones Utilities Weekly chart is that the recent price trend is moving lower. This contradicts the trends of the Industrials and Transports. Next, we see a much clearer Head-and-Shoulders pattern set up in the Utilities Index – which suggests resistance near 850 may play a big role in future price activity. Lastly, we see diminishing volume in this recent downtrend of price – which suggests “capitulation” has yet to enter this downward price trend.

Our researchers believe the only thing missing from the Utilities breakdown, which would indicate a broader market peak is setting up, is increased volume while the Utilities continue to trend lower. Once this technical pattern sets up, we believe we would have enough technical confirmation of a breakdown of the Dow Theory Trend Alignment component to warn that a major market peak/top is very near (or already happened).

What this means for skilled technical traders is that you should start “hedging” against risk and considering how to protect your open long positions. If you have not already considered how to accomplish this, we would suggest Precious Metals, Miners, Bonds and possibly small positions in Inverse ETF (such as ProShares UltraShort S&P500 (NYSE:SDS) or ProShares UltraShort QQQ (NYSE:QID)). Hedging is a very valuable tool for skilled technical traders when trends weaken or risks become more evident in the markets. Moving capital into positions that can help protect against loss can help to balance your portfolio and reduce exposure to risk factors.

In closing, we do not have confirmation of this Dow Theory technical pattern yet. All we need to see is for the Utilities Index to continue to move lower and to see increased volume in the selling trend. Once we see this, we’ll consider the Dow Theory Trend component “broken” and we believe a major peak/top won’t be too far away. We suggest all of you pay close attention to these three indexes and watch for a breakdown of the primary trends in the future. This is a great way for you to understand basic Dow Theory and the how broad market trends tend to work in “alignment” or “unison”.

Hedge accordingly. We could be in for a wild ride in this breakdown confirms with increased volume.