U.S. markets surged higher overnight. The Dow Jones had its best session of 2014 and the Street loved the drop in applications for jobless benefits. This indicates an improving labor market. Today we get the much awaited NFP.

Yesterday’s rise was due to the absence of bad news. The decline of the last week has been the market looking for direction. We had poor performance in the emerging markets and some reports showing slow U.S. growth, so investors panicked and pulled capital out into safe havens. A goo NFP today will help equity markets. Claims going down is a good sign, now we need the NFP to give us a good reading.

STOCKS

The DJIA saw its best day of 2013 jumping 188.30 points or 1.2 percent to close at 15,628.53. The S&P500 jumped 1.2 percent or 21.79 points to close at 1,773.43. The gains on the S&P was a broad-based one. Only telecommunications missed out.

The tech heavy Nasdaq Composite also jumped into the gains. It was up 1.2 percent or 45.57 points to finish at 4,057.12.

Volume was heavy as 743 million shares traded on the NYSE and Composite volume was over 3.8 billion. For ever one share down, 3 rose on the Dow Jones.

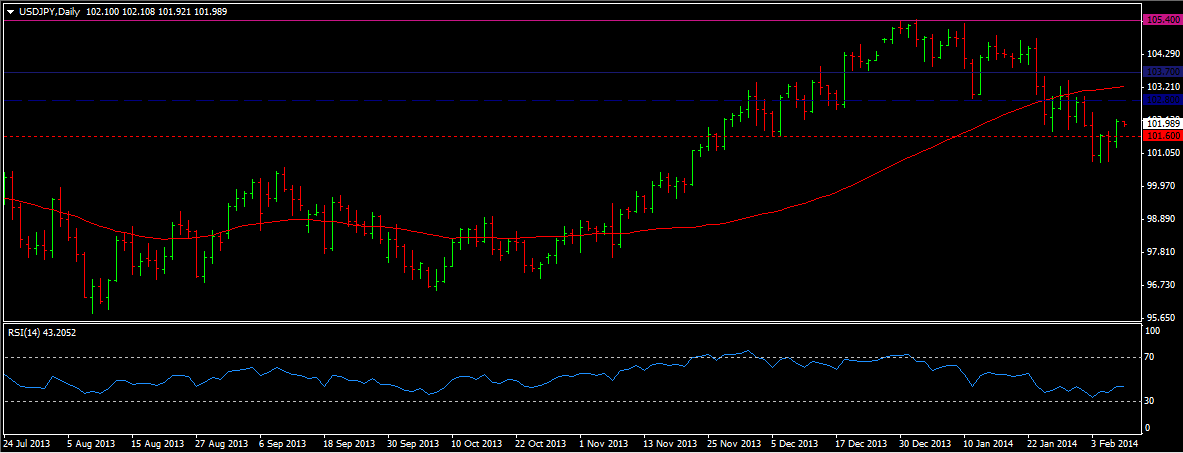

After being closed for a week, mainland China’s exchanges reopened to losses as the rest of Asia was up. The Nikkei has moved up 1.6 percent and back above the 200 day moving average. This is its first gain in four sessions as the yen continues to climb against the Dollar. It is trading through 102 and the 11 week high, set on Tuesday is 100.76 in the USD/JPY. There is speculation of new monetary easing that helped spur gains.

The Shanghai reopened today and promptly moved lower. We touched 2,014, its lowest level since January 22 as weak economic data showed the growth in the services sector is near a two and a half year low. The ASX 200, in Sydney, is up 0.6 percent after rallying over1 percent yesterday. The RBA raised its GDP forecast for 2014 and that rates would stay at 2.5 percent for some time.

CURRENCIES

USD/JPY (101.99) has recovered from 100.65, which is near the 2013 top and could extend gains now back to 102.40. However, while below 102.50 and even 103.25, we remain bearish for 98.

EUR/USD (1.3591) is starting to lose some of its bearish momentum. We still need a break above 1.3650/1.3660 to have a strong rally. While in this area we could dip further. AUD/USD (0.8940) is struggling within the cluster resistance area of 0.90 toward 0.9120. It has recovered nicely for 0.8690 but we need to break out of this area to extend gains. A failure here will be bearish.

COMMODITIES

Copper (3.242) his bounced sharply higher as support at 3.1750 has continued to hold. A break of 3.25 takes us to 3.30 then 3.35. Brent Crude (107.30) has risen sharply overnight as it found support near 105.15. A rise to 108 is now in the cards on a break above 107.50. Gold (1261.60) is trading from 1250 to 1275 right now. This may continue for a bit longer with a break above 1274 targeting 1295.

TODAY’S OUTLOOK

Today the US will release its NFP jobs report. This will be a market mover. Unemployment data has been coming in fairly good all week long and we need this to continue today with the NFP. This could be the good news the markets need right now to break its three week long correction lower.