Dow Jones Industrial Average and major U.S. indexes post Christmas week gains

The Dow Jones Industrial Average (DIA) gained 1.6% for the Holiday shortened week after closing fractionally lower on a low volume Friday Session.

The Nasdaq 100 (QQQ) lost 0.29% on Friday but the Nasdaq Composite was up 1.3% for the week.

The SP500 (SPY) climbed 1.3% week over week.

The Santa Rally appears to be well underway and the bulls are looking for more gains to close out the last two trading days of the year.

On My Stock Market Radar

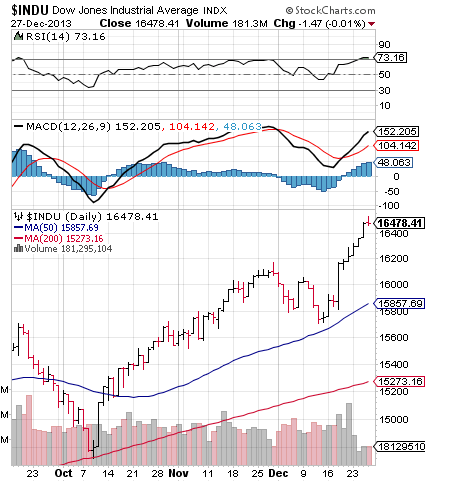

On a technical basis, the Dow Jones Industrial Average (DIA) is in a solid bull market but with several warning signals flashing.

RSI, relative strength is over 70 which is considered in the overbought range and momentum is positive, however, the index is considerably overextended when compared to its 50 and 200 day moving averages.

Also, adviser and retail investor sentiment are at extreme highs and margin debt is at record highs which are both contrarian bearish indications. Nevertheless, seasonality favors a continued extension of the current bull market at least into the early days of January as investors close out 2013 and look ahead to the New Year

Last week’s economic news was positive with a sharp drop in unemployment claims and positive University of Michigan consumer sentiment reading. Durable goods orders were positive and new home sales supported the Holiday mood.

With just two trading days left in the year and a Holiday shortened week ahead, investors will be looking to close our their books and add “window dressing” to portfolios.

It will be a light week for economic reports with November Pending Home Sales on Monday, Case/Shiller Housing and PMI on Tuesday and a heavy set of reports on Thursday with weekly jobless claims, Markit PMI, construction spending and ISM on the schedule.

Bottom line: The Santa Rally is likely to continue, however, U.S. markets are very overextended, complacency is running high and the major indexes are in bubble territory by many valuation methods. How, when or where this ends is unknown, but current conditions are similar to previous major market tops in 2000 and 2007.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow Jones Posts Christmas Gains

Published 12/29/2013, 12:15 PM

Updated 05/14/2017, 06:45 AM

Dow Jones Posts Christmas Gains

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.