A small note on the frankly hilarious news that the Dow Jones Industrial Average smashed through to all-time-highs.

First of all, while stock prices are soaring household income and household confidence are slumping to all-time lows. Employment remains depressed, energy remains expensive, housing remains depressed, wages and salaries as a percentage of GDP keep falling, and the economy remains in a deleveraging cycle. Essentially, these are not the conditions for strong organic business growth, for a sustainable boom. We’re going through a structural economic adjustment, and suffering the consequences of a huge 40-year debt-fuelled boom. While the fundamentals remain weak, it can only be expected that equity markets should remain weak. But that is patently not what has happened.

In fact, it has been engineered that way. Bernanke has been explicitly targeting equities, hoping to trigger a beneficent spiral that he calls “the wealth effect” — stock prices go up, people feel richer and spend, and the economy recovers. But with fundamentals still depressed, this boom cannot be sustained.

There are several popular memes doing the rounds to suggest, of course, that this time is different and that the boom times are here to stay, including the utterly hilarious notion that the Dow Jones is now a “safe haven”. They are all variations on one theme — that Bernanke is supporting the recovery, and will do whatever it takes to continue to support it. Markets seem to be taking this as a sign that the recovery is real and here to stay. But this is obviously false, and it is this delusion that — as Hyman Minsky clearly explained last century — is so dangerous.

There are many events and eventualities under which throwing more money at the market will make no difference. Central banks cannot reverse a war, or a negative trade shock, or a negative production shock, or a negative energy shock simply by throwing money at it. And there are severe limits to their power to counteract financial contractions outside their jurisdiction (although in all fairness the Federal Reserve has expanded these limits in extending liquidity lines to foreign banks). Sooner or later the engineered recovery will be broken by an event outside the control of central bankers and politicians. In creating a false stability, the Federal Reserve has actually destabilised the economy, by distorting investors’ perceptions.

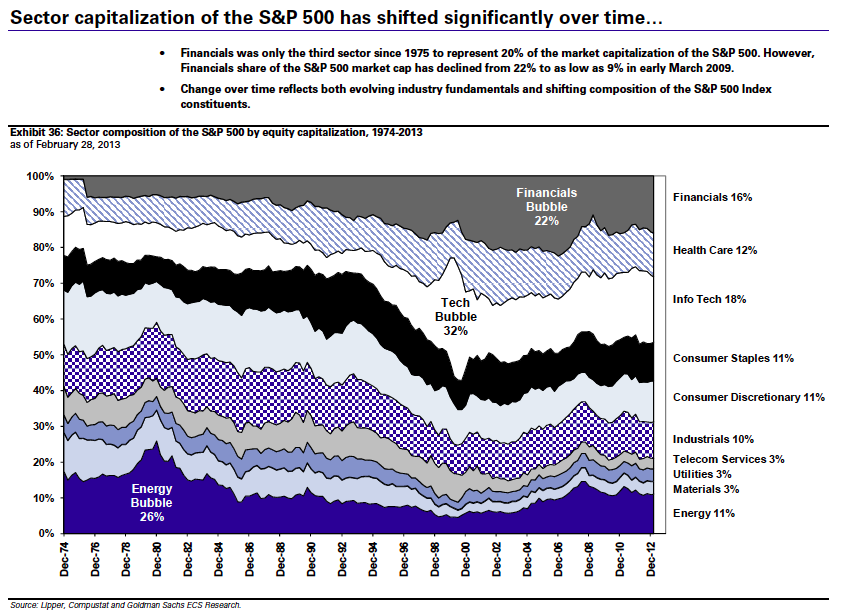

But, of course, some analysts think that this time really is different. Here’s a chart from Goldman showing the S&P500 by sectoral composition:

The implication here is clear — with no obvious sectoral bulge like that of the late 1970s, the tech bubble, and the financial bubble — there is no bubble. But what if the bubble is spread evenly over multiple sectors? After all, the Federal Reserve has been reinflating Wall Street in general rather than any one sector in particular.

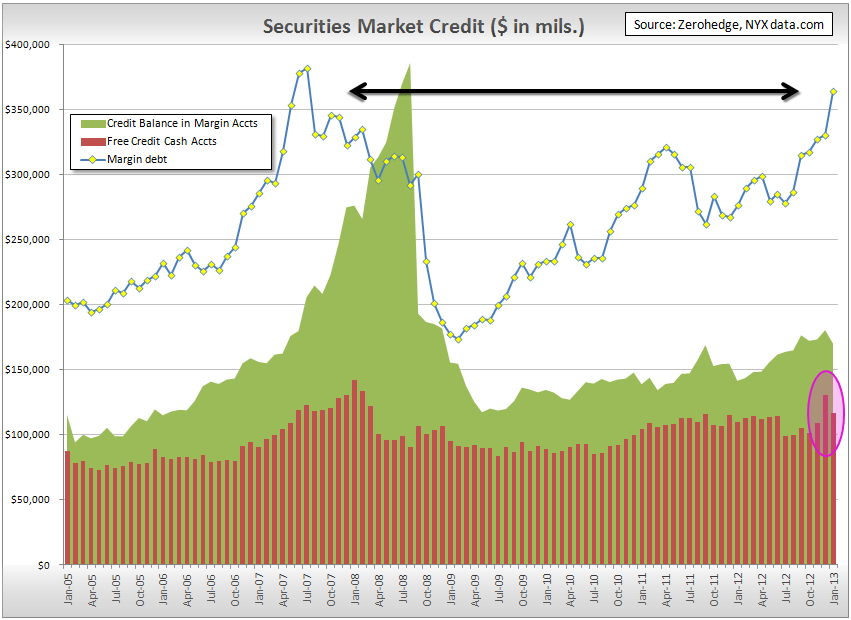

Wall Street leverage is, unsurprisingly, approaching 2007 levels:

Is this the final blowout top? I’m not sure. But I would be shocked to see this bubble live beyond 2013, or 2014 at the latest. I don’t know which straw will break the illusion. Middle eastern war? Hostility between China and Japan? North Korea? Chinese real estate and subprime meltdown? Student debt? Eurozone? Natural disasters? Who knows…

The wider implications may not be as bad as 2008. The debt bubble has already burst, and the deleveraging cycle has already begun. Total debt is slowly shrinking. It is plausible that we will only see a steep correction in stocks, rather than some kind of wider economic calamity. On the other hand, it is also plausible that this bursting bubble may herald a deeper, darker new phase of the depression.

With every day that the DJIA climbs to new all-time highs, more suckers will be drawn into the market. But it won’t last. Insiders have already gone aggressively bearish. This time isn’t different.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow Jones High: This Time It’s Different - 2013 Edition

Published 03/06/2013, 07:46 AM

Updated 07/09/2023, 06:31 AM

Dow Jones High: This Time It’s Different - 2013 Edition

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.