E-mini S&P December futures 1 or 2 steps forward then 1 step back. We held 3870/60 on the downside but are only consolidating as I write.

Nasdaq December highly volatile as we collapsed on Thursday, rocket on Friday and reverse again on Monday.

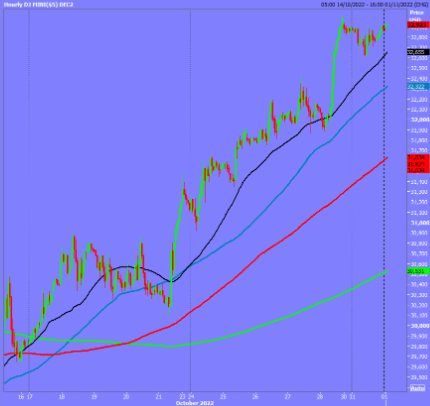

Dow Jones Futures consolidates gains, holding the first downside target of 32650/600.

Today's Analysis

E-mini S&P December holding 3870/60 on the downside to re-target the 100 day moving average at 3910/20 in quiet conditions. Again this is key to direction. A break above 3930 should be a buy signal targeting 3950/60, perhaps as far as resistance at 4000/4010 this week. Watch for a high for the recovery here and a resumption of the bear trend.

Very minor support at 3870/60, with better support at 3830/20.

Nasdaq December strong resistance again at 11700/750. Shorts need stops above 11800. A break higher is a buy signal with 11750/700 then acting as support to target strong resistance at 11950/12000.

First support at 11450/400. Longs need stops below 11350 (my level as a little too high yesterday). Better support at 11250/200. Longs need stops below 11150.

E-mini Dow Jones holding the 200 day moving average at 32575. The bounce is likely to retest last week's high and first resistance at the 500 day moving average at 33000/33100 as we become overbought on the daily chart. Even after the 4000 tick recovery, we still remain in a 10 month bear trend. I am not brave enough to call a high for the bounce yet, with such strong momentum, but I will watch for any negative signals here. A break above 33200 can target 33450.

Failure to beat the 500 day moving average at 33000/33100 targets 32600/550, perhaps as far as 32350/250.