The Dow Jones Industrials (DIA) gained 2.77 points on Tuesday to keep its eight day win streak alive while other major indexes declined for the day.

The S&P 500 (SPY) was again unable to reclaim all time high numbers as the index declined 0.24%, and it was joined by the Nasdaq 100 (QQQ) dropping 0.39% and the Russell 2000 (IWM) slipping 0.24%.

The day was another low volume day as investors toyed with record highs and wondered what is happening to Apple (AAPL) as the tech darling dumped another 2.16% to close at $428.43.

Europe was mostly down on the day with the iShares Italy ETF (EWI) dropping 0.71% and the iShares Spain ETF (EWP) falling 0.77%. Asia joined in the red zone with the iShares Japan ETF (EWJ) falling 1.09%.

VIX, the CBOE S&P 500 Volatility Index, also known as the “fear index,” jumped 6.14% after falling to a six year low Monday as investor complacency receded for the day.

As March drags on, more attention is turning to the potential for yet another deadlock in the sequestration debate and yesterday’s House Republican proposal to trim the budget deficit added to concerns that the two sides would be unable to find a compromise position as Paul Ryan’s “Path To Prosperity” was called the “wrong course” by the White House. As everyone knows, markets hate uncertainty and the ongoing stalemate between the House of Representatives and the White House is uncertainty of the highest degree.

With economic reports remaining light until today’s retail sales reports, more attention is likely to be paid to the continuing political standoff in Washington.

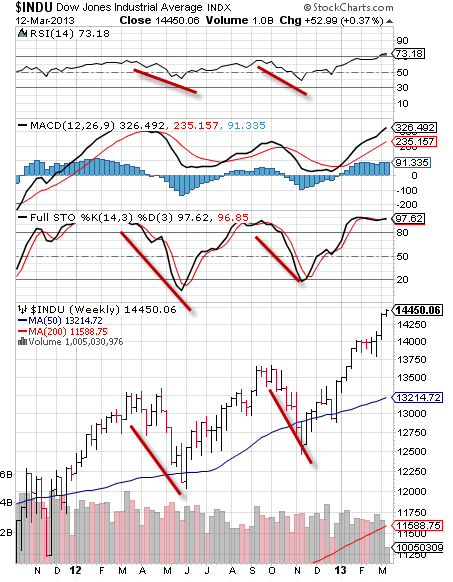

On a technical basis, major U.S. indexes remain overbought with the Dow Jones Industrials (NYSEARCA:DIA) sporting daily, weekly and monthly RSI and Stochastic readings in or near overbought levels. Current levels are typically conditions from which significant declines have started in the past.

Bottom line: It’s not often that daily, weekly and monthly RSI and Stochastic readings all reach overbought levels, and certainly, coupled with low volume and significant resistance levels, current conditions flash a red flag for the near-term health of the Dow Jones Industrials (NYSERCA:DIA) and other major U.S. indexes. Investors will be looking for resolution from Washington and ongoing support from the Federal Reserve for reasons to bid the currently overextended market higher.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow Industrials Squeak Green, Others Go Red

Published 03/13/2013, 01:15 AM

Updated 05/14/2017, 06:45 AM

Dow Industrials Squeak Green, Others Go Red

Dow Jones Industrials squeaked out a small gain while other major indexes went red on Tuesday.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.