Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Market

Trends

Price and Volume

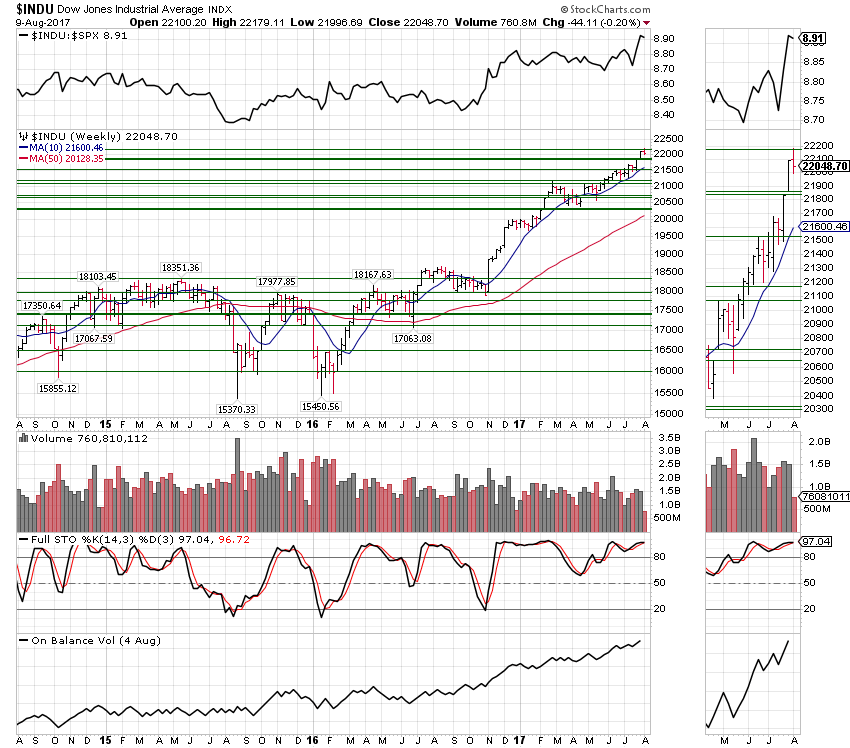

The primary trend is aligned up (LTCO > 0 and LTREV > 0).

Price and Leverage

The secondary trend is aligned up (LTCO > 0 and LTLO > 0).

Energy

Q3 DI = 8% defines accumulation within a bearish cycle.

Time

BuT = 74 weeks. Average aligned up impulse is 39 weeks. BuST = 0.8 indicates BuT is beyond the norm but not statistically extended (BuST > 2).

Seasonals

Seasonal weakness is generally displayed until September.

Conclusion

While the primary and secondary trends remain up, they're aging as stocks enter a seasonally weak period. Smart money remains patient but has no reason to sell or short stocks.