Investing.com’s stocks of the week

Dow Index

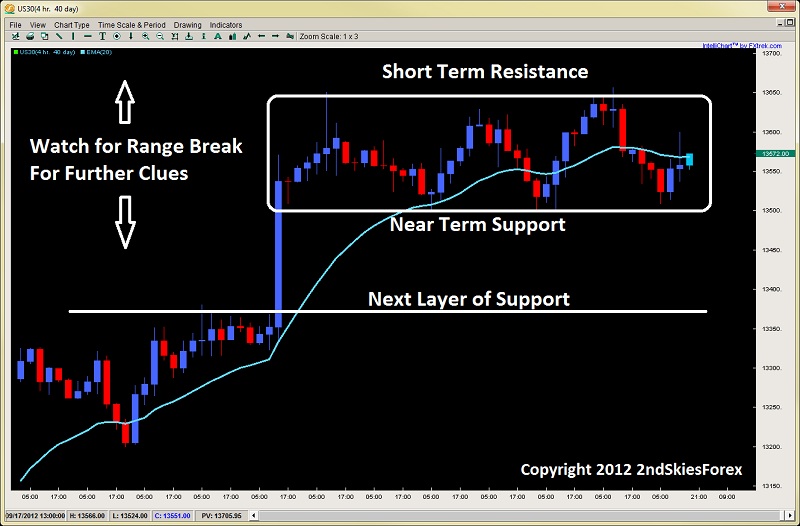

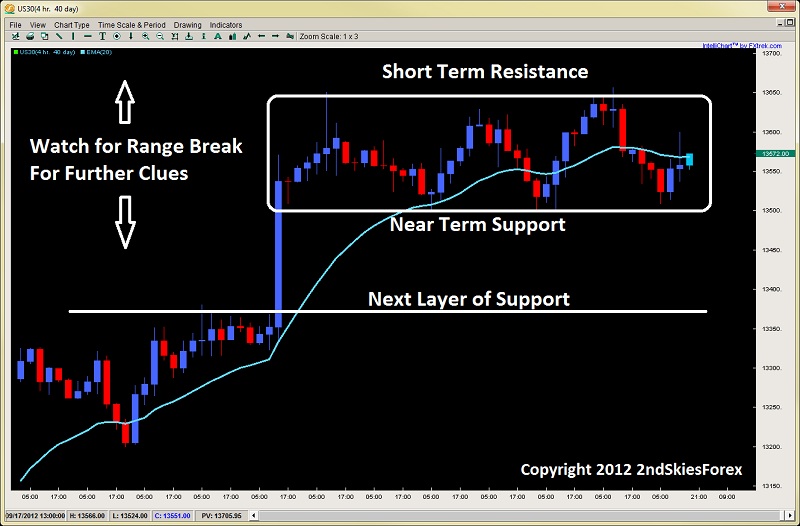

After the QEinfinite nod from Bernanke, the Dow broke the yearly highs and went on a 350pt run in a few days. But over the last six, the index has been consolidating forming a series of overlapping bars, playing ping pong off the 13495 and 13653 levels. This consolidation makes sense after the bullish ebullience from the Fed easing policy and thus natural to form some re-distribution of the order flow.

Although i’m not sure how much longer this range will hold, as long as the intraday price action looks corrective, there are plays for both bulls and bears at the key levels. Medium term I favor an upside break, but since it is in a range, you have to treat it like a range. Thus, I will watch intraday price action clues for selling towards the highs around 13653 with tight stops above, and looking for buys around the 13495/13500 area until the range breaks so some potentially profitable setups here with low risk and strong reward.

Global Market Commentary:

Weak German sentiment and Chinese optimism data gave a hit to global markets and the Euro today with economic news relatively light on the day.

Spain also continues to come up as an issue with Catalonia voting on Thursday to cut off ties with the Spanish state. This would certainly undermine an EZ recovery and put pressure on the regional currency along with bond markets and indices.

The Dow lost 20pts on the day while Gold shed over $11 with the Euro losing 50pips closing just above the 1.29 figure.

Original post

After the QEinfinite nod from Bernanke, the Dow broke the yearly highs and went on a 350pt run in a few days. But over the last six, the index has been consolidating forming a series of overlapping bars, playing ping pong off the 13495 and 13653 levels. This consolidation makes sense after the bullish ebullience from the Fed easing policy and thus natural to form some re-distribution of the order flow.

Although i’m not sure how much longer this range will hold, as long as the intraday price action looks corrective, there are plays for both bulls and bears at the key levels. Medium term I favor an upside break, but since it is in a range, you have to treat it like a range. Thus, I will watch intraday price action clues for selling towards the highs around 13653 with tight stops above, and looking for buys around the 13495/13500 area until the range breaks so some potentially profitable setups here with low risk and strong reward.

Global Market Commentary:

Weak German sentiment and Chinese optimism data gave a hit to global markets and the Euro today with economic news relatively light on the day.

Spain also continues to come up as an issue with Catalonia voting on Thursday to cut off ties with the Spanish state. This would certainly undermine an EZ recovery and put pressure on the regional currency along with bond markets and indices.

The Dow lost 20pts on the day while Gold shed over $11 with the Euro losing 50pips closing just above the 1.29 figure.

Original post