Investing.com’s stocks of the week

While the Dow Jones Industrial Average (DJI) is having a good week, set to topple the 25,000 level for the first time in a month, it will be just the second straight weekly gain for the index. In fact, the Dow hasn't had a four-week win streak since late January, just before the stock market correction -- sending up a signal not seen since April 2008, prior to the financial crisis.

In 2016 and 2017, lengthy weekly win streaks were not uncommon for the index. Not so much in 2018. Even if the Dow moves higher again next week (ending 7/20), it will be just a third straight weekly gain, and the 25th straight week without a four-week win streak.

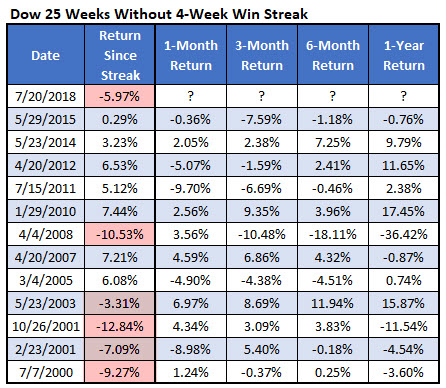

The last time the DJI went that long without four straight week-over-week gains was May 2015, according to Schaeffer's Senior Quantitative Analyst Rocky White. Prior to that, you'd have to go back to May 2014. What's more, this is the first time the blue-chip index has gone south between win streaks in more than 10 years, with the Dow currently down nearly 6% in that time frame.

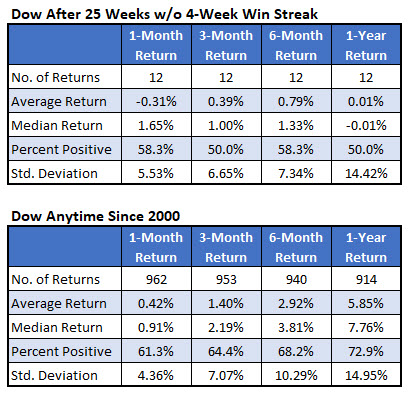

Looking at Dow performance after a 25-week hiatus between four-week win streaks, going back to 2000, the index tends to underperform. Specifically, the DJI was down 0.31%, on average, a month later, compared to a one-month anytime average gain of 0.42%. Three months out, the Dow was up just 0.39% -- not even a third of its average anytime gain in the same time frame.

Six months after a hiatus, the blue-chip barometer's average gain of 0.79% is once again not even a third of its average anytime gain of 2.92%. One year later, the Dow was basically flat, with a win rate of just 50%. That's compared to an average anytime 12-month gain of 5.85% with 72.9% positive.