After the big gains in 2013, (and subsequent declining yields), income investors are scouring the market for safe yields in 2014. With this in mind, we took a look at the 2 highest yielding dividend paying stocks in the DOW 30: AT&T, (T), and its arch rival Verizon, (VZ). In particular, we compared these 2 stocks’ next quarterly dividends to covered call premiums, in order to see if you could increase your yield, while gaining some downside protection.

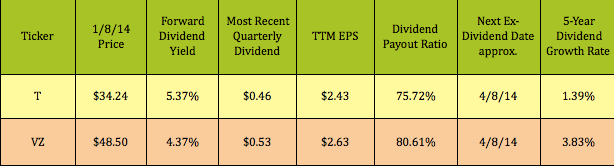

DIVIDENDS: Both of these stocks are listed in our High Dividend Stocks By Sector Tables, in the Telecoms section. AT&T has a higher dividend yield than Verizon, but Verizon’s 5-year dividend growth rate trumps AT&T’s.

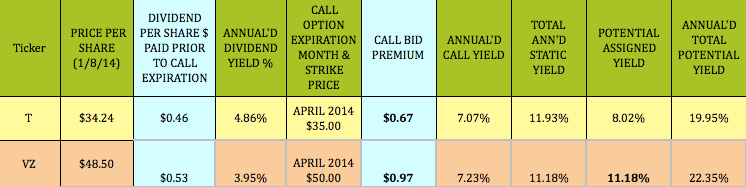

COVERED CALLS: These April 2014 covered call options trades both have strikes above each stock’s price/share, which offers you a chance for some assigned price gains, in addition to increasing the yield above that of the dividends:

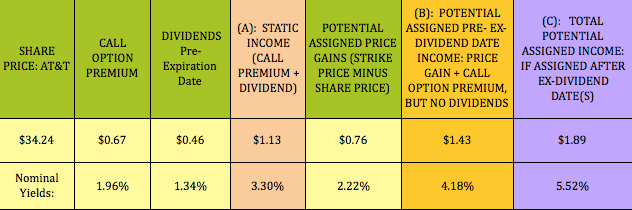

Here are the 3 main income scenarios for each trade. You can find more details for these 2 trades and over 30 others in our free Covered Calls Table.

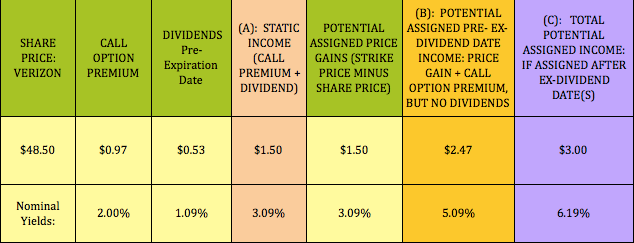

Since VZ’s strike price is further above its share/price, you have more of a chance for potential price gains:

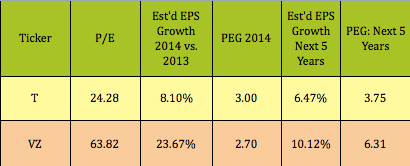

EARNINGS: To be sure, neither of these stocks are growth stocks – here’s how they stack up against each other:

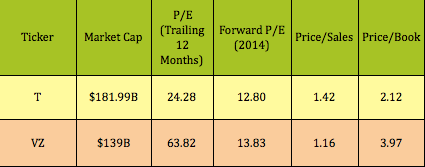

VALUATIONS: The good news is that both stocks look to have more attractive P/E’s in 2014. VZ is commanding a premium over T in its Price/Book and P/E ratios.

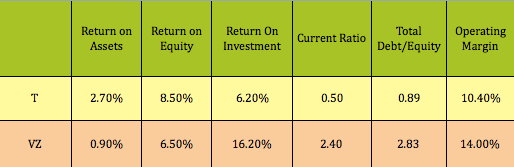

FINANCIALS: VZ has used more debt for financing than AT&T has, and has a higher Operating Margin and ROI:

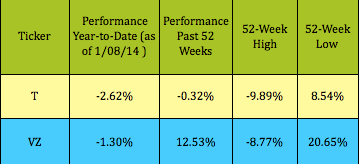

PERFORMANCE: While VZ lagged the market during 2013, AT&T went absolutely nowhere over the past 52 weeks:

Author: Robert Hauver,copyright 2014 DeMar Marketing, All Rights Reserved.

Disclosure: Author had no positions at the time of this writing.

Disclaimer: This article was written for informational purposes only. Author not responsible for any errors, omissions, or actions taken by third parties as a result of reading this article.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow Dividend Stocks For 2014: A Look At AT&T And Verizon

Published 01/10/2014, 01:57 AM

Dow Dividend Stocks For 2014: A Look At AT&T And Verizon

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.