US markets moved very little overnight as low pre New Year volumes led to very little volatility. The S&P, if nothing major happens, is on track for its best year in 16 years. Pending home sales did come in lower than expected, but did not damage sentiment badly. The Dow Jones is also at a new record high.

Volume was extremely light, as expected. We are anticipated the S&P 500 will have year in which it saw a nice 29% gain as well as double digit gains for the other major indexes. Even though housing data was bit soft, the Street shrugged it off as investors looked at the entire year and saw home prices are up 13.5 Percent for the year. This would be its best year in six years.

Asian markets are mixed in pre-holiday trade as investors are worried over the amount of China’s debt which came in at $3 trillion. The country’s record growth seems to have been paid for with a massive spending and borrowing spree over the recent years. This could hurt GDP growth going forward.

STOCKS

The DJIA has achieved yet another record close. The Dow Jones rose 25.88 points to close at 16,504.29. The S&P lost a fraction, a flat day, to close at 1,841.07. The market is on track for its fourth monthly gain in a row and has gained an impressive 29 percent for the year. This is on track for its best year since 1997. Much of this gain has been sparked by the Fed’s massive QE program, so we ask ourselves what is in store for 2014 as QE is being wound down.

The Nasdaq Composite is still well above 4,000 as it lost 2.4 points overnight. The tech heavy composite closed at 4,154.19.

Volume was very light, thanks to the holiday season. We will have the same today as it is New Year’s Eve and markets will be closed tomorrow. Volume on the NYSE was 462 million and Composite volume was near 2.3 billion.

China’s Hang Seng has recovered a bit and up 0.8 percent but gains are capped by liquidity fears emerging once again. Also, five new companies have been approved to join the exchange ending the IPO ban that was in place for one year. Other Asian markets were very quiet today and little changed. The ASX 200 closed mildly higher in a shorten session today.

CURRENCIES

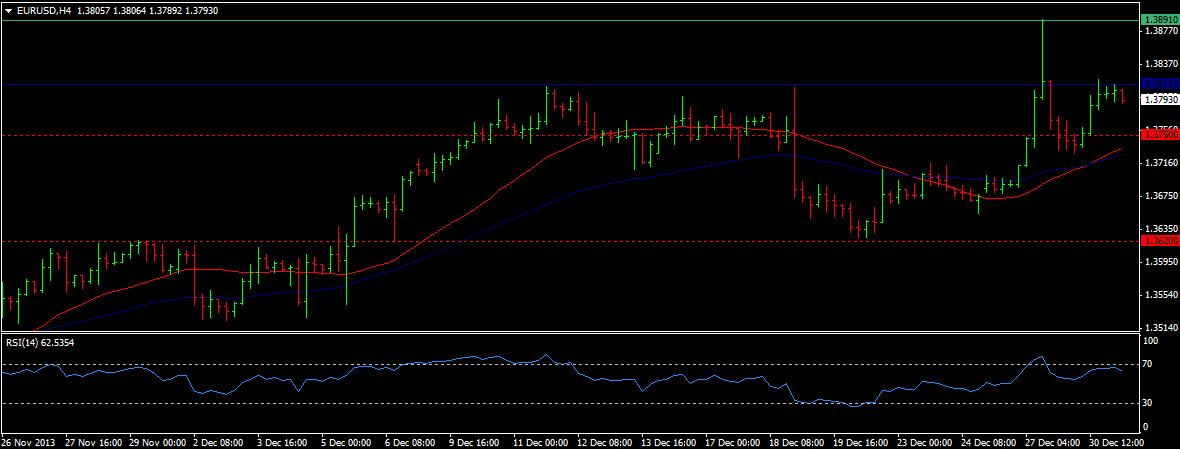

EUR/USD (1.3794) saw a nice rally before being rejected at 1.389. We have strong resistance at 1.39/40 that is holding well as expected. We are now testing 1.38 to 1.3810 congestion area. While below that area we will see some selling pressure. We see key support at 1.3750 and 1.3650.

USD/JPY (105.042) has pulled back a bit after touching 105.49. We remain bullish for 109 and see only weakness on a fall below 103.50 which could then see us dip to 102.50. Below that the bears come out to play. GBP/USD (1.3794) saw a two year high at 1.6577 this year but pulled back. While above 1.62 we remain bullish for more rallies towards 1.67 and 1.6750.

COMMODITIES

Gold (1198.20) fell off sharply after failing near 1215. We remain below 1225 and bearish for 1180 and lower. Only a break above 1225 and then 1250 can bring in the buyers again. Silver (19.495) has moved lower as well. Is testing key support at 19.50 now. If it holds we could bounce back to 21.00 if it fails we can dip to 18.50.

Copper (3.3795) is stable and still within distance of 3.38 and 3.40. Looks like we are range bound from support at 3.35 up to 3.40. Unless we break 3.40 look for that to continues.

TODAY’S OUTLOOK

Happy New Year everyone! Volume will be light today with no big moves expected. Looks like he U.S. markets will have double digit gain for the year and global markets did fairly will overall. Next year will be interesting in Europe as it is facing deflationary problems and China could face some debt and credit problems.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dow At Record High, Asian Markets To Close 2014 Mostly Higher

Published 12/31/2013, 01:22 AM

Updated 05/14/2017, 06:45 AM

Dow At Record High, Asian Markets To Close 2014 Mostly Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.