DOW

From the Aug. 11, 2021 report:

“Three notable reports I wrote in 2007 (July 7, October 7, December 2) identified key peaks. If one did not trade, however, the first two of those three reports would have left one the poorer. The 3rd was the charm, bearing the title, “2008 Dow Crash.”

“It is natural human behavior to fear “missing it,” but, in that case, either have a great strategy – or really deep pockets.”

Since August 2019, these reports have focused on a strategy that earns income during a bull phase, while being positioned for leveraged gains in the event of sharp quarterly declines.

Absent such a rules-based strategy, one needs to exit a bear position before the onset of what one believes to be a countertrend bounce. Of course, such rallies could also lead to new highs.

In 2007 – 08, such was the case and I was lucky enough to have cut potential losses after recognizing that the July and October highs referenced above were intermediate term, but not final peaks.

This is relevant today, particularly since there is so much in common between the two periods’ technical conditions.

Bullish Scenario

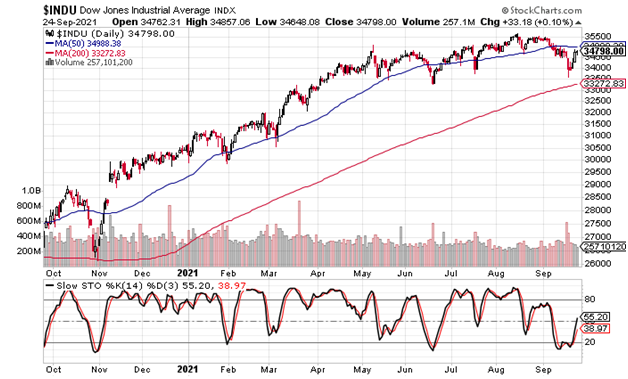

The 1-year daily Dow chart appears immediately below. We can see that the Dow closed on Friday within ~1500 points of its 200-day moving average, after having come within shooting distance of it.

Beneath the price chart, please note the slow stochastic. As we can see, my favorite momentum indicator turned up after a bullish divergence. The proximity to the 200-day moving average and the stochastic divergence are plain and clear evidence of a correction of some sort having ended.

Disconcerting aspects, however, are found in the speed with which the stochastic is advancing toward overbought and, even more ominously, the equally plain and clear dome formation of the top that has been developing since June.

Bearish Scenario

The Aug. 11, 2021 report analyzed several Dow and inter-asset class stock market and economic indicators, the conclusion of which was that the index’s next major low should occur in the 17,500 – 20,500 area. Based on the different forms of analysis, including those pertaining to the long term expanding triangle, I will merely summarize here a point relating to inferential reasoning:

Major long term corrections, regardless the international equity index, tend to cut that index in half. Since my preferred view regarding the coming major low is a bottom in the 18,000 area (a minor new low under the 2020 bottom), one may infer that the final high should not be much higher than where the Dow has already been (~36,000).

This means that short sellers can use tight stops, if fading new highs that could result from manipulation that seeks to drag the last dollar and the last short coverer into the market.

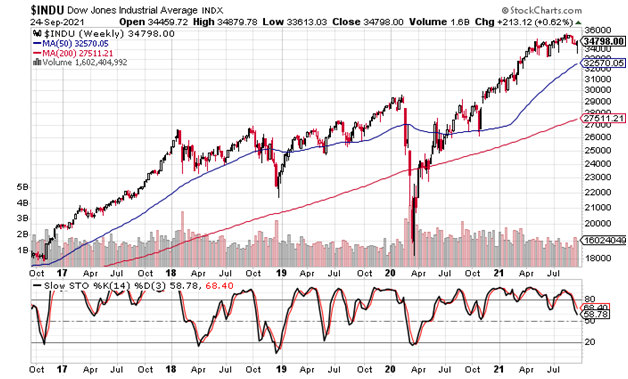

The 5-year Dow weekly chart appears below. Beware.

In contrast to the daily chart above which gave a bullish buy signal divergence that crossed over 20, this weekly chart shows a clear and evident sell signal by way of its negative divergence that led to a break below 80!

Conflicting signals are consistent with the Dow’s dome formation that is forming and preparing to roll over and fall out of bed, with a floor far below around 18,000.

The CNN Fear & Greed Index

From the August 11, 2021 report:

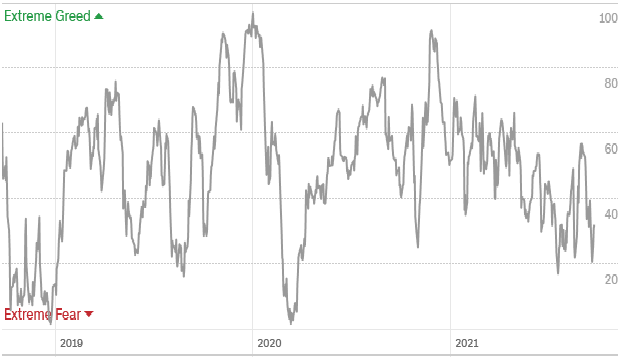

“….we see that the market actually dipped into “extreme fear” a week ago. It can still fall below 25 again to deepen the reading in creating a short-to-intermediate term buy signal, but a cross above 50 would confirm that the signal has already arrived.”

As we can see from the chart at the bottom, the CNN Fear & Greed Index crossed above 50, only to then successfully retest the lows.

A spike flush-out, as what we just saw, was perfectly consistent with the Dow charts. The “Extreme Fear” reading (below 20) that had already been achieved suggested that a new spike low was already being discounted.

Will a minor new high in the Dow coincide with a reading in the “Extreme Greed” zone (above 80)?

iShares Silver Trust

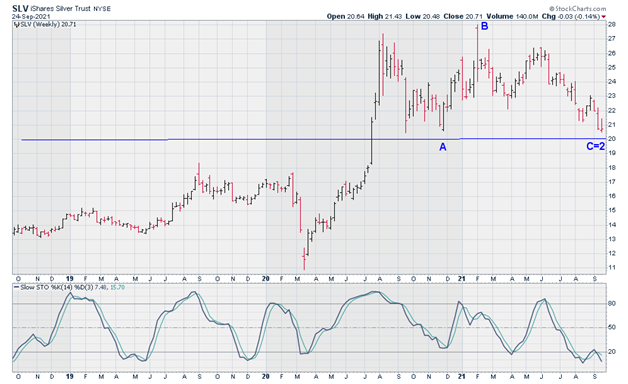

The 3-year iShares Silver Trust (NYSE:SLV) weekly chart appears below. My interpretation of the price action since the 2020 bottom at $11 is that the “orthodox low” was put-in at $14, while the subsequent Wave-1 peak concluded at $27 in August 2020.

The subsequent “a-b-c flat” which followed suggests that we have pretty much seen the low of Wave-2.

From the August 11, 2021 report:

“The 6-month daily SLV chart below includes clear and undeniable bullish divergences in the stochastic, seen beneath the price chart. One divergence is intra-month in July, while there is yet another versus the June low. My only concern on this score is the speed with which the stochastic is rising versus the price action.

“Will it be overbought too soon, or would that condition merely indicate that a very brief breather would be needed to resume the more meaningful rise? So, let us look at the weight of broader technical evidence.”

“More important for one considering whether or not silver needs more time to consolidate is the fact that the 200-week moving average sits all the way down at $17.59. Therefore, more consolidation would continue to refresh the market’s available buying power by relieving itself of long term profit-takers. This is how I interpret the value of a 200-week moving average.”

In deference for the lower zone contemplated in the preceding paragraph ($17.59), the support level on the following chart appears at $18.

While I believe that the $20 support level (chart above) will hold as the worst-case scenario discussed in the Aug. 11, 2021 report, I mention it for traders to stay alert and take advantage of that price if it were to actually flush-out to $18 by quarter-end next week.

The 11-year SLV weekly chart appears below.

Today’s conclusion is unchanged from the Aug.11, 2021 report. I expect Wave-3 to achieve the $44 zone.

CONCLUSION

“I believe that the SLV could achieve the $44 area by November. A longer consolidation above $20 would allow buying power to be wholly refreshed, as measured by the 200-week moving average; the latter is presently at $17.59 (see weekly chart above).

“Mine is the more bullish view but, either way, one should be 100% long silver.

“For speculators, the January 20, 2023 $28-strike calls closed yesterday with a bid-ask of $2.43 – $2.48. In the event of a longer consolidation period, I would advise a more aggressive stance at the next entry point.”

The option advised for speculators has fallen to $1.31 - $1.35, and I do indeed advise a more aggressive stance as discussed in the preceding paragraph.

Based on the analyses in this section, my recommendation remains unchanged.

As we can see from the following CBOE Silver ETF Volatility VXSLV chart (SLV option premium index), an intermediate term breakout above the 31.5 level has already been seen and merely requires sustaining a new bull zone.

Finally, as with prior lows, the bottom in the VXSLV is three months old (July), and represents a bullish divergence against higher SLV levels. This is due to the fact that option premiums are lead indicators; this long-term cycle is bullish, thereby indicating the context for interpreting the VXSLV.

This strategy is, therefore, in my view, immediately actionable.