A snapshot view of yesterday’s New York - London session with technical notes...

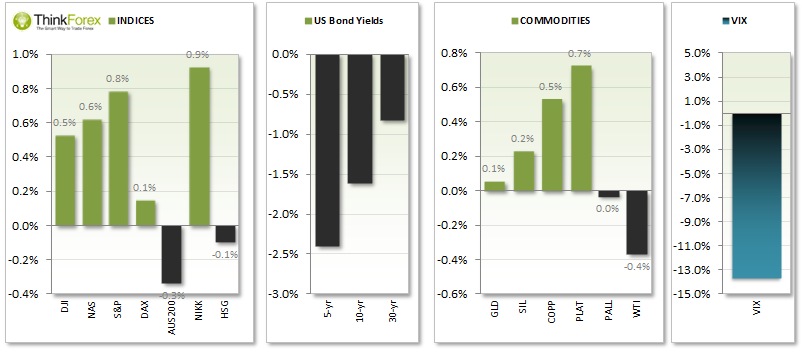

No real surprises from the FED - Concerns with rate growth, Labour market has improved with lower unemployment and it has been retreated there is a lot of uncertainty out there in a 'steady as she goes' approach. Rate is likely to remain near zero for a considerable amount of time and Tapering continues as planned at 10bn.

Yellen stated in the press conference the FED "has no target to what volatility should be" as VIX reached a new multi-year low as Stocks print fresh new highs.

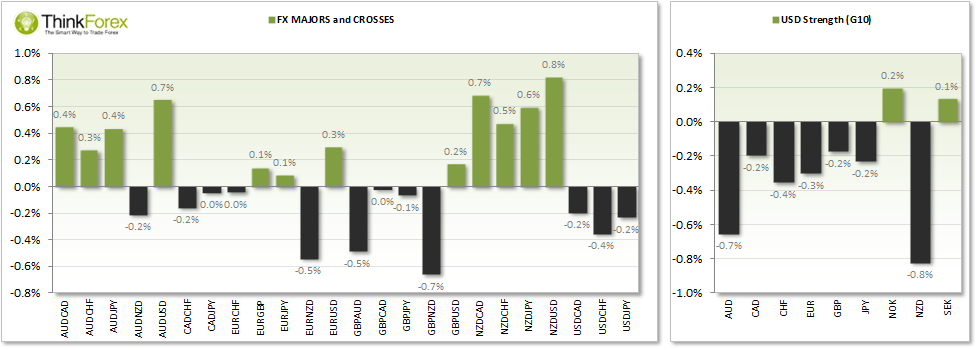

The Aussie and Kiwi expected to benefit from Yellen’s' Dovish comments.

CAD Wholesale Sales m/m above expectations and a 6-month high at 1.2% vs 0.3% expected. The USD/CAD back at 4-week lows with a near-term bearish tone. Overall bias remains bullish above 1.08

UK MPC keep Official Bank rate at 0.5% and Asset Purchase stable after a unanimous vote, although many suspect a few key committee members will begin to sway towards rate rises over the coming months.

Forex:

DXY: Bearish outside day and below 80.50 paints a near-term bearish bias for the Greenback

AUD/USD: Bullish engulfing rejected 0.932 support with a near-term bullish bias favoured and trading just above 0.940

EUR/USD: Up at a 6-day high but meets resistance at 1.36 - bias remains neutral

GBP/USD: Back above 1.70 with a near-term bullish bias above this level, however potential for a retracment towards 1.697

USD/CAD: at a 4-week low but D1 remains within a trading range

USD/CHF: Looks heavy below 0.90 with a topping formation expected to roll-over

USD/JPY: Clings onto Monthly Pivot 101.80 - a break below confirms near-term bearish bias

NZD/USD: Bullish with support at 0.870

Indices:

US Equities back to new highs with European Indices (FTSE, DAX and CAC) all fomring swing lows and looking to follow the US and break to new highs soon.