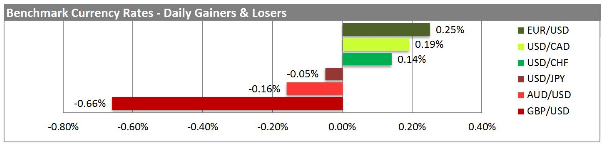

A mixed day for the dollar, with EUR and JPY gaining modestly while the commodity currencies and CHF lost ground against the USD. The biggest loser was GBP, while the Scandis --- SEK and NOK – were the biggest gainers.

The main driver of the market was remarks by FOMC members Bullard, a noted hawk, and Dudley, a noted dove. Both were dovish, with Bullard noting the risk of deflation and urging the ECB to consider quantitative easing, while Dudley said the Fed could adjust QE up or down. The focus will remain on Fed policy today too as the FOMC releases the minutes of the May meeting and Fed Chairman Bernanke testifies in Congress on the US economy.

After yesterday’s adjustment in expectations, I expect that the risks are asymmetrical: expectations of imminent “tapering off” have diminished, hence further dovish comments (likely from Bernanke) would not have such a major impact, while signs in the minutes that a change in policy is being seriously considered could move the market significantly.

The pound lost ground as its inflation for April was much lower than expected (+0.2% mom vs. expected +0.4%, +2.4% yoy vs. +2.6%). The lower inflation gives the Bank of England more scope to cut rates if they choose, although the somewhat stronger-than-expected growth recently and the improving outlook means there is less pressure for them to cut rates, too. Nonetheless the pound weakened, perhaps in anticipation of today’s minutes of the May Bank of England meeting. The pound fell last month after the minutes continued to show a 6-to-3 split against further easing. With the same split likely to appear again this month, the same reaction is possible as well.

Other data out today includes the EU current account figure for March, with the surplus forecast to move lower from €16.3bn to €15.0bn. Not usually that market affecting. Existing US home sales for April may get more-than-usual attention after the recent slew of disappointing housing data. Forecasts are for a 1.4% mom gain to a 4.99mn annualized pace, up from -0.6% and 4.92mn in March.

It’s notable that these forecasts have been creeping up over the last few days despite the surprising decline in housing starts during the month. Those making the forecast must be quite confident. A number like that could swing sentiment back to the strong US economy/strong USD side, four hours before the FOMC minutes are due out.

The Market

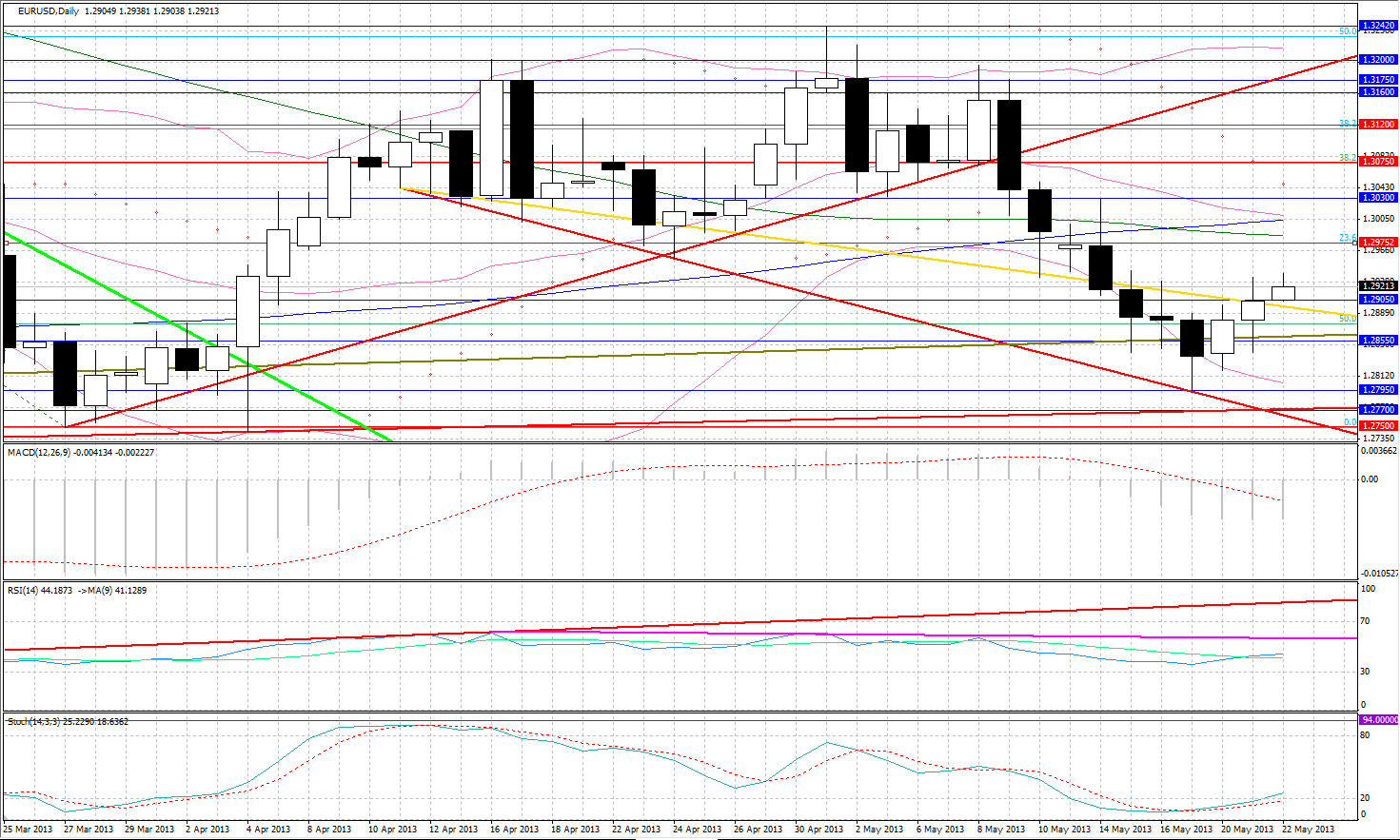

EUR/USD

• EUR/USD moved higher after breaking resistance at 1.2900, continuing its rebound. The next strong resistance comes at 1.2980 where there is a 23.6 % Fibonnacci retracement as well as the 50 Day Moving Average and 1.3030 in extension. The area near 1.2900 is expected to act as a support with 1.2855 to remain a lower trend line support.

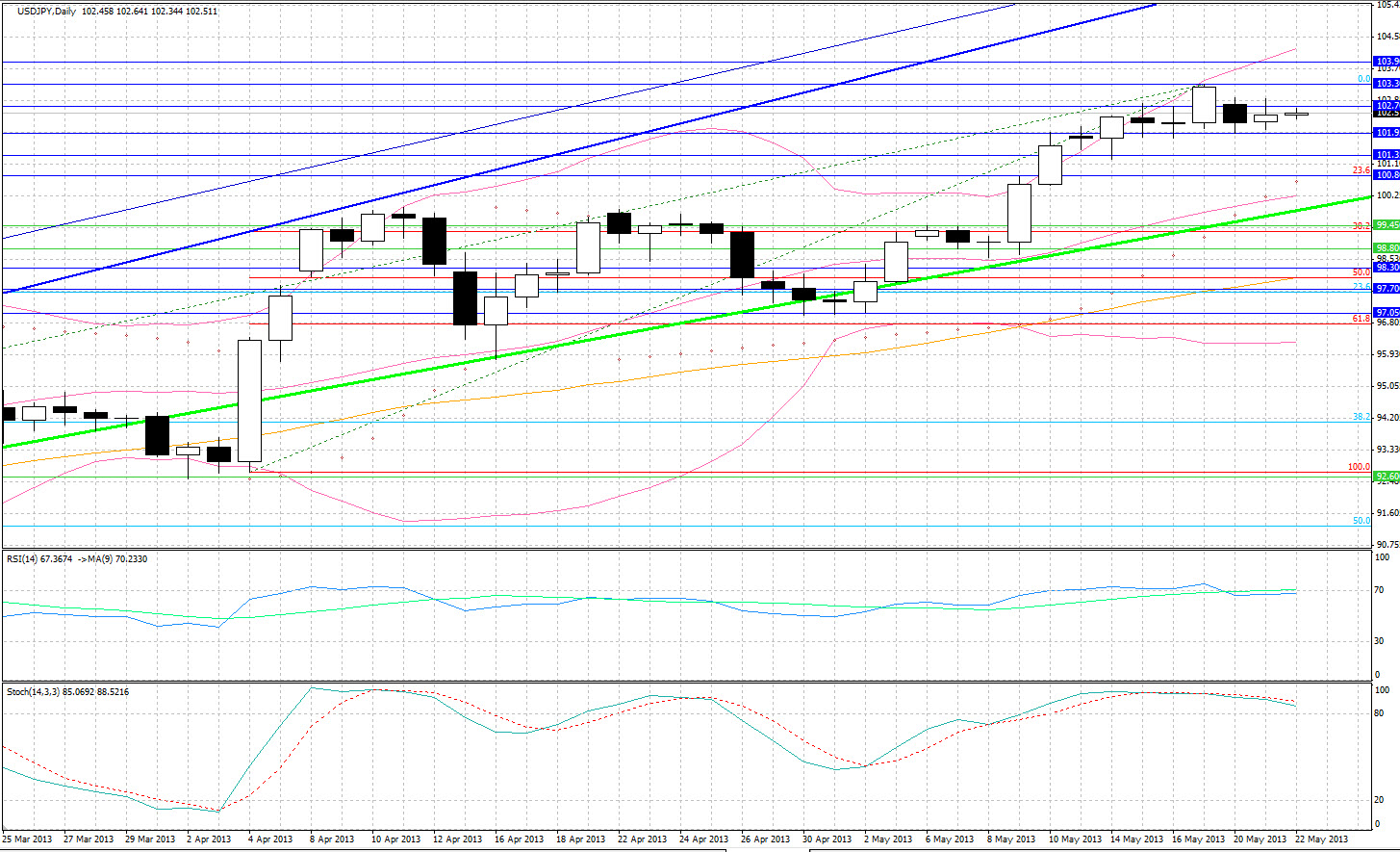

USD/JPY

• USD/JPY moved marginally higher yesterday, while being unchanged from last night with resistance found at 102.90. Resistance lies in the 102.90-103.00 area, while a break of 103.30 will find the pair with no significant resistance till 104.00. Well-tested support remains at 101.95, with further support at 101.35.

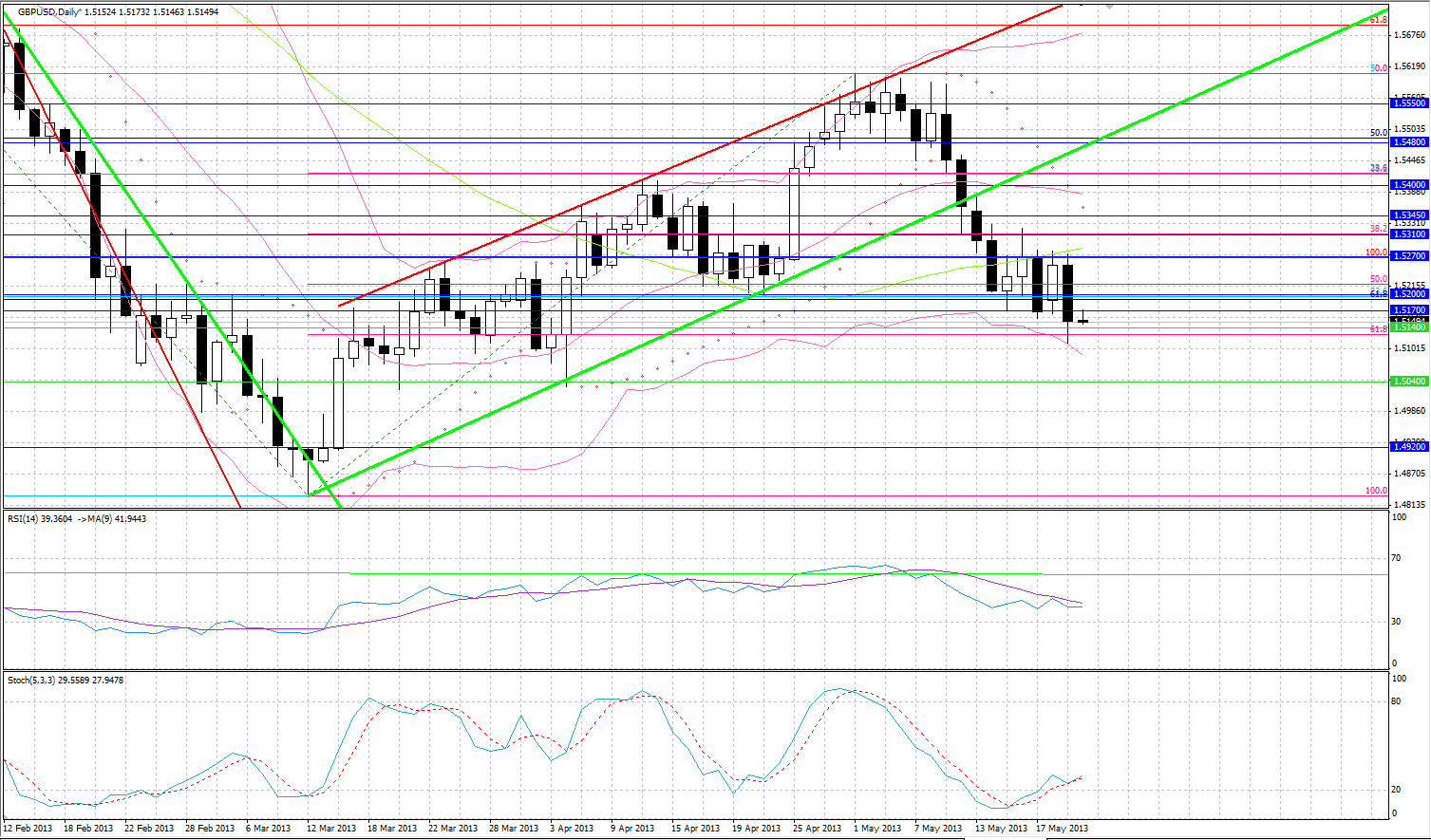

GBP/USD

• GBP/USD continued to move lower after breaking the 1.5200 level, but found support at its bottom Bollinger level. The pair is likely to move lower today and support is to be found at the 1.5100 psychological level and also bottom Bollinger level, with a break leading to 1.5040. The 1.5200 level is likely to act as strong resistance today, followed by another strong resistance at 1.5270.

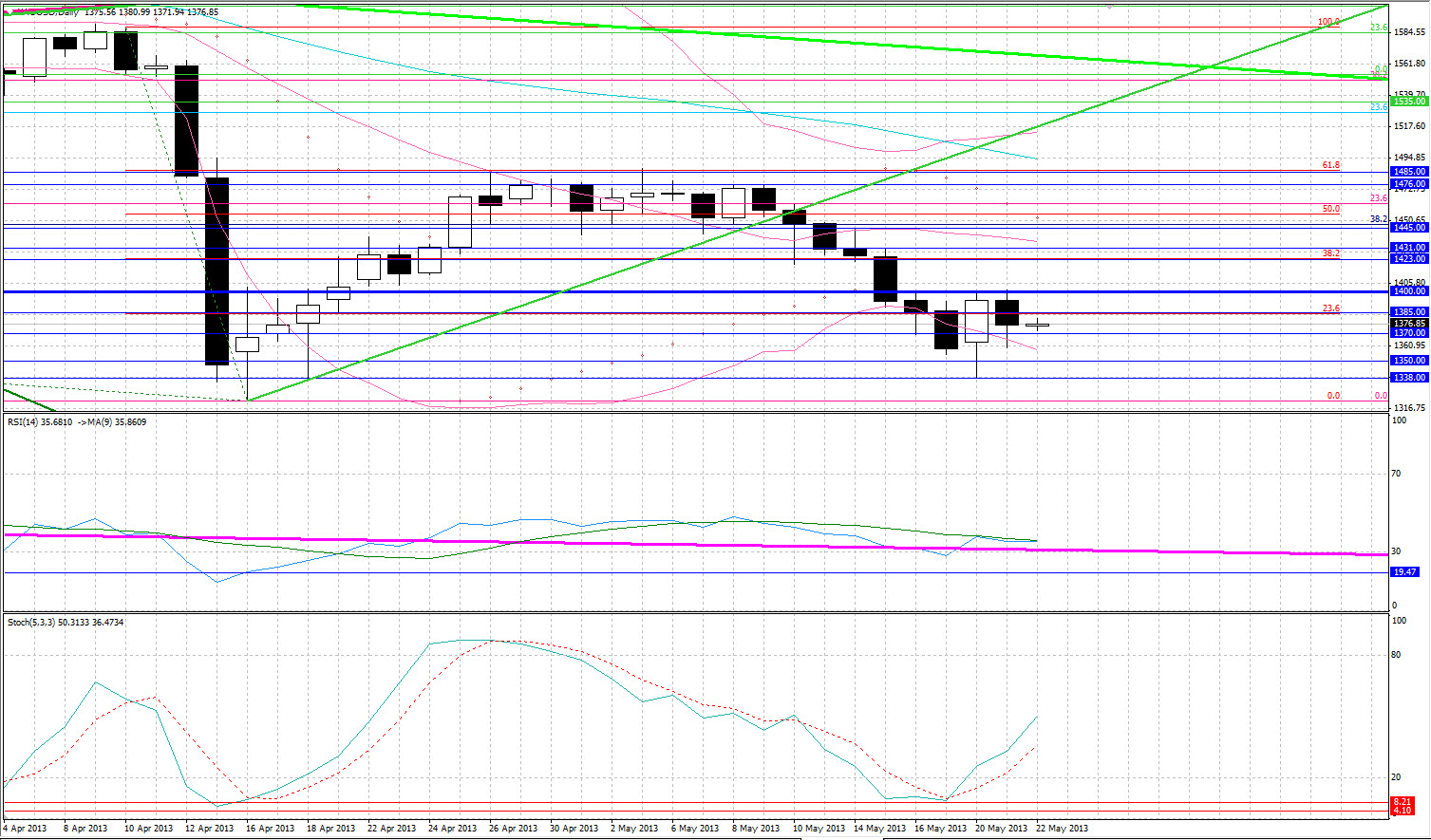

Gold

• Gold’s rebound yesterday found once again resistance at $1400 and ended up the day with losses. Resistance remains at $1400 with a breakout leading towards the $1423 – 1431area. Support comes at the previous lows of $1350 and $1340 with the Stochastic still remaining bullish.

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

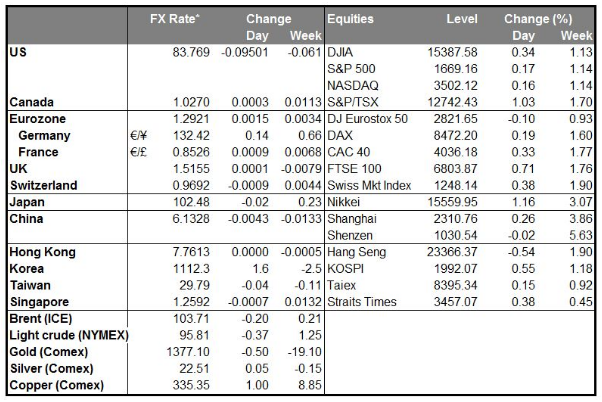

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dovish Comments Dent Dollar

Published 05/22/2013, 06:28 AM

Updated 07/09/2023, 06:31 AM

Dovish Comments Dent Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.