The Swiss franc has depreciated sharply against the US dollar over the last three weeks as the Fed talks up the December meeting. The SNB too has played its part, but a double top could indicate a reversal is on the cards.

The franc has depreciated against the US dollar as comments from the US Federal Reserve suggested that a rate hike for December was still on the cards. The hawkish rhetoric from the Fed last week was a bit of a surprise to the markets, which had been expecting the usual dovishness. Fed Chairwoman Janet Yellen yesterday testified before the House Financial Services Committee and reiterated her stance which the market paid attention to. There is plenty of time for doubt to creep in between now and the December 17th meeting, so watch for some US dollar weakness as it consolidates.

The Swiss National Bank (SNB) has certainly helped in weakening the Swiss franc. SNB Chairman Thomas Jordan has on several occasions called the franc “overvalued” and also said monetary policy is based on two pillars:

“The first pillar is the negative interest rate on sight deposits at the SNB. The second pillar is our willingness to intervene on the foreign exchange market as required”.

That is very dovish rhetoric and could see the franc weaken significantly over the long term, but in the short term, we could see a pullback.

There is one particular news event this week that demands attention. Of course I am talking about the US Nonfarm Payrolls, which have shown some poor results in recent months. The market is expecting 181k, which would be solid given that last month came in at just 142k and the month prior was downgraded to 136k. Also watch for the Swiss foreign currency reserve figures as they will indicate how much the SNB has intervened.

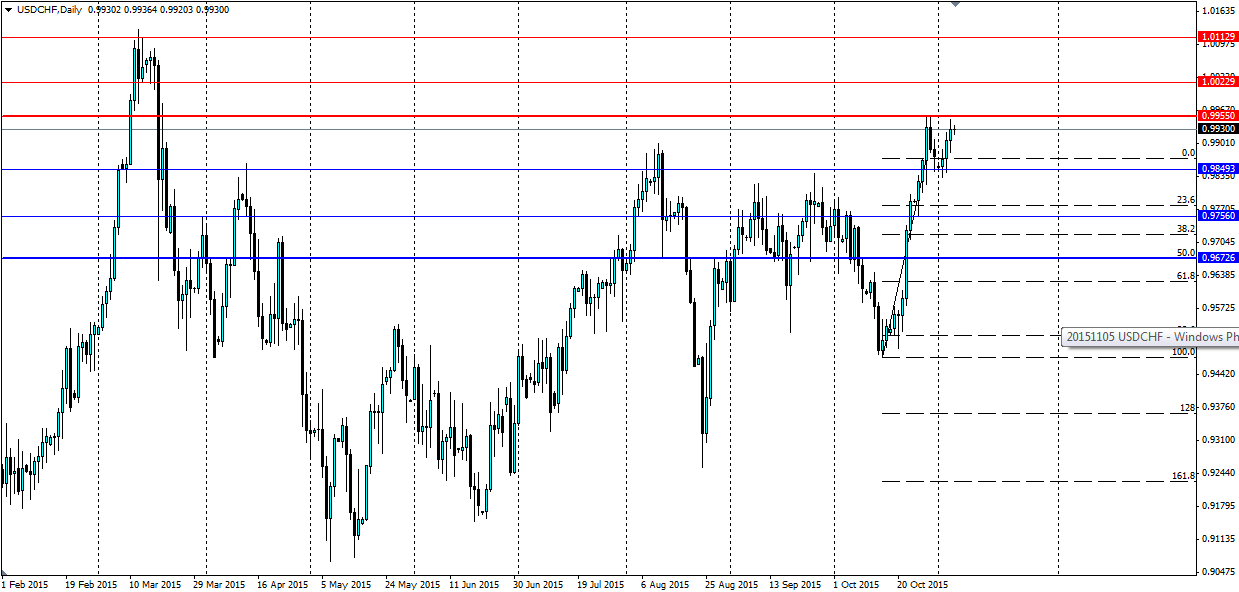

The technical set up is simple: a large double top just short of the significant resistance at 0.9955. This level has acted as a swing point for previous moves, and has already proven itself in this move. A rejection off it yielded a 110 pip move, followed by a second charge at the line. The level held overnight as the price came up short, which is a good sign if the pattern is to play out how the text books say it should.

A retracement to the 50.0% Fibonacci level is a reasonable target for the pair given that the pattern is 100 pips wide. The Resistance at 0.9672 is right on the 50% level and 120 pips below the neck line of the double top, so the market will likely be interested in it.If the double top plays out, watch for support at the neck line at 0.9849, with further support at 0.9756 and the 50.0% Fib level of 0.9672. If the fundamentals conspire against the setup, resistance will be found at 0.9955, 1.0022 and 1.0112.