The pound has been volatile recently with some strong moves in both directions. The election resulted in a big push higher, but that has been met with some strong resistance and a double top is now forming that could take the pair lower.

The pound had a very strong week thanks to some impressive data and the unexpected election result. The services PMI provided some support early in the week as it lifted from 58.9 to 59.5 and the US data was overall weaker adding to a US dollar sell off.

The election resulted in a strong win for the Conservatives who retain power for another 5 years, a vastly different result to the hung parliament the polls were predicting in the days before. Questions are being asked of the polling outlets as to how they got it so wrong. The polls leading up to the election had the two main parties neck and neck, so the result was a shock to the market and the pound rallied over 200 pips.

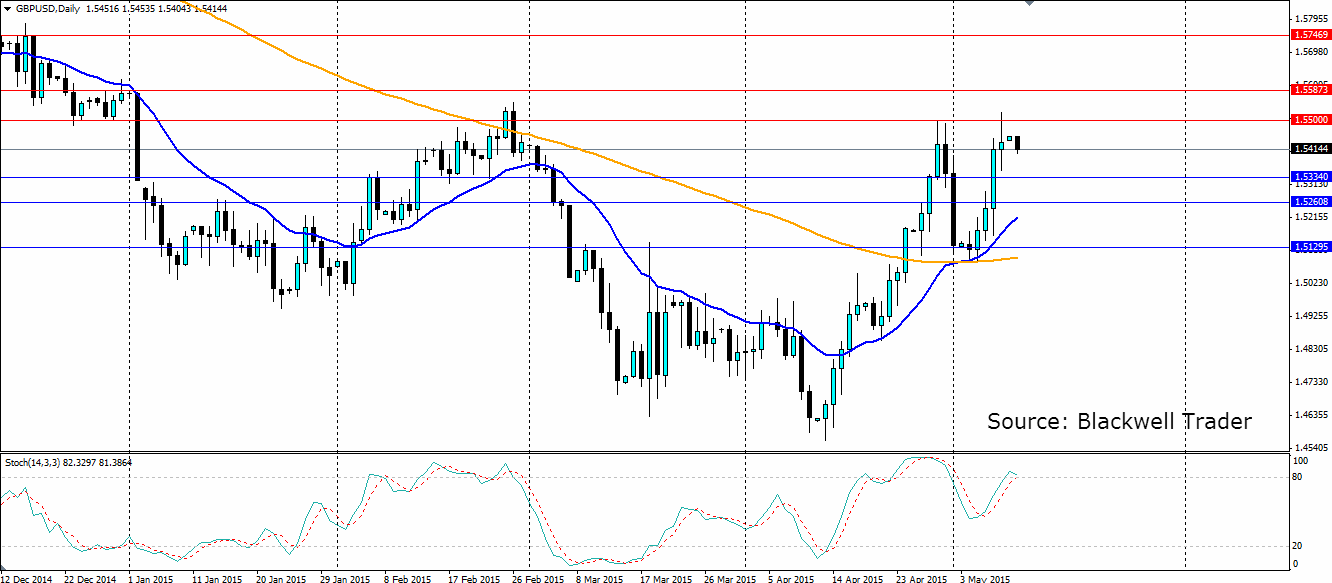

That now looks to be coming to an end. The chart shows the volatility the election has added to the cable with a large double top pattern forming at the resistance at 1.5500. This could see some of the recent gains given up as the pair retraces. The Stochastic oscillator appears to support this as it produced a lower high while the price made a higher high which means bearish divergence.

One point to note is that the 20 EMA has pulled up over the 100 SMA which could provide some bullish support from the longer term traders. Look for resistance to be found at 1.5500 (as above), 1.5587 and 1.5746. Support is found at 1.5334, 1.5260 and 1.5129. The support at 1.5129 has acted as a pivot point on several occasions so this will be an important level to watch out for.