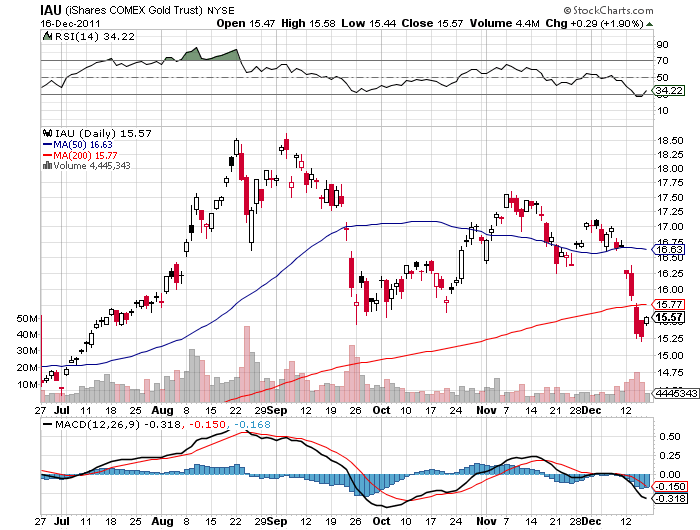

First let us take a look at how Gold performed last week: not good. Actual gold prices dropped just over 6% and gold ETFs such as the SPDR Gold Trust (NYSEARCA:GLD) iShares COMEX Gold Trust (NYSEARCA:IAU) posted similar declines. The chart illustrates this dramatic carnage:

So, as gold flattens at the bottom of the ravine, I am here to speculate that it is simply too early to underestimate Gold for the long term until two things DO NOT HAPPEN.

First, Europe must not tank the world, and secondly, the U.S. economy must not stumble on its way to what is, at best, a mediocre recovery.

If these two events do not happen, then investors have every right to write off Gold unless (until?) the fiat currencies fail. If however, the US or Europe places any more strain on financial markets, gold will likely be everyone’s currency of choice.

Dr. Bernanke and Company stand ready with the printing presses if the U.S. economy slows or things blow up in Europe. Gold’s decline last week was directly related to the Fed’s inaction and it’s easy to foresee a scenario in early 2012 where the Fed would embark on QE3. A recession in Europe and a marked slowdown in China will most likely ripple onto our shores with slower domestic growth and any action in this direction would be a boost to gold.

Additionally, a European collapse would have potentially far reaching and disastrous implications. Things are definitely not going well for “Team Merkozy” and if they do not get their fiscal house in order to investors’ liking, the entire Euro Zone could crumble and gold would become a “safe haven” as it usually does during times of financial stress and uncertainty.

A look at gold exchange traded funds tells us that holdings have been reduced, however, still remain near record highs at more than $120 Billion. Options traders also remain bullish on the yellow metal with significant positions in call options extending into March. Furthermore, central banks continue their widespread purchases of gold which will also serve to support prices going forward.

Bottom line: Gold (NYSEARCA:IAU) NYSEARCA:GLD) is in a bear market, having dropped below its 200 day moving average and sporting double digit losses from its recent peak, however, many fundamental factors point to the potential for a resumption of the bull market as we move into 2012. The world remains a dangerous place; dangerous situations are generally good for gold and so, in the not too distant future, gold could gleam again.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Don’t Write Off Gold Yet

Published 12/19/2011, 04:13 AM

Updated 05/14/2017, 06:45 AM

Don’t Write Off Gold Yet

Last week’s 6% drop in Gold prices triggered a global blood bath which handed many investors their lunch and destroyed any extra Christmas spending money. Despite the pain and suffering caused by the gold sell-off last week, there are still reasons to believe that it is too early to write off gold completely.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.