Secretly, I think that’s what Fed Chairman Ben Bernanke is saying to investors right now.

In the wake of his Congressional testimony – when he hinted at changing his quantitative easing ways – investors bailed on stocks.

Heck, the exodus was pronounced enough that the S&P 500 Index ended up posting a weekly loss for the first time in five weeks.

But bailing on stocks right now simply based on the Fed Chairman’s comments? That makes absolutely no sense.

Here’s why – and more importantly, what investment moves we should be making instead…

In the Event of a Miraculous Economic Recovery

As I wrote on Friday, there’s zero chance that the Federal Reserve will take its foot off the quantitative easing gas pedal before the end of the year. Not unless GDP growth accelerates well above 3%.

I’m sorry, but that’s not even remotely in the realm of possibility.

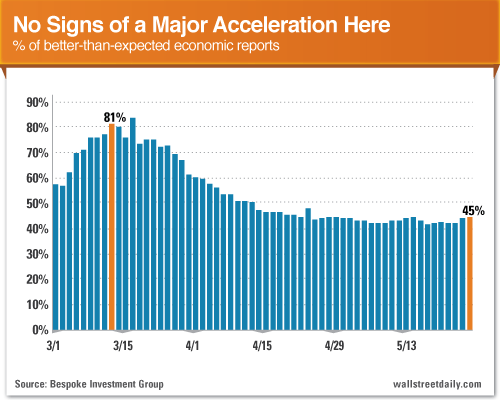

Sure, eight of the nine major economic reports came in better than expected last week. But the cumulative percentage of better-than-expected reports for May checks in at just 41%.

That’s certainly a long way off from an overly healthy reading. And it’s not even close to March’s 81%, according to Bespoke Investment Group.

If a rapid acceleration in the economy were in the cards, it’d be a total shocker. And it’d show up in the data with an overwhelming majority of economic reports coming in ahead of expectations.

Simply put, that’s not happening.

Nevertheless, let’s assume for a moment that GDP growth does somehow accelerate north of 3% in the coming months…

And the Fed does miraculously find a way to curb its money printing addiction…

Or in the words of Bernanke himself, “If we see continued [economic] improvement and we have confidence that [it's] going to be sustained, then we could in the next few meetings… take a step down in the pace of purchases.”

If that happened, we should welcome such a development – not run from stocks on the possibility.

After all, a strong economy – along with less intervention from the Fed – is precisely what we need to get back on a path to long-term prosperity, right?

Maybe I’m a fool for thinking so. Or maybe it’s just that investors remain too focused on the short term, or they fear that an end to the Fed’s intervention could stop the economic recovery dead in its tracks.

Even if that’s the case – and pockets of the economy suffer withdrawal symptoms when the Fed stops printing money – we still shouldn’t bail on stocks completely.

Instead, we should focus on sectors of the economy that are showing legitimate signs of improvement – and don’t need any additional monetary support to continue. Then we’d narrow our search down to the top-performing companies within those sectors.

I know what you’re thinking now…

Do any such opportunities exist? They sure do!

And tomorrow, I’m going to share one of my favorites with you, including a few timely charts. So stay tuned.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Don’t Let Bernanke Sucker Punch Your Portfolio

Published 05/30/2013, 03:44 AM

Updated 05/14/2017, 06:45 AM

Don’t Let Bernanke Sucker Punch Your Portfolio

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.