As we get older, we should get a little wiser. Personally, in an attempt to refine my listening skills, I have learned to key-in on certain words. Such as "when vs. if", "sure vs. yes" and the infinity words "always & never". Growing up in the world's most productive country, with a one hundred year, plus, stint of superiority, makes you numb to these words. We grow up hearing, "That would NEVER happen here", or "we will ALWAYS be...". Many of you reading this are already way ahead of me... FAMOUS LAST WORDS.

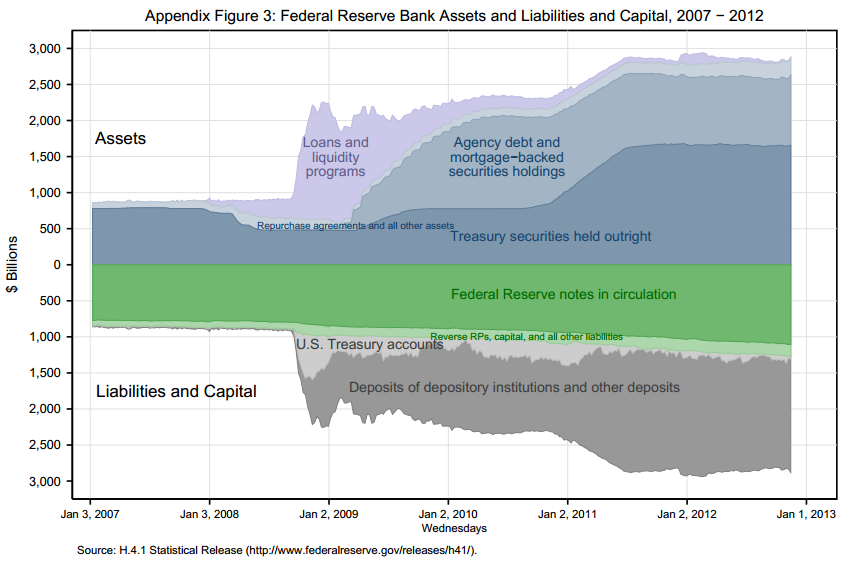

This chart reminds me of a cartoonist's rendition of some super villain's atomic laser blast. Unfortunately, "we the people" are on the receiving end of this weapon of mass destruction. It is especially disturbing when you consider that the chart grew to almost 4,000 million dollars by Jan 1, 2014. With an estimated 50 - 60% of all US Dollars in circulation residing on foreign soil, we need to take a closer at people who don't feel the same about our country. For many citizens of other countries, the USA has been a great opportunity to increase their own personal wealth. They really don't care about our country or its citizens. We have to keep this in mind when the rush to the EXIT door begins.

Rush to the Exit Door.

What signs should we be looking for? What is the first thing you hear, when somebody "in the know", knows that things are going south quickly? "NOBODY PANIC!" Which in turn, makes everybody panic. Soooo, nobody is going to say that. The people "in the know" are just going to keep sipping their cocktails and holding their superficial little conversations, all the while, craftily moving toward the door. If you look real closely, you can see a couple of people over at the life rafts, quietly lowering them under the cloak of darkness. Hoping that no one sees them. They just want to sneak away before anyone even notices.

These headlines are little clues, yet, skillfully worded to avoid panic. If you check the H.4.1 report published by the Federal Reserve, you can clearly see a growing distrust, as "Securities held in custody for foreign official and international accounts" steadily decrease. Eventually, foreign investors will not buy US debt and they will need to turn to us, the citizens to foot the growing debt bill. Seems rather ironic, I know. They tax us into poverty and then they want to ask us for more... well kind of.

The Debt Funding Masquerade

Personally, I can't remember the last time the government made a big push for buying savings bonds. In fact, I have never owned one. However, President Obama's latest State of the Union address included a beautifully disguised solicitation for our new "pseudo-war bond". In times of war, we would rally as a country behind our leaders. An overwhelming majority, would make major sacrifices in spending habits and budgets, in order to financially stand behind our country and its values. Not these days and the government knows it. If they did try a televised savings bond campaign, people would laugh - "who in their right mind is going to stand behind this out-of-control government and its unrestrained spending?"

During the State of the Union address, the President, filled with pride, assured every individual, that doesn't have a retirement plan, that they would be offered one, the "myRA". HOLD ON A SECOND, there is something a little fishy about all this.

"MyRA is not for everyone," said Vielka Burey-Jacas, a certified financial planner with Women's Financial Advisory Group in Miami. "One of the major cons to myRA, is that there are not many choices. Account holders do not have to pay fees, and their principal is protected, but you can only invest in bonds."

I mean "really"! Common Man! This quote appeared in an article today - Obama’s myRA: Get out sooner rather than later . What really makes me upset, is the fact that to start a regular IRA you normally need a deposit, around $1000. That means the government is targeting people who can't even save $1000 and enticing them to buy bonds, under the cloak of "we care about your retirement". Am I the only one that feels a little hot-under-the-collar over this?

So here is my thought on the matter - STAY AWAY!! If you are a small business owner, with your life and life savings wrapped up in your business, now is the time to put together a Financial Disaster Preparedness Plan. I am not anti-American! I appreciate this country, more than I can express. However, I felt the same way about several of my failed businesses. I was very "pro-my-business" but stupid is still stupid. If you want to hold on to the railing and go down with the ship, "more power to ya". For those of us who realize that it is time to go back to the ship yard and build a better ship, this is not treason, it is just common sense.