In a recent post, we talked about how commodities were getting hit by a rising US Dollar. While the commodities market remains in a down trend since 2011, some commodities are performing better than others.

In this post, we’ll breakdown commodities into 5 sectors and see how they have performed since last year.

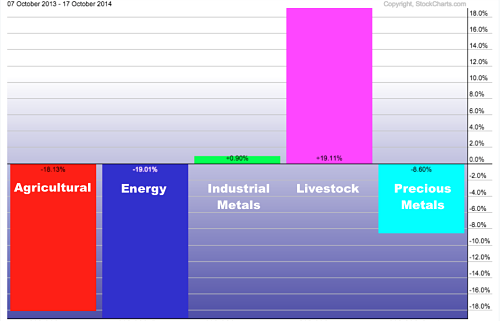

The chart above shows the performance of each of the commodity sectors since October last year.

Overall, pressure on commodity prices remains in place. The exception to the rule is the livestock market, which managed to rise 19% since last October. Disease and widespread drought conditions in California and other states drove livestock prices up to record highs.

On the other hand, energy was the worst sector, down 19% since October of last year. Americans driving less and more efficient cars caused US demand to decrease while US production is peaking as the nation is enjoying a renaissance in its domestic crude oil and gas exploration.

In the same manner, soft commodities lost 18% this year, the second-worst performer. Precious metals remain at low levels, falling 9% this year.

Finally, industrial metals managed to perform better than these other sectors, ending quite flat on a year-to-year basis.

What This Means For Metal Buyers

It seems that there is little interest in the market to support significant increases in commodity prices. Without a strong fundamental story behind it and the commodities market remaining depressed, industrial metals will most likely continue to trade in a sleepy range at best.