The Blackstone (NYSE:BX) Group stock has had a series of moves higher since making a low with the market in October 2014. It was a Top 10 pick in the Premium service a few weeks back and delivered. But maybe you missed the chance to get in this steady stock. If so, no problem, the market is giving you a second chance. No need to chase Steve Schwarzman into the elevator.

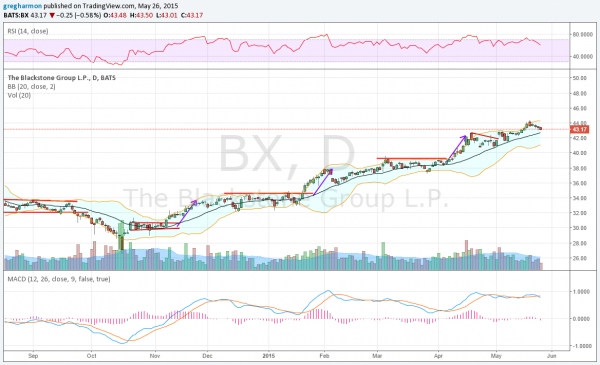

There are two major things to note in the chart below beyond the beautiful trend higher form October. The first is that the 20 day SMA, the line in the middle of the Bollinger Bands®, has acted as support many times. The second is that if the price goes below that 20 day SMA, then the lower Bollinger Band has been support. Simple right?

But which one will it be this time? A very close look reveals that when the Bollinger Bands are wide on a relative basis, like they are now, the 20 day SMA has been support. When it hits that level it has reversed higher. But when the Bollinger Bands are tight, they have been the place where price has bounced.

There are no guarantees that what has happened in the past will happen again. And that is usually the problem that most non-technicians have with this type of analysis. They take it as certainty instead of possibility. This means you need to employ risk management techniques as well, like a stop loss. But understand, when the price pulls back to the 20 day SMA with broad Bollinger Bands, if you are not looking for a reversal you may miss your chance again.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.