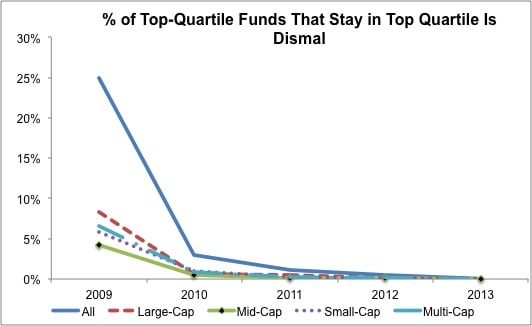

Any investor who believes there is no need to do their own research and diligence should take a look at this report from S&P. Oh, and this one too. The first report shows that 74% of actively managed US equity funds underperformed the market over the past three years. The second report shows that less than 5% of all top-performing funds remain in the top-quartile two years later.

Figure 1: More Luck Than Skill:

Source: S&P Persistence Scorecard 2013

I wrote an article recently that index investing is not a substitute for due diligence and even passive investors must make active management decisions.

S&P’s latest reports all but prove that blindly turning over your money to an active mutual fund manager is also a bad idea. Most active managers underperform the market in any given year. Those few managers that do outperform in one year are highly unlikely to repeat the feat the next. Betting on which manager gets lucky in any given year is not smart investing.

Digging deeper into the two reports mentioned above reveals just how severely active managers have been underperforming. All domestic funds have lagged the S&P Composite 1500 by 23% over the past five years. All large-cap funds have returned 52% less on average than the S&P 500 over that same time frame. Most active managers are clearly not justifying their fees.

Don’t think you can identify a winning manager based on their track record either. Investors may have thought Bill Miller was unbeatable in 2005 after his fund had outperformed the market for 15 consecutive years. Those investors received a rude awakening when Miller’s Legg Mason Value Trust (LGVAX) lost 36% over the next five and a half years while the S&P 500 gained 13%.

Consistent outperformance by actively-managed funds is almost non-existent, as seen in Figure 1. Of the 558 mutual funds in the top quartile of performers in 2009, only one remained in the top-quartile for each of the next four years.

The takeaway is: trying to pick the next manager to get hot is not investing. It’s gambling, and the odds are heavily stacked against you. There is no substitute for good due diligence.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Don’t Bet On Luck: Active Management Underperforms

Published 08/01/2013, 06:16 AM

Updated 07/09/2023, 06:31 AM

Don’t Bet On Luck: Active Management Underperforms

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.