It’s no secret at The Real Asset Company that we’re big fans of Grant Williams’ Things That Make You Go Hmm… . The latest issue was one of the best in recent months, if anything for it’s fantastic introduction to the huge tidal wave of gold surging toward Asia.

Is It For Real?

Last week a friend asked if the recent climb in the gold price was just gold investors being set up for another fall. I had to sympathise, given the knocking around many gold buyers have felt in the last two years this is a concern I can appreciate. However, in the last two years we haven’t seen this desperate thirst for gold in the East as we are now. Were we seeing this in in the West then I would perhaps be cautious, as investors here are more likely to sell-up when they think the price has hit a new high. Yet in the East, it’s unlikely they’ll be letting go of their gold quite so easily. So when we see this much gold flowing from West to East, it’s ok to expect the real fundamentals of demand and supply to kick in.

Williams touched on this in his latest offering and Lawrie Williams summarised it beautifully:

Those students of history will probably know the perhaps apocryphal story of King Canute, or perhaps properly Cnut, the one time ruler of England, Denmark, Norway and parts of Sweden back in the early 11th Century AD, being persuaded by his sycophantic advisers that he ruled everything including the incoming tidal flow of the North Sea. He thus set himself down on the beach and commanded the incoming tide to cease its progress – naturally to no avail. According to Wikipedia, this was all chronicled by Henry of Huntington in the 12th Century thus: Cnut set his throne by the sea shore and commanded the tide to halt and not wet his feet and robes. Yet “continuing to rise as usual [the tide] dashed over his feet and legs without respect to his royal person. Then the king leapt backwards, saying: ‘Let all men know how empty and worthless is the power of kings, for there is none worthy of the name, but He whom heaven, earth, and sea obey by eternal laws.’ He then hung his gold crown on a crucifix, and never wore it again “to the honour of God the almighty King”. This incident is usually misrepresented by popular commentators and politicians as an example of Cnut’s arrogance. In fact Cnut has been considered by history as an extremely wise ruler.

I mention this as the attempt to control the onset of the sea has its parallels in the machinations of the central and bullion banks and governments to try and control the gold price in the face of seemingly inexorable demand from points east, notably India and China. The gold tide may well be on the turn and will likely rise and wash all the paper gold merchants’ price control efforts away.

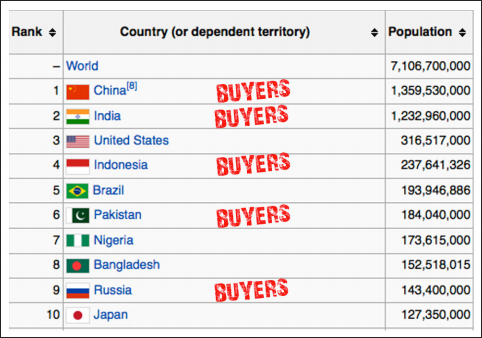

Grant Williams, in his latest Things that make you go hmm… newsletter, says it plainly: “You do NOT want to bet against a tide like this — not in a commodity [gold] with a very fixed existing supply and a very consistent, but small, annual supply increase of around 2,500 tons… Five of the ten most populous nations on earth are hungry buyers of gold, and each of them has a burgeoning middle class that has, over the years, embedded in its cultural psyche the idea that owning gold is just what you do when you can afford to.” He illustrates this with the following graphic showing the world’s ten most populous nations and pointing out those which are predominantly gold buyers:

Sixth In Line

Arguably, although Williams doesn’t do so, it could be worth mentioning that the U.S. itself was the sixth largest gold buying area in the second quarter of this year – After India, China, Europe, the Middle East and Turkey and although its buying was dwarfed by the gold outflows from the big ETFs there, as the tide turns, and these ETF liquidations fall away, it too will probably become a net buyer of the yellow metal – as may well the people of many other nations as well.

But, society in the West and East does have rather different attitudes towards gold. The West, for the most part, looks upon it as a short to medium term trade, while the East sees it primarily as a store of wealth and an inflation protector and puts it away against a rainy day – and given the growth that is occurring in the highly populated eastern nations, these rainy days are becoming few and far between, so this gold is just not coming back on the market.

Don't Overlook Silver

It may also be worth looking at silver. As we forecast just over a month ago, silver has maintained its historical movement advantage over gold when the latter is on the move upwards with the gold silver ratio falling. As I write, the gold:silver ratio is sitting at around 58 – as opposed to around 65 when the above article was put together. In fact the silver price has risen by about 30% in the past two months while gold has risen 17% over the same period.

Over the weekend gold broke back up through the $1400 level and somehow the sentiment towards it seems to have changed. People are getting nervous about the general stock market, which has had a good run while gold had been falling. Now there is a realisation that the rising stock market may have vulnerabilities, despite the amount of money still being pumped into the economy through easing programmes – and talk of tapering now seems to be depressing the general stock market as much as gold – if not more so. How quickly attitudes can change in the markets. Momentum seems to be building in the gold and silver space. The East is still buying, and the West may have ceased its big gold ETF sell-off. Where is the gold and silver coming from to meet this big, and seemingly rapid, change in the market with demand for physical metal outstripping new supplies? Are the ‘wise men’ truly in the East still today? People at last seem to be coming to the realisation that paper gold is just paper and they need to get the real thing in their hands.

The Rising Tide

As Grant Williams says - “You do NOT want to bet against a tide like this”. And if indeed the tide has turned and gold is on the up again, with demand seemingly exceeding supply, the movement could be prolonged, rapid and big. – And silver will likely do even better.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Don’t Bet Against The Gold-Buying Tide

Published 08/27/2013, 01:41 PM

Updated 05/14/2017, 06:45 AM

Don’t Bet Against The Gold-Buying Tide

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.