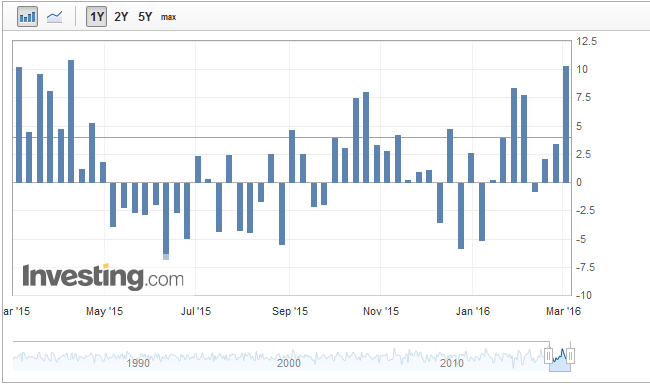

The crude oil price has been largely positive over the past week, as WTI prices have edged up to $34.73 a barrel, sparking speculation that the commodity had finally discovered a bottom. However, oil fundamentals remain the same and the commodity must reduce in price before supply can be rebalanced.

US West Texas Intermediate (WTI) stocks have largely been on a rollercoaster over the past few months as a supply glut has continued to impact prices.

However, February has been largely positive for the commodity, with prices climbing back above the key $30.00 a barrel level. Subsequently, there has been a growing cacophony of rhetoric that crude oil might finally have turned the corner and be readying for a significant rally.

Unfortunately, the reality is that the dynamics of the new oil order are only just beginning and that the rally to above the $30 handle is nothing but a dead cat bounce. As I have reiterated before, market forces determine the equilibrium price, not OPEC (despite their protestations otherwise). The ongoing supply glut continues to be the primary factor impacting oil prices and given that world supply has remained relatively static over the past month (including the Iranian increases and frozen Saudi production levels) the problem certainly still remains.

In fact, Iran has been resolute with pursuing production and efficiency increases now that the imposed nuclear sanctions have been removed. Subsequently, don’t expect the regime to play ball over any OPEC/non OPEC arranged cuts. The country desperately needs the export revenues after a fairly long period of sanctions and there is likely to be little in the way of negotiation over crude output. In addition, Venezuela faces an even worse set of circumstances, as their country flirts with a domestic (and potentially international) default.

The upshot is that many of the forces that unified OPEC during the crude oil price boom years are now placing pressure upon the various exporting nation states. Subsequently, there is little appetite from anyone for the supply cuts needed to restore a reasonable price level. Given the fractious pressure, it is clear that no agreement will be seriously sought or enforceable lest it destroy the cartel in short order.

The reality is that the only way forward for oil markets is for production to be reduced through the harsh reality of bankruptcies and defaults. As crude oil prices decline, so too will the pressure on the least efficient and competitive operators. In fact, this phase of rebalancing may have already started as the US grapples with a bubble occurring in high yield bond markets which has largely been driven by energy companies. In a classic case of what goes up must come down, these firms face potential action from creditors as the low oil price ameliorates any form of cash flow to service their debts. Subsequently, 2016 could be the year where we see some sharp exits from the crude oil industries.

Ultimately, the recent price rally to above the $30 handle is likely to be temporary, and largely a dead cat bounce. Subsequently, expect crude to challenge the downside in the coming weeks as the screaming hordes of market pundits stop declaring that crude oil’s bullishness is here to stay.