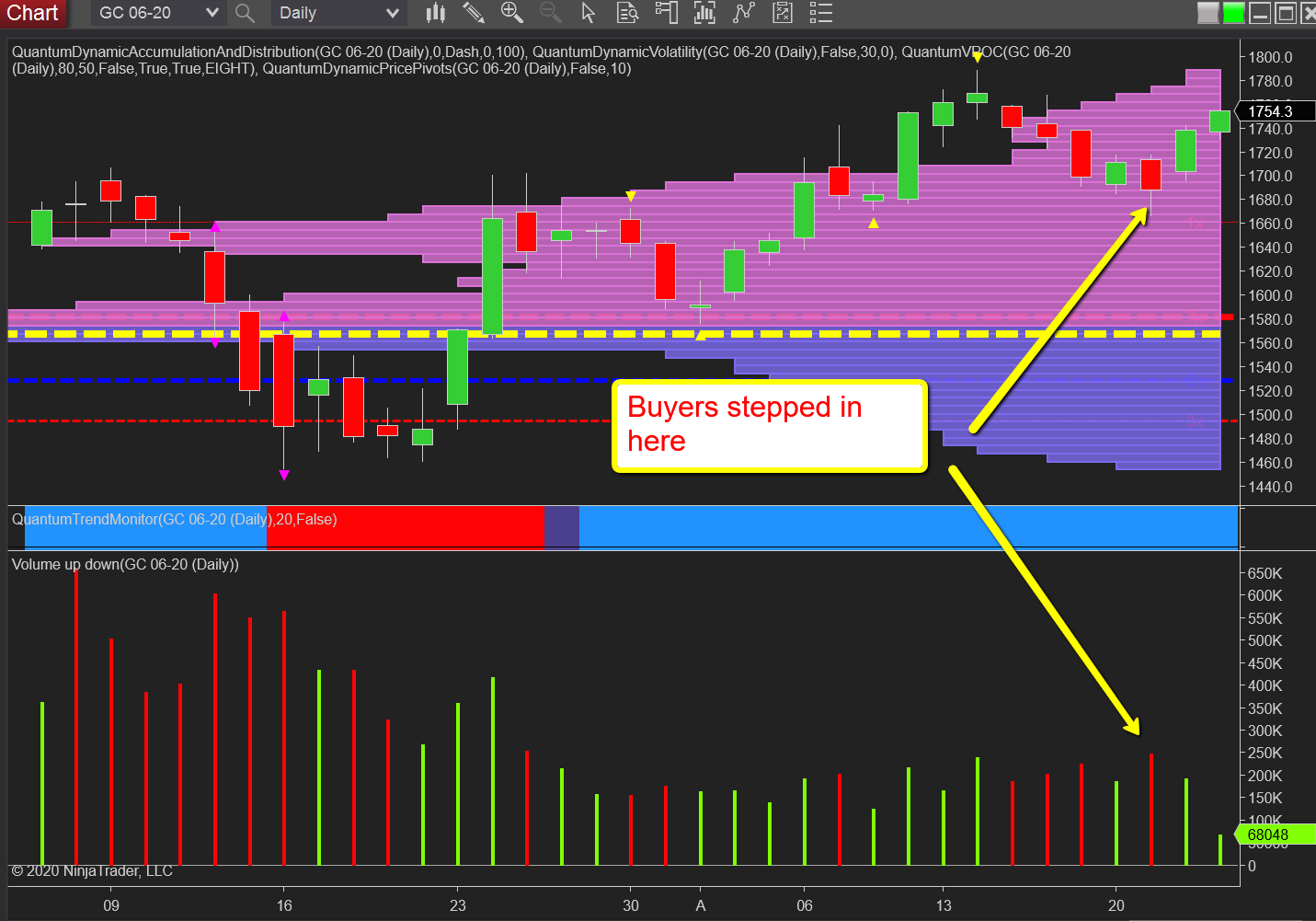

The message for gold bugs is clear – don’t panic. Tuesday’s volume and price action sent a clear signal of buyers moving in strongly on the day with a narrow spread down candle on high volume thereby confirming the bullish picture for gold. This was enough to propel the precious metal through the $1700 per ounce region once more before closing yesterday with a solid up candle on good volume, with bullish sentiment continuing in early trading as the precious metal pushes higher and through $1750 per ounce at the time of writing.

The way ahead is now relatively clear with no price based resistance on the daily chart, and with volume falling on the volume point of control histogram the yellow metal should move through here with ease and break above $1800 per ounce in the medium term with plenty more to come. Note throughout the recent pullback, the trend monitor indicator has remained firmly blue and continues to signal that bullish momentum remains intact.