While the US market will be reacting to the Financial sector’s earnings reports as well as guidance and commentary from the big bank CEO’s this week, and while US investors still hang on every headline about the China tariff deal – whether there is an agreement or not and what it involves – later this week The EU will meet in Brussels (the European Council Summit, actually) and then Parliament will hold an unusual Saturday session, the first time this century per the Financial Times.

Here is a timeline from euronews that details what happen this week:

My issue with the China and US tariff spat is that it completely crowded out the Brexit issue (at least in the US mainstream financial media), with Germany and the UK comprising the 4th and 5th largest economies by GDP in the world.

While the US and China are #1 and #2 when ranked by GDP growth, (Japan is #3), Europe has no doubt been impacted by Brexit and really just the uncertainty it’s created, given the size of the German and UK economies. Not knowing the rules or the consequences of longer-term business investment decisions (look at financial firms in London), has had to have at least contributed to the slowdown in European GDP.

The sentiment around a “no-deal” Brexit seems to change daily, however we are getting down to crunch time, and if it is a no-deal Brexit at least those are the rules the European companies know and can follow, and hopefully that will be a step forward.

The Dollar – Time for a Trend Change ?

Nick Colas and Jessica Rabe started Datatrek’s nightly blog in the last year, and so far it’s been a worthwhile subscription.

Here is what Nick and Jessica wrote after the China trade agreement on Sunday night, October 13th, 2019:

DAILY DATAPOINT

In “Markets” we discussed 3 issues that matter to near term equity investor sentiment; for “Data” we want to dig into just one issue: the longer-term value of the dollar.

Our measurement of choice is the Federal Reserve’s “Trade Weighted Dollar Index: Broad, Goods”. That’s a mouthful, but basically it is a measure of the greenback’s performance versus a basket of other currencies weighted by America’s trading relationships. For 2019, these are the largest exposures:

- European Union (euro): 18.6%

- Canada (dollar): 13.6%

- Mexico (peso): 13.3%

- Japan (yen): 6.4%

- United Kingdom (pound): 5.1%

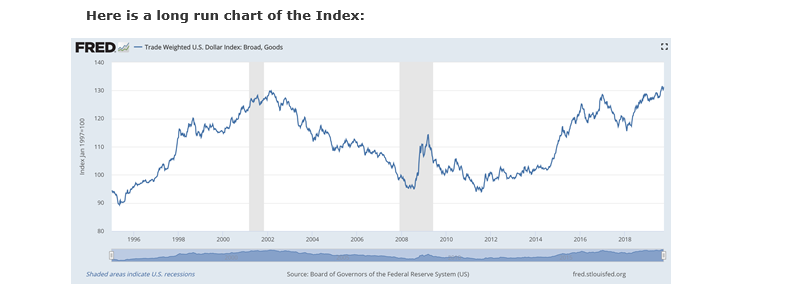

Here is a long run chart of the Index:

Three things pop out to us from this graph:

#1: The trade-weighted dollar sits at generational highs. The current reading of 131.3 is above the old peaks of February 2002 (129.8). It is even 15% higher than the March 2009 lows for global risk assets.

#2: The proximate cause of this level is a combination of the US-China trade war and the wide differential between US and global interest rates. The official yuan rate (16% of the index) has slipped by 6% from its March 2019 levels. The euro is 11% lower from its March 2018 high water mark, back when the German 10-year bund yielded +0.6% instead of its current -0.4%.

#3: US equities can rally with a stronger dollar (1990s, 2011-present) or a weaker one (early 2000s), but history shows this should be a turning point for the greenback. Twenty-plus years of index levels say the currencies of America’s major trading partners should start to strengthen. If they don’t, it means something is very different this time around. And “different” in this case probably doesn’t mean “good” when it comes to investor risk appetites.

Why all this matters now:

#1: While the value of the dollar is not technically part of the Federal Reserve’s portfolio of responsibilities, a strong US currency does put export-driven companies/employers at a disadvantage and makes it harder for the Fed to reach its inflation targets. To the degree these issues affect future hiring plans/macro inflation, they do hit the Fed’s radar screen.

#2: Super cap Tech stocks – important market leaders for US equity markets – have the greatest financial exposure to non-dollar revenues of any S&P group. At 57% non-domestic revenues, Tech companies face a strong currency headwind just now. Other groups with above average (+38%) dollar exposure: Materials (54%), Consumer Staples (45%), and Energy (42%). The FactSet link in Markets has all the details (p 25).

#3: A weaker dollar in coming weeks will be an important capital markets signal as we start considering the investment climate for 2020. Risk aversion, negative European/Japanese interest rates, and trade war blowback are the trifecta of reasons the dollar sits at multi-decade highs. Seeing the greenback weaken as 2019 comes to a close would be an important signal that next year will be more “normal”.

Summing up: we pay attention to currency markets because their size and variety of participants makes them clearer-eyed observers of macro conditions than other financial assets. The remarkable strength of the dollar in 2019 fits the narrative we all know about the year: fear of global recession caused by a seemingly endless US-China trade conflict. If we’re moving from that storyline to something more positive in 2020, then the dollar should begin to weaken soon. And if it doesn’t, that’s an important sign as well.

Summary / conclusion: If there is one thing we learned last Q4 ’18, it’s that things can change quickly in the capital markets, and the potential to remove two long-troublesome issues – China trade and Brexit – could get resolved shortly. I’m amazed that UK citizens haven’t suffered from Brexit fatigue given it’s been over 3 years since the vote for the UK to leave the EU.

A resolution to Brexit would undoubtedly help Europe if from nothing more than knowing what the future will look like.

DataTrek is looking for a change in the dollar trend, which would actually help the SP 500 at the margin given that anywhere from 1/3rd to 40% of SP 500 revenues are non-US.

(Please excuse the FRED chart of the trade-weighted dollar – it wouldn’t copy correctly from the Datatrek blog, so the graph / chart was snipped and inserted separately.)