I am not the first person to point out that the stock market, at outlandish multiples, is not behaving consistently with commodities markets that are flashing imminent depression. If we insist on anthropomorphizing the markets, it really makes no sense at all unless we posit that “the market” suffers from a split personality disorder of some kind. But that sort of thing happens all the time, in little ways.

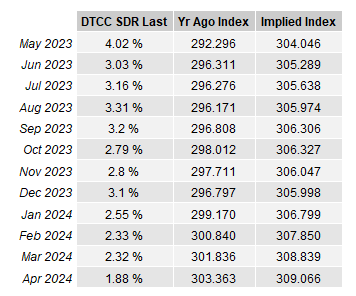

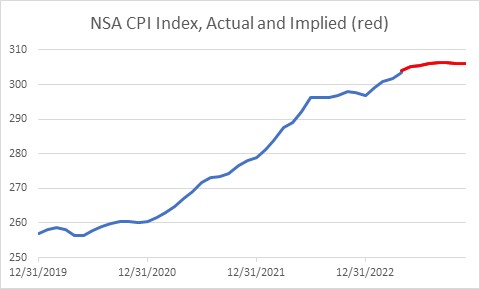

But here is something that seems very weird to me. Prices of short-dated inflation swaps in the interbank market suggest that NSA headline inflation is going to rise less than 0.9% for the entire balance of 2023 (a 1.45% annualized rate). And most of that rise will be in the next 2 months. The market is pricing that between June’s CPI print and December’s CPI print, the overall price level will rise 0.23%…less than ½% annualized!

Now, eagle-eyed readers will notice that there was also a flat portion of 2022, covering roughly the same period. Headline inflation between June and December last year rose only 0.16%, leading to disappointing coupons on iBonds and producing proclamations that inflation was nearly beaten.

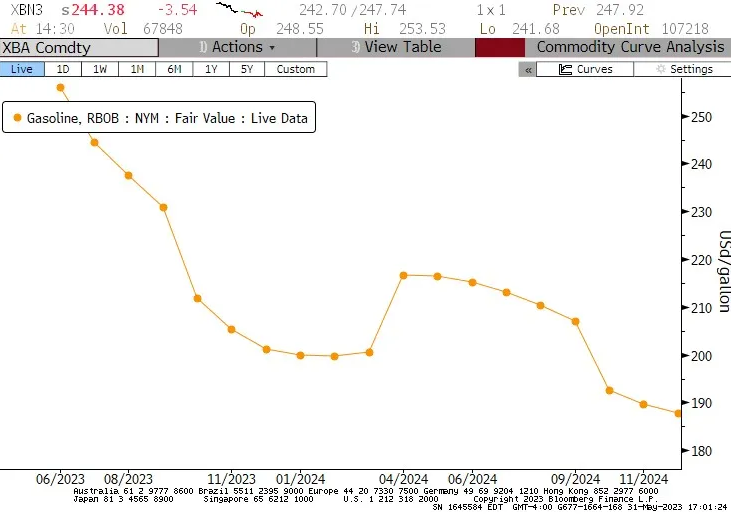

Here’s the thing, though. In the second half of 2022, it made perfect sense that headline inflation was mostly unchanged. Oil prices dropped from $120/bbl the first week of June to $75 by mid-December. Nationwide, average unleaded gasoline prices dropped from $5 to $3.25 during that period.

A comparable percentage decline would mean gasoline would need to drop to $2.32 from the current $3.58 average price at the pump. To be sure, the gasoline futures market is in much steeper backwardation than normal, with about 44c in the curve from now until December compared with 28c from June to December 2024*. So that can’t be the whole source of this insouciance about inflation. If gasoline declines that much, the inflation curve will be right…but there’s an easier way to trade that: to sell Nov or Dec RBOB gasoline futures.

So the flatness must be coming from elsewhere. It can’t be from piped gas, which has recently been a measurable lag, because Natural Gas prices have already crashed back to levels somewhat below the norm of the last 10 years. Prices of foodstuffs could fall back more, which would help food-at-home if it happened, but food-away-from-home tracks wages, so it’s hard to get this huge of an effect from food.

Ergo…this really must be core. Except there, the only market where you can sort of trade core inflation rather than backing into it, the Kalshi exchange, has the current prices of m/m core at 0.35% in May, 0.32% in June, 0.57% in July, 0.45% in August, 0.35% in September, 0.18% in October, and 0.22% in November. (To be sure, those markets, especially for later months, are still fairly illiquid but getting better). That’s not drastically different from the 0.41% average over the last six months.

Markets, of course, trade where risk clears and not necessarily where “the market thinks” the price should be. I find it hard to understand, though, who it is who would have such exposure to lower short-term prices that they would need to aggressively sell short-term inflation…unless it is large institutional owners of TIPS who are making a tactical view that near-term prints would be bad. Sure seems like a big punt, if so.

Naturally, it’s possible that inflation will suddenly flatline from here. I just don’t feel like that’s the ‘fair bet.’ That is, after all, a key function of markets: offer attractive bets to people who don’t have a natural bias in the market in question to offset the flows of those people who are willing to pay to reduce their risk in a particular direction. (This should not be taken to suggest that I don’t have a natural bias in the market; I do.)

There’s another reason that this matters right now. Recently, markets have also been starting to price the possibility that the Federal Reserve could continue to hike interest rates, despite fairly clear signals from the Chairman after the last meeting that a ‘pause’ was in the offing. That certainly makes sense to me since 25bps or 50bps makes almost no difference.

After one of the most-aggressive hiking cycles in history, putting rates at approximately long-term neutral at the short end, it would seem to be prudent to at least look around. If, in looking around, the Fed were to notice that the balance of the market is suggesting that inflation has a chance of going instantly and completely inert, it would seem to be even stranger to think that the FOMC is about to fire up the rate-hike machine again for another few hikes.

*June to December on the futures curve isn’t the exact right comparison since prices at the pump lag wholesale futures prices, but it gives you an idea.